With debt-levels hitting record highs and growth running low on steam, European policymakers have found themselves facing a grim dilemma: should government spending be increased at the risk of reawakening the wrath of the sovereign bond markets? Or should austerity instead assume the political mantra with the hope of merely muddling through?

True, substantial theoretical and empirical evidence lend support to the idea that a deficit-financed expansion in public spending may raise output and speed up the recovery. And the most recent experience in Europe has shown with terrifying clarity that high levels of debt may provoke yet another round of sovereign debt crises. But there is little, if any, support in the current macroeconomic literature for the view that expansionary fiscal policy must come at the price of ramping up debt. In fact, contemporaneously tax-financed spending might do the trick equally well. And inasmuch as a ‘balanced-budget stimulus’ can set the economy on a steeper recovery path, the long-run sustainability of debt may well improve, and not deteriorate (DeLong and Summers 2012).

The reasoning underlying these ideas is known as Ricardian equivalence (Barro 1974). Yes, the same theorem that allegedly bears responsibility for putting a “nail in the coffin” of the Keynesian multiplier (Cochrane 2009) also suggests that spending will have the same effect independently of its source of financing. Ricardian equivalence states that, under certain conditions, financing a given level of spending through debt (ie future taxes), or through current taxes, is irrelevant.

Yet while Ricardian equivalence might have put a nail in the coffin of the Keynesian multiplier, it has certainly not pre-empted the underlying idea: that an increase in government spending may provoke a kickback in output many times the amount initially spent. Indeed, a body of recent research suggests that the fiscal multiplier may be very large, independently of the foresightedness of consumers (Christiano et al 2011, Eggertson 2010). And in a recent study of mine (Rendahl 2012), I identify three crucial conditions under which the fiscal multiplier can easily exceed 1 irrespective of the mode of financing. These conditions, I argue, are met in the current economic situation.

Three conditions for a large balanced-budget multiplier

Condition 1. The economy is in a liquidity trap …

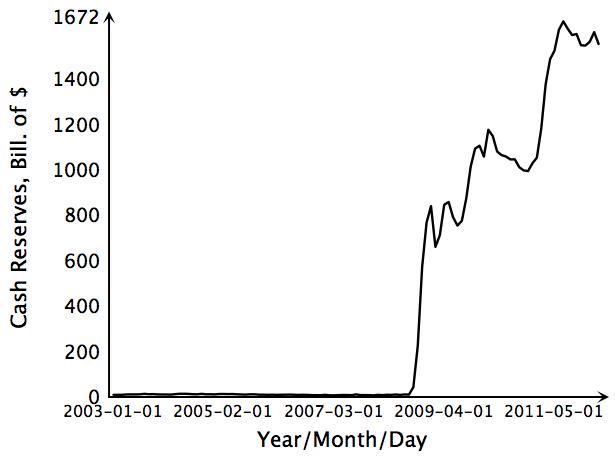

When interest rates are near, or at, zero, cash and bonds are considered perfect substitutes. As the intertemporal price of money fails to adjust further, a disequilibrium emerges in which the demand for assets exceeds the supply. A dollar lent is no longer a dollar borrowed, and cash is instead hoarded. Figure 1 illustrates the evolution of US banks’ cash reserves held at the Federal Reserve from 2003 until today. While money, of course, is a very elusive concept, the skyrocketing rise of bank cash reserves suggests that liquid means are being pulled out of circulation.

Figure 1.

Under these peculiar circumstances the laws of macroeconomics change. A dollar spent by the government is no longer a dollar less spent elsewhere. Instead, it’s a dollar less kept in the mattress. And the logic underpinning Say’s law – the idea that the supply of one commodity must add to the immediate demand for another – is broken. In a liquidity trap, the supply of one commodity (eg labour) may rather add to the immediate demand for cash, and not to any other real commodity per se (Mill 1874). From merely being a means of payment, cash turns into a means of storage.

Condition 2. … with high unemployment …

So while a dollar spent by the government is not a dollar less spent elsewhere, it is not immediate, nor obvious, whether this implies that government spending will raise output. The second criterion therefore concerns the degree of slack in the economy.

If unemployment is close to, or at, its natural rate, an increase in spending is unlikely to translate to a substantial rise in output. Labour is costly and firms may find it difficult to recruit the workforce needed to expand production. An increase in public demand may just raise prices and therefore offset any spending plans by the private sector.

But at a high rate of unemployment, the story is likely to be different. The large pool of idle workers facilitates recruitment, and firms may cheaply expand business. An increase in public demand may plausibly give rise to an immediate increase in production, with negligible effects on prices. Crowding-out is, under these circumstances, not an imminent threat.

Combining the ideas emerging from Conditions 1 and 2 implies that the fiscal multiplier – irrespective of the source of financing – may be close to 1 (cf Haavelmo 1945).

