The spread of the coronavirus and the associated containment measures have led to a shutdown of many economic activities during the first half of 2020 (Baldwin and Weder di Mauro 2020), also impacting the banking sector. Although banks entered the crisis with a higher level of capital and liquidity compared to recent crisis episodes, the observed sharp tightening in financial conditions, the heightened funding stress, and the major repricing in risky assets have tested their resilience (Acharya and Steffen 2020). These developments, together with the increasing potential for more adverse scenarios to materialise, triggered an unprecedented policy intervention.

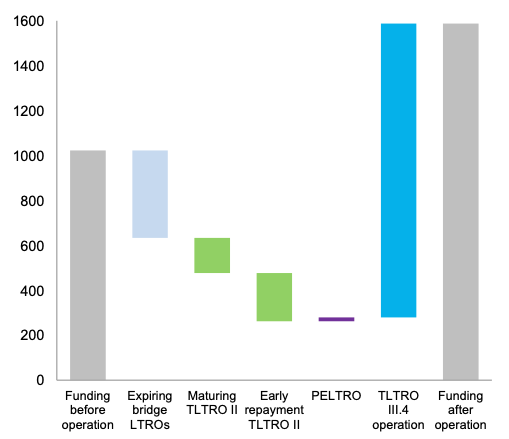

In many jurisdictions, the policy response to the COVID-19 crisis has resulted in a series of new and additional measures by monetary and prudential authorities. In the euro area, the response included a recalibration of the targeted longer-term refinancing operations (TLTROs) by the ECB and the relaxation of capital requirements by the centralised microprudential authority and by national macroprudential authorities. Figure 1 displays the size of borrowing by banks under the recalibrated TLTRO III programme and the size of the capital relief generated by prudential measures taken in response to the COVID-19 shock.

Figure 1 Monetary policy and prudential policy measures in response to COVID-19

Notes: Left-hand side: Eurosystem borrowing (billions of euros); right-hand side: CET1 capital and buffers (billions of euros). The top panel displays the change in euro area banks’ borrowing from the Eurosystem before and after the June 2020 TLTRO operation. The bottom panel displays the size of the capital relief brought forth by the micro and macroprudential measures taken in response to the COVID-19 crisis.

The existing body of literature that studies the impact of monetary policy measures (e.g. Rostagno et al. 2019) and of capital requirements on bank credit focuses on pre COVID-19 episodes. Exceptions are a few recent US-based studies (Brunnermeier and Krishnamurthy 2020, Blank et al. 2020). Moreover, most of the existing literature studies only individual policies. As a consequence, empirical evidence on the interaction and potential amplification effects of monetary policy and prudential policy is scant. As monetary policy easing was coupled with an easing of macroprudential and microprudential measures during the COVID-19 crisis, it is important to understand whether the effects on bank lending associated with this combination of measures are larger than the effects associated with the same measures taken in isolation. This is an important question with vast policy implications, and it boils down to whether monetary policy and prudential policy are complements or substitutes. If the policies are complementary, this would indeed point to benefits of tight coordination. The rationale is related but distinct from the ‘leaning against the wind’ orientation of monetary policy, which involves taking financial stability considerations into account in setting monetary policy objectives (Woodford 2012, Borio 2014, Svensson 2017).

In our recent paper (Altavilla et al. 2020), we provide the first empirical assessment of the effectiveness of the policy responses directly targeting bank lending conditions in protecting banks’ intermediation capacity in the euro area. Moreover, we also investigate whether the coordinated nature of the pandemic response policies triggered amplification effects above and beyond the impact of their individual announcement and implementation.

The three main results of our analysis are summarised below.

