In the case of sovereign debt, creditor rights are not as well defined as for private debts. This is essentially due to two reasons. First, most sovereign assets are located within the borrower's jurisdiction and the borrower cannot credibly commit to hand over these assets in case of default. Second, there are legal principles that protect sovereign assets, even when they are located in foreign jurisdictions (sovereign immunity has however been eroded in recent years, see Schumacher et al. 2018).

Starting from these considerations, the economic literature on sovereign debt has focused on the incentives to repay that sustain the market for sovereign debt when enforcement is weak. The main insight of this literature is that, given that countries cannot be forced to repay, they will do so only if they think that the actual cost of paying is lower than the expected cost of not repaying (Eaton and Gersovitz 1981). As creditors will only lend if they expect that debtor countries will likely repay, the expected costs of default are what makes sovereign debt possible. Empirical work on the costs of sovereign default has mostly focused on reputation in the international capital market and GDP growth. These are also the main indicators used to proxy the cost of default in quantitative models of sovereign debt (Arellano 2008).

The results of the empirical literature that test for reputational effects are mixed. Several authors find that the negative consequences of sovereign defaults on the terms of access to the international capital market are either short lived or small (see Eichengreen and Portes 1986, Borensztein and Panizza 2010, Gelos et al. 2011). Cruces and Trebesch (2011) show that, although these results hold for the average defaulter, the reputational costs of default are increasing with the haircut imposed on creditors. Catão and Mano (2015), on the contrary, find that defaulters pay a large and long-lived premium, irrespective of the size of the haircut.

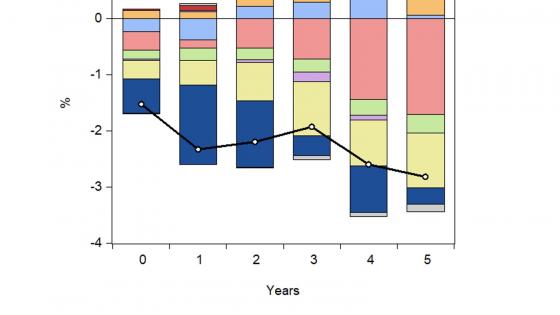

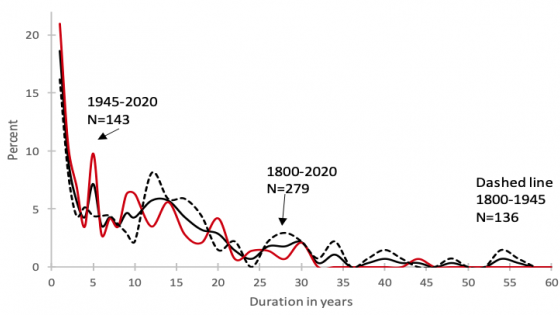

There are also mixed results in the empirical literature that focuses on the output costs of default. Cross-country regressions suggest that defaults are associated with a short-term decrease in GDP growth of approximately two percentage points (Sturzenegger 2004, Borensztein and Panizza 2010, Esteves et al. 2021).1 There is also evidence that ‘decisive’ debt restructurings tend to have lower output costs (Reinhart and Trebesch 2014).

Rather than looking at the cost of default, our recent paper (Caselli et al. 2021) studies the benefits of repaying during times of widespread default. We focus on the case of Colombia, the only large Latin American country that is generally deemed to not have defaulted in the 1980s.

In the tradition of Eaton and Gersovitz (1981), we expect that reputational gains in the international capital markets should be higher if a country shows willingness to service its debts when faced with a very large negative shock. For example, Tomz (2012) argues that this is exactly the reason why during the 1930’s the Argentinean Minister of Finance Alberto Hueyo insisted that Argentina continue servicing its debt.2 Similarly, in our case the lead debt negotiator for Colombia in the 1980s emphasised that maintaining the role of ‘good debtor’ and being an exceptional case in Latin America and in most of the developing world could improve Colombia's future market access (Garay 1991).

While Colombia is normally classified as a country that did not default in the 1980s, in fact the country went through four rounds of debt rescheduling, with conditions which were only slightly more favourable to creditors than the conditions applied by other Latin American countries that are normally classified as defaulters. Indeed, following these rescheduling, Colombia's syndicated bank loans were trading in the secondary market at a large discount. The binary classifications of default/non-default typically employed in the empirical literature fail to capture these events. Our extensive research of the IMF archives shows that Colombia’s main differences with other countries in the region were more of a political rather than economic nature. On the one hand, Colombia’s fundamentals in the early 1980s were similar to those of its neighbouring (defaulting) countries, suggesting that its ‘ability to pay’ was not significantly different. On the other hand, historical research shows that the Colombian authorities had a clear willingness to maintain a good relationship with their creditors. For this reason, they strived and managed to avoid a formal restructuring agreement within an IMF program but were able to convince the IMF to play the informal role of external monitor. This was only made possible by the strong political support from the US administration and the US Federal Reserve.

