The year 2024 marks the 80th anniversary of the Bretton Woods conference, when 44 international delegates met in New Hampshire to devise a new economic order after WWII. Led by British economist John Maynard Keynes and US Treasury representative Harry Dexter White, a bold new monetary standard was established. Under this gold-dollar standard, the dollar became the official reserve currency, convertible to gold at $35 per troy ounce, and international payments were settled in dollars. The system was designed as a compromise, maintaining the fixed exchange rates of the gold standard while providing more flexibility for domestic policymaking, yet it suffered from many of the same issues as the classical gold standard, leading to its eventual demise in the early 1970s (Bordo 2017).

The international cooperation and synchronisation that established the Bretton Woods monetary standard was a major shift from the operation of the gold standard in the interwar years. After WWI, countries independently decided to restore the gold standard at various times in the 1920s – sometimes at their pre-war parity, and sometimes at other parities. By 1925, about 60% of currencies listed by the League of Nations were restored to a gold standard, and by 1930, the gold standard was back to being almost universal (Bernanke and James 1991). When the gold standard began to fall apart in 1931, it similarly broke down piece by piece. The lack of cooperation meant that countries that devalued earlier in the 1930s were generally advantaged in international comparison, enjoying increased industrial production and exports (Eichengreen and Sachs 1985, Boucasse 2023) and rising inflation expectations and lower real interest rates (Ellison et al. 2024).

Britain was one of these early leavers, abandoning the gold standard in September 1931. Like other nations, in 1931 Britain was in the depths of the Great Depression, shaken by the failure of the Austrian bank Creditanstalt, the collapse of the global price level, and mass unemployment on an unprecedented scale. Britain’s devaluation is often seen as a turning point in its recovery from the Great Depression, boosting its international competitiveness, enabling monetary expansion, and reversing inflation expectations (Solomou 1996, Morys 2014, Crafts 2018). Yet the impact of devaluation on labour markets in Britain has been difficult to disentangle quantitatively owing to the many policy changes that occurred in this brief period and a lack of data.

In a new paper, we explore how the 1931 departure from the gold standard impacted the interwar British economy through its effects on unemployment (Lennard and Paker 2023). Britain’s unexpected departure from the gold standard increased its international competitiveness dramatically as the sterling effective exchange rate (a trade-share weighted average of bilateral exchange rates against the pound) fell by 23% between the second and fourth quarters of 1931 (Andrews 1987). This was a boon for the export industries that had struggled to compete in international markets with an overvalued currency, while non-export-intensive industries were less directly affected by devaluation.

We use this channel to identify the causal impact of devaluation on unemployment in Britain. We construct a new dataset linking high-frequency micro data on monthly unemployment rates by industry from Paker (2024) with newly collected data on industries’ export intensity in 1930. We use this dataset to identify the impact of devaluation by evaluating the differences in how unemployment rates changed in export-intensive industries versus in non-export-intensive industries immediately after Britain left the gold standard. This difference-in-differences approach holds fixed the national macroeconomic environment, expectations, and underlying differences between export and non-export industries to isolate the impact of leaving the gold standard on unemployment rates for impacted (export) industries.