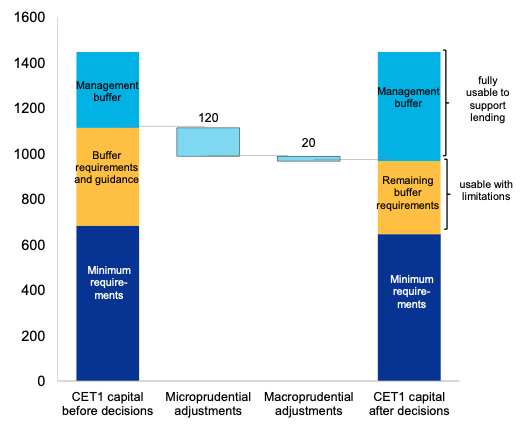

First, in absence of the pandemic response measures, persistent impairment in access to market-based funding, coupled with the substantial surge in loan demand for emergency liquidity needs (Schivardi and Romano 2020), would have seriously undermined banks’ intermediation capacity. The cumulative impact of the non-standard monetary policy measures on loan growth is sizeable. Figure 2 compares our estimate of the average annual impact on lending growth with the estimates found by 17 studies from the literature: the increase in loan growth due to TLTRO would be around 1.1-1.7 percentage points each year. Thus, the June 2020 operation alone has the potential to avert at least 3 percentage points of loan volume decline over the period 2020-22.

Figure 2 Average annual impact of TLTRO on bank loan growth

Note: The vertical lines report two estimates of the impact of the TLTRO operation conducted in June 2020 (TLTRO III.4) on the average annual loan growth of euro area banks over the life of the programme. The solid line shows the distribution of estimates available in the literature (see Altavilla et al. 2020).

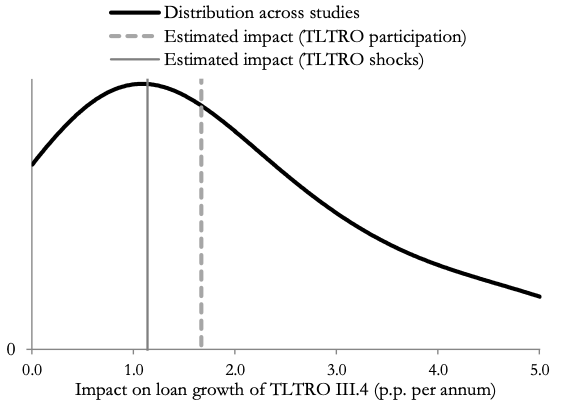

Moreover, the micro and macroprudential relief measures effectively reduced regulatory capital requirements, thus complementing monetary policy action by providing ample space for banks to absorb losses and still support the economy and thereby mitigating the risk of pro-cyclical deleveraging. Taken together, it is estimated that these measures grant a capital relief of 1.5 percentage points, thus creating space for an impact on lending growth that we estimate to be as high as 2.2 percentage points a year. This assessment is in line with the median impact from a wide range of studies covering both empirical and model-based assessments (Figure 3).

Figure 3 Total impact of capital relief measures on bank lending

Note: The vertical line reports the estimated impact of the capital relief measures on loan growth. The solid line shows the distribution of estimates available in the literature (see Altavilla et al. 2020).

Second, when looking at variables that have been more exposed to similar policies already in the past, such as the adjustment in labour input variables for firms, we find that in the absence of the pandemic policies, firms’ employment could decline by 1.4% over the next two years, which is equivalent to more than one million workers losing their jobs.