In our empirical analysis we try to measure the short-term and long-term benefits from repaying. We find that during the Latin American debt crisis, by not explicitly defaulting, Colombia enjoyed significant economic benefits. However, we also find that Colombia’s improved reputation in the international capital market was not long lived.

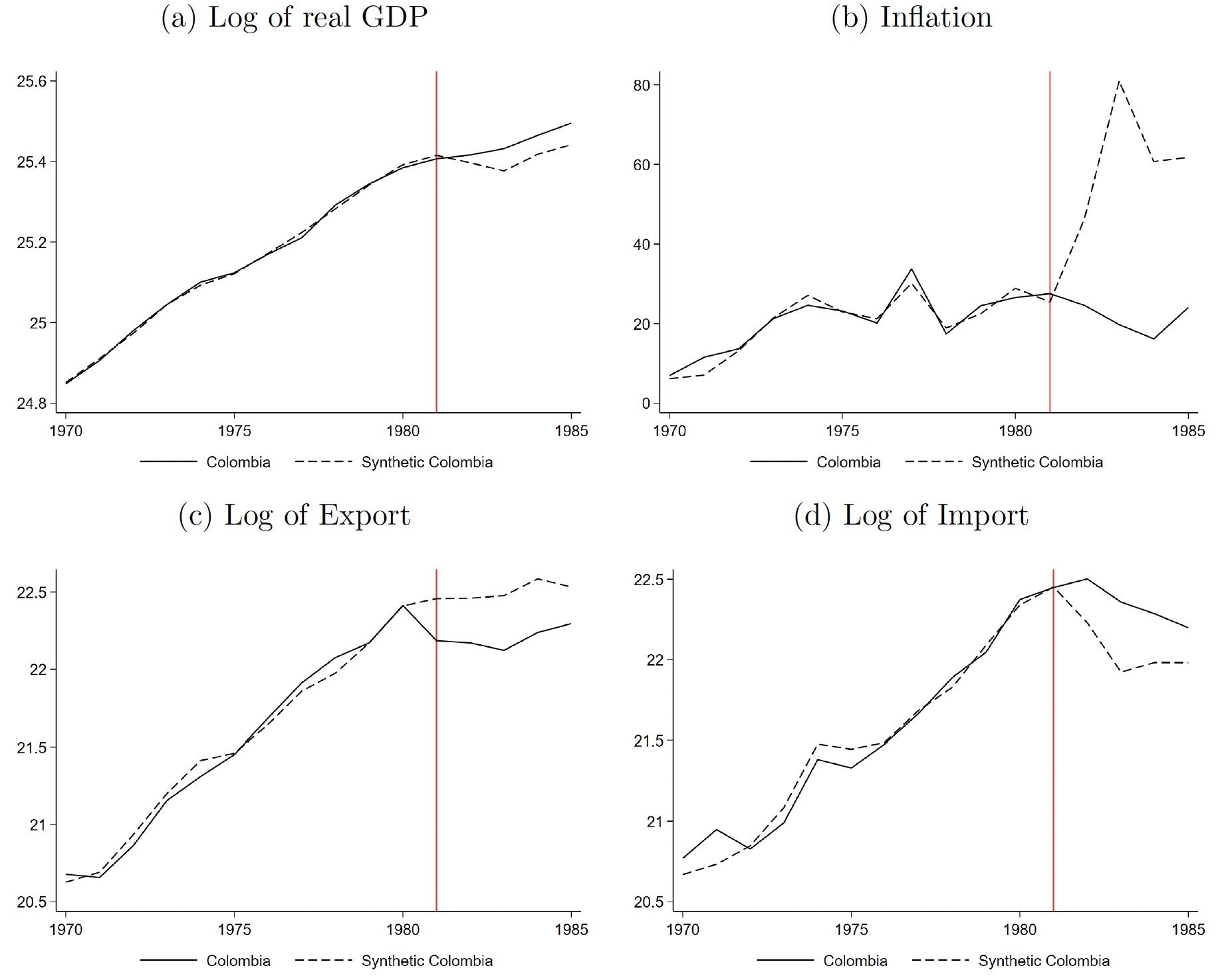

In order to measure the effect of Colombia's decision to avoid a formal debt rescheduling in the short run, we use synthetic control and synthetic difference-in-differences. Figure 1 shows the results of the synthetic control analysis, comparing Colombia (solid line) with a counterfactual built from a weighted average of its neighbouring defaulting countries. We see that Colombia did better in terms of higher output growth and lower inflation, while it avoided the typical sudden stop scenario of a sharp trade balance reversal (large contraction of imports and rise of exports) of its counterfactual. Our results are in line with those of Trebesch and Zabel (2017) and Asonuma and Trebesch (2016), who find that conflictual restructuring processes are associated with larger output losses.