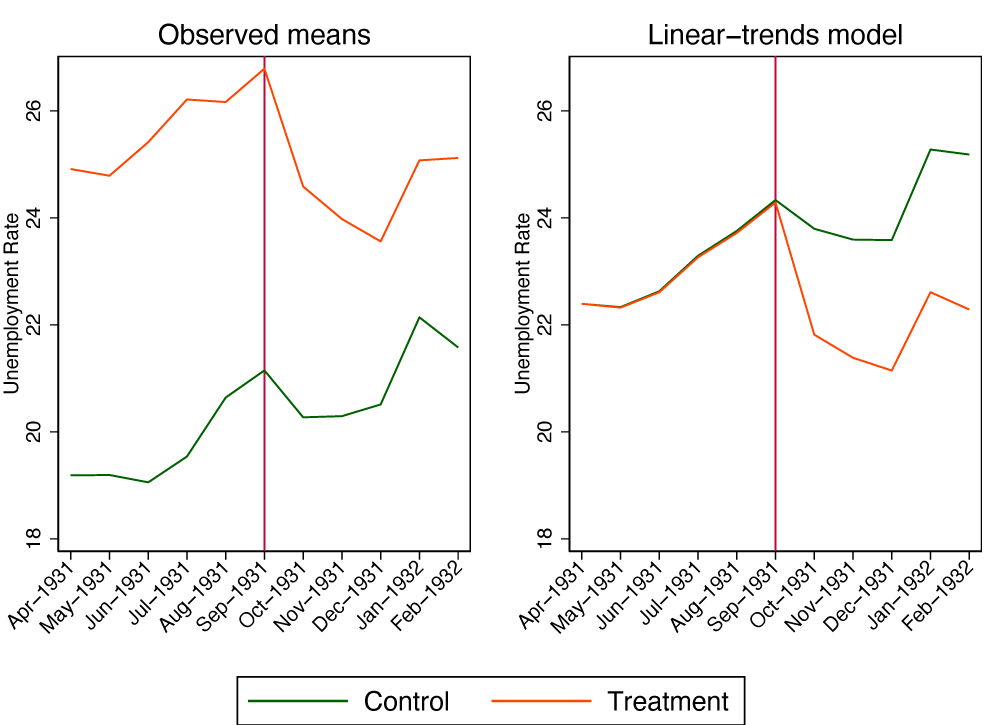

Figure 1 illuminates this identification strategy, showing the difference in unemployment rates between export-intensive and non-export-intensive industries before and after leaving the gold standard in September 1931. Prior to leaving the gold standard, export industries had higher unemployment rates than non-export industries, but unemployment rates were trending in parallel. After leaving the gold standard, unemployment rates fell much more for export industries than for non-export industries, which is the causal impact of devaluation.

Figure 1 Unemployment rates in export vs. non-export industries before and after devaluation

Note: The control group is the non-export-intensive industries and the treatment group is the export-intensive industries. Export-intensive industries are those that reported the percentage of their output exported in the 1930 Census of Production as greater than 10%.

In this analysis, we find that leaving the gold standard lowered unemployment rates by 2.7 percentage points more in export-intensive industries compared to those industries that were relatively closed. Because export industries had much higher unemployment rates to begin with, this represents a reduction in the differences in unemployment rates between open and closed industries by almost half.

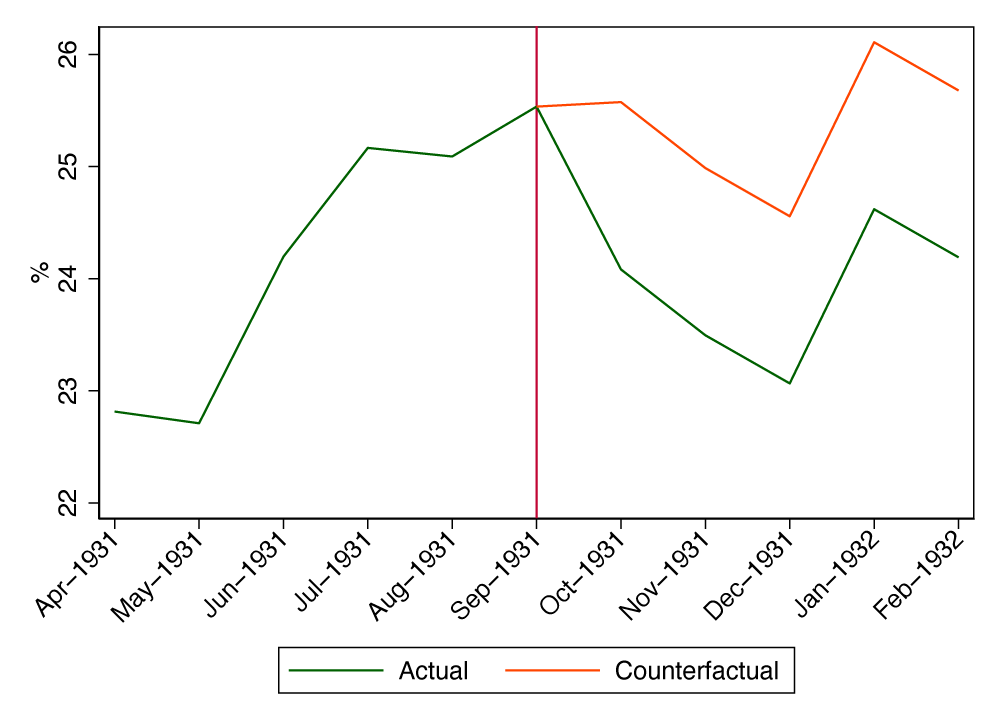

What were the macro effects of this benefit to employment in the export industries? Figure 2 gives the actual aggregate unemployment rate and our estimated counterfactual unemployment rate without devaluation. We conservatively estimate that devaluation’s impact on the export industries alone reduced aggregate unemployment by about 1.5 percentage points. In additional analyses, we associate this decrease in aggregate unemployment with about a 0.6-0.7% reduction in government spending and about a 0.6-0.9 percentage point increase in economic growth.