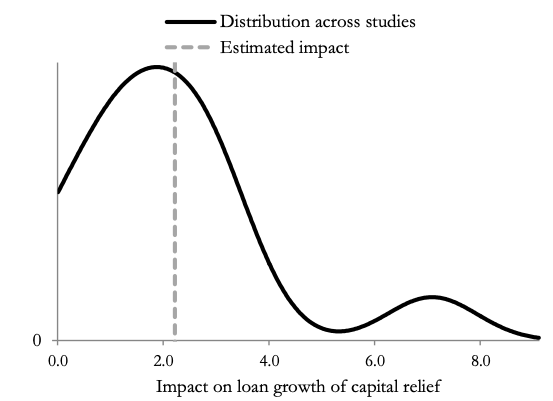

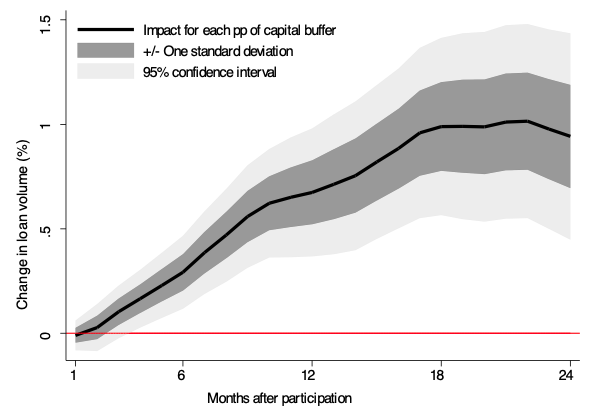

Third, we document strong complementarities between the monetary policy and the micro and macroprudential policy measures. The liquidity provision injected through TLTROs sustains banks’ intermediation capacity and is found to be particularly effective in stimulating lending if it can rely on banks’ ability to draw on their capital buffers. Based on past experiences with TLTROs, each percentage point of capital buffer can enable up to one additional percentage point increase in loan volumes for participating banks. This effect is gradual and stabilises at around one and a half years after take-up (Figure 4). By creating space for bank lending, capital relief measures can therefore significantly boost the effectiveness of the TLTROs, provided that banks can actively deploy the capital buffers released.

Figure 4 Complementarity between monetary policy and prudential policy measures

Note: The figure reports the impact on loan growth of participating in a TLTRO operation for each percentage point of available capital buffer.

In summary, the pandemic response policies have prevented an adverse equilibrium of acute financial market volatility coupled with impaired access to funding, which would have resulted in a substantial contraction in lending and an even sharper collapse in real economic activity. The measures significantly improved banks’ capacity to remain active carriers of the monetary stimulus. We assess the effects of the pandemic response measures on the real economy by estimating the adjustment in labour input variables for firms that in the past have been more exposed to similar policies and find that, in the absence of monetary and prudential policies, firms’ employment would significantly decline. Finally, our analysis reveals important complementarities between a targeted stimulus for loan origination via term funding operations and the endowment of the capital buffers necessary to produce the intended increase in exposures. We estimate that the close coordination between monetary policy and prudential measures has generated a sizable amplification effect on lending.

Authors’ note: The views expressed are those of the authors and do not necessarily reflect the views of the ECB or the Eurosystem.

References

Acharya, V and S Steffen (2020), “Stress tests’ for banks as liquidity insurers in a time of COVID”, VoxEU.org, 22 March.

Altavilla, C, F Barbiero, M Boucinha, L Burlon (2020), "The great lockdown: pandemic response policies and bank lending conditions," Working Paper Series 2465, European Central Bank.

Baldwin, R, B Weder di Mauro (2020), Economics in the time of COVID-19, a CEPR press eBook.

Blank, M, S G Hanson, J C Stein and A Sunderam (2020), “How should U.S. bank regulators respond to the COVID-19 crisis?”, Hutchins Center Working Papers, No 63.

Borio, C (2014) “Monetary policy and financial stability: what role in prevention and recovery?”, BIS Working Paper, No 440.

Brunnermeier, M and A Krishnamurthy (2020), “Corporate Debt Overhang and Credit Policy”, Brooking Papers on Economic Activity, June.

Rostagno, M, C Altavilla, G Carboni, W Lemke, R Motto, A Saint Guilhem, J Yiangou (2019), “A tale of two decades: the ECB’s monetary policy at 20”, ECB Working Papers, No 2346, European Central Bank.

Schivardi, F, G Romano (2020), “Liquidity crisis: Keeping firms afloat during Covid-19”, VoxEU.org, 18 July.

Svensson, L E O (2017), “Cost-benefit analysis of leaning against the wind”, Journal of Monetary Economics 90: 193-213.

Woodford, M (2012), “Inflation targeting and financial stability”, NBER Working Paper No. 17967.