Figure 1 Effect of Colombia’s non-default on macroeconomic conditions

As mentioned, the reputation improvement with international creditors was not long lived. To investigate the possible presence of long-term beneficial reputational effects, we conduct an event study around the sudden stop episode that followed the Russian default of August 1998. The financial shock associated with this event was enormous: flows to the largest seven Latin American economies fell from $100 billion over the period 1997Q3-1998Q2 to $37billion in 1998Q3-1999Q2, while average sovereign yield spreads in the region tripled (Calvo and Talvi 2005). We focus on this event based on the idea that reputation should be particularly valuable during times of extreme stress.

We find that in the aftermath of the Russian default Colombia did not enjoy privileged market access with respect to other Latin American countries. In fact, our estimations suggest that the Colombian spreads rose even more than those of its neighbouring countries. We offer two possible interpretations for this result. The first is simply that reputation is short-lived, possibly attached to governments rather than countries. The second interpretation is that investors saw through what happened in the 1980s and realised that, notwithstanding Colombia’s classification as a ‘non-defaulter’, the country did enjoy debt treatments which were very similar to those of the countries who explicitly defaulted in the 1980s.

Taken together, our results support the view that it may be misleading to treat default episodes as binary events (Meyer et al. 2019) and that more research is needed to understand the short and long-term economic effects of different debt rescheduling strategies.

Authors’ note: The views expressed here are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

References

Arellano, C (2008), “Default Risk and Income Fluctuations in Emerging Economies”, American Economic Review 98(3): 690-712.

Asonuma, T and C Trebesch (2016), “Sovereign Debt Restructurings: Preemptive or Post Default”, Journal of the European Economic Association 14(1): 175-214.

Borensztein, E and U Panizza (2010), “The costs of sovereign default: Theory and reality”, VoxEU.org, 06 May.

Calvo, G and E Talvi (2005), “Sudden Stop, Financial Factors and Economic Collapse in Latin America: Learning from Argentina and Chile”, NBER Working Paper 11156.

Caselli, F, M Faralli, P Manasse and U Panizza (2021), “On the Benefits of Repaying”, CEPR Discussion Paper 16539.

Catão, L and R C Mano (2015), “Measuring the interest premium for past default”, VoxEU.org, 29 September.

Cruces, J J and C Trebesch (2011), “Haircuts and the cost of sovereign default”, VoxEU.org, 13 October.

Eaton, J and M Gersovitz (1981), “Debt with potential repudiation: Theoretical and empirical analysis”, The Review of Economic Studies 48(2): 289-309.

Eichengreen, B and R Portes (1986), “Debt and Defaults in the 1930s: Causes and Consequences”, European Economic Review 30: 599-640.

Esteves, R, S Kenny and J Lennard (2021), “The aftermath of sovereign debt crises”, VoxEU.org, 20 July.

Garay, L J (1991), El Manejo de la Deuda Externa de Colombia, Bogota: Fondo Editorial CEREC.

Gelos, R G, R Sahay and G Sandleris (2011), “Sovereign Borrowing by Developing Countries: What Determines Market Access?”, Journal of international Economics 83(2): 243-254.

Jorgensen, E and J Sachs (1989), “Default and Renegotiation of Latin American Foreign Bonds in the Interwar Period”, in B Eichengreen and P Lindert (eds), The International Debt Crisis in Historical Perspective, Cambridge MA: MIT Press.

Meyer, J, C Reinhart and C Trebesch (2019), “Sovereign Bonds since Waterloo”, NBER Working Paper 25543.

Reinhart, C and C Trebesch (2014), “Sovereign-debt relief and its aftermath: The 1930s, the 1990s, the future?”, VoxEU.org, 21 October.

Schumacher, J, C Trebesch and H Enderlein (2018), “The legal cost of default: How creditor lawsuits are reshaping sovereign debt markets”, VoxEU.org, 16 July.

Sturzenegger, F (2004), “Toolkit for the Analysis of Debt Problems”, Journal of Restructuring Finance 1(1): 201-203.

Tomz, M (2012), Reputation and international cooperation: sovereign debt across three centuries, Princeton University Press.

Trebesch, C and M Zabel (2017), “The Output Costs of Hard and Soft Sovereign Default”, European Economic Review 92(C): 416-432.

Endnotes

1 Note that these short-term effects on GDP growth can have long-term effects on output levels.

2 Tomz (2012) and Jorgensen and Sachs (1989) study Argentina's behaviour in the 1930s. The former suggests that Argentina obtained reputational gains from not defaulting in the 1930s. In the latter, the authors conclude that “when the countries returned to the international capital markets in the 1950s, no apparent systematic difference between defaulters and non-defaulters emerges” (p. 79). While these authors reach opposite conclusions, they do not provide any formal test.