Condition 3. … which is persistent

But if unemployment is persistent, these ideas take yet another turn. A tax-financed rise in government spending raises output, and lowers the unemployment rate both in the present and in the future. As a consequence, the increase in public demand steepens the entire path of recovery, and the future appears less disconcerting. With Ricardian or forward-looking consumers, a brighter outlook provokes a rise in contemporaneous private demand, and output takes yet another leap. Thus, with persistent unemployment, a tax-financed increase in government purchases sets off a snowballing motion in which spending begets spending.

Where does this process stop? In a stylised framework in which there are no capacity constraints and unemployment displays (pure) hysteresis, I show that the fiscal multiplier is equal to the inverse of the elasticity of intertemporal substitution, a parameter commonly estimated to be around 0.5 or lower. Under such conditions, the fiscal multiplier is therefore likely to lie around 2 or thereabout.

Collecting arguments

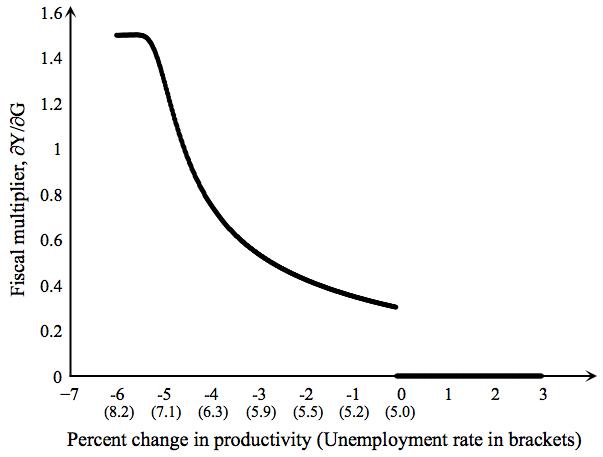

To provide more solid grounds to these arguments, I construct a simple DSGE model with a frictional labour market.1 A crisis is triggered by an unanticipated (and pessimistic) news shock regarding future labour productivity. As forward-looking agents desire to smooth consumption over time, such a shock encourages agents to save rather than to spend, and the economy falls into a liquidity trap. In similarity to the aforementioned virtuous cycle, a vicious cycle emerges in which thrift reinforces thrift, and unemployment rates are sent soaring. Figure 2 illustrates the associated fiscal multiplier (y-axis) under a range of news shocks, stretching from a 7% decline in labour productivity to a 3% increase. The unemployment rate is given in brackets.

Figure 2.

There are three important messages to take away from this graph.

- First, for positive or small negative values of the news shock, the multiplier is zero. The reason is straightforward: With only moderately pessimistic news, the nominal interest rate aptly adjusts to avert a possible liquidity trap, and a dollar spent by the government is simply a dollar less spent by someone else.

- Second, however, once the news is ominous enough, the economy falls into a liquidity trap. The multiplier takes a discrete jump up, and public spending unambiguously raises output. Yet, in a moderate crisis with an unemployment rate of 7% or less, private consumption is at least partly crowded-out.

- Lastly, however, in a more severe recession with an unemployment rate of around 8% or more, the multiplier rises to, and plateaus at, around 1.5. Government spending now raises both output and private consumption, and unambiguously improves welfare.

Conclusions

Pessimism and uncertainty about the future fuels fear, and fear is, as we know, a powerful thing.

- A gruesome outlook can set the economy on a downward spiral in which fear reinforces fear; thrift reinforces thrift; and unemployment rates are sent soaring.

But the same mechanisms that may cause a vicious circle can also be turned to our advantage.

- A tax- or debt-financed expansion in government spending raises output and sets the economy on a steeper path to recovery.

Pessimism is replaced by optimism and spending begets spending.

But these times are also fragile. Without a credible plan for financing, an increase in government spending will come at the price of debt. And a rise in debt may contribute to further rounds of pessimistic expectations. To be successful, therefore, the tax and spending policy advocated in this column must not magnify people’s insecurities.

References

Barro, Robert (1974), “Are Government Bonds Net Wealth?”, Journal of Political Economy, 82(6).

Christiano, Lawrence, Martin Eichenbaum, and Sergio Rebelo (2011), “When is the Government Spending Multiplier Large?”, Journal of Political Economy, 119(1).

Cochrane, John (2009), “Are We All Keynesians Now?”, The Economist.

DeLong, Bradford, and Lawrence Summers (2012), “Fiscal Policy in a Depressed Economy.” Brookings, March.

Eggertson, Gauti B (2010), “What Fiscal Policy is Effective at Zero Interest Rates?”, NBER Macroeconomics Annual, 25(1).

Haavelmo, Trygve (1945), “Multiplier Effects of a Balanced Budget”, Econometrica, 13(4).

Mill, John S (1874), Some Unsettled Questions of Political Economy, London: Longmans, Green, Reader and Dyer.

1 DSGE model = Dynamic Stochastic General Equilibrium model.