Figure 2 Actual and counterfactual unemployment with no devaluation

Note: The actual unemployment rate is the aggregate unemployment rate among insured industries, while the counterfactual unemployment rate is the estimated aggregate unemployment rate in the absence of devaluation.

Our results suggest that leaving the gold standard was an important initial spark in Britain’s recovery from the Great Depression. The almost-immediate boost to export industries from devaluation paved the way for a full recovery from the Great Depression that was ultimately reinforced and completed by cheap money, revised inflationary expectations (Lennard et al. 2023), and rearmament.

Britain’s unexpected departure from the gold standard in 1931 was at odds with other leading nations such as the US and France, which remained on the gold standard until 1933 and 1936, respectively. Our work shows that this led to a major devaluation that decisively benefited Britain’s economy and started its recovery from the Great Depression. In an era where international cooperation was ineffective, devaluation provided a boost to domestic economies.

The Bretton Woods conference 80 years ago was significant for ushering in a new era of international monetary cooperation. This cooperation ultimately led to a shift to floating exchange rates later in the 20th century. However, despite these advances, modern economies have still experienced large and unanticipated depreciations. For example, after the Brexit vote in June 2016, the pound immediately dropped to a 30-year low against the euro and found a level 15-20% weaker than prior to the referendum (Coyle 2021). Russia’s invasion of Ukraine in 2022 and the resulting international sanctions led to a decline against the dollar of 40% from December 2022 to September 2023 (Scott Davis and Patel 2023). These recent events demonstrate that, despite a much more integrated and cooperative monetary system than in the interwar period, the macroeconomic consequences of large exchange rate depreciations remain relevant.

References

Andrews, B P A (1987), “Exchange Rate Appreciation, Competitiveness and Export Performance: The UK Experience in the Inter-war Period”, DPhil thesis, University of Oxford.

Bernanke, B and H James (1991), “The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison”, in R G Hubbard (ed.), Financial Markets and Financial Crises, University of Chicago Press.

Bordo, M D (2017), “The Operation and Demise of the Bretton Woods System: 1958 to 1971”, VoxEU.org, 23 April.

Bouscasse, P (2023), “Canst Thou Beggar Thy Neighbour? Evidence from the 1930s”.

Coyle, C (2021), “How has Brexit Affected the Value of Sterling?”, Economics Observatory.

Crafts, N (2018), Forging Ahead, Falling Behind and Fighting Back: British Economic Growth from the Industrial Revolution to the Financial Crisis, Cambridge University Press.

Eichengreen, B and J Sachs (1985), “Exchange Rates and Economic Recovery in the 1930s”, Journal of Economic History 45(4): 925–946.

Ellison, M, S S Lee and K H O’Rourke (2024), “The Ends of 27 Big Depressions”, American Economic Review 114(1): 134–168.

Lennard, J, F Meinecke and S Solomou (2023), “Measuring Inflation Expectations in Interwar Britain”, Economic History Review 76(3): 844–870.

Lennard, J and M M Paker (2023), “Devaluation, Exports, and Recovery from the Great Depression”, CEPR Discussion Paper 18702.

Morys, M (2014), “Cycles and Depressions”, in R Floud, J Humphries, and P Johnson (eds), The Cambridge Economic History of Modern Britain: 1870 to the Present, 4th ed, vol 2., Cambridge University Press.

Paker, M M (2024), “Industrial, Regional, and Gender Divides in British Unemployment Between the Wars”, European Review of Economic History, forthcoming.

Scott Davis, J and K Patel (2023), “Russian Ruble Buckles under Trade Sanctions, Declining Export Earnings”, Dallas Fed Economics.

Solomou, S (1996). Themes in Macroeconomic History: The UK Economy, 1919–1939, Cambridge University Press.