Addressing climate change is one of the most pressing priorities of our time. There is now a broad consensus that climate change is happening, that it could be immensely costly, and that human activity is responsible. The economic growth imperative has overridden sustainability considerations for far too long. From being propounded by a few, fighting climate change has become the cause of the vast majority.

But it is one thing to recognise the need for policy adjustments and quite another to implement them (Weder di Mauro 2021). ‘Greening the economy’, i.e. cutting CO2 emissions to address the ‘physical risk’ of huge climate-induced damage, will call for a major reallocation of resources – a shift from emissions-intensive (‘brown’) to emissions-light (‘green’) activities. This reallocation is bound to be painful, hard to engineer, and fraught with ‘transition risks’. It requires major government intervention (e.g. Pisu et al. 2022).

What is the role of the financial sector in this necessarily collective effort? It is sometimes argued that action in the financial sector can compensate for inaction in the real economy. That is, there are expectations for the financial sector to lead the way, rising above a merely supporting role.

Our view is that these expectations are exaggerated. Finance faces the very obstacles that have hamstrung progress in the real economy. Moreover, seeking to tackle these obstacles first or only through the financial sector runs the risk of decoupling the sector from the real economy, thereby raising financial stability risks. There are risks of commission that would come on top of the far better-known risks of omission, i.e. those of failing to anticipate the disruptions that greening the economy would bring.

The nature of the problem

Why has it proved so difficult to tackle climate change?

For starters, there has been a problem of information. For a long time, a major stumbling block was the failure to agree that a problem existed in the first place. Initially, it was doubts about whether increases in global temperatures were significant enough to point to a trend. Subsequently, once this was no longer disputed, fierce disagreements raged over whether human activity was primarily responsible. But now policymakers have come to the view that urgent action is needed, in response to accumulated evidence and a swell of public opinion spearheaded by the younger generations. Hence the recent pledge by many countries to achieve net zero CO2 emissions by 2050 (UNEP 2021).

The remaining, and much higher, stumbling block has to do with incentives. For one, while the benefits of a transition will accrue mainly to the yet-to-be-born or the very young and voiceless, the costs will fall mostly on the ones who can act now. This intergenerational conflict will wane over time but is still very much with us. In addition, even if everyone agrees in principle on the need to act, it is tempting to free-ride on the action of others while avoiding the costs of the transition. Moreover, these costs will be very unevenly spread. Within countries, the poorer segments of the population are likely to be the hardest hit, for example from higher prices for highly polluting energy. Above all, some countries will lose more than others, depending on exposures to transition risk stemming from the economic structure (e.g. importers or exporters of emission-intensive energy inputs) as well as exposure to physical risk.

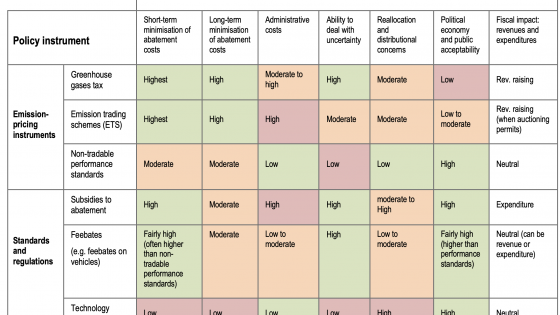

Public authorities have not succeeded in overcoming these incentive problems. Distributional issues across and within generations have inhibited the necessary action on the real side of the economy, which is where physical risks originate and where reallocation must take place. In principle, a well-calibrated set of taxes and subsidies (e.g. a carbon tax) as well as quantity and other regulatory limits can engineer the change. But the measures taken so far and those pledged fall well short of what is needed (IEA 2021).

Can the financial sector substitute for action on the real side and possibly take the lead? The conundrum is that agents in the financial sector face the same incentive problems as those in the real sector of the economy. Absent the necessary changes in the real sector, agents would have to leave risk-adjusted returns on the table (Fisher-Vanden and Thorburn 2008). If they didn’t have to, there would be no market failure on the road to the green transition in the first place. There is no free lunch.

Without effective government action,1 ‘green preferences’ can go some way in easing this conundrum, as they weaken private incentives to maximise risk-adjusted returns. Hence the surge in ‘green investments’ (Aramonte and Zabai 2021, Flammer 2021).

But the mere existence of such preferences is not sufficient to ease the conundrum. They need to be large and robust enough to make a material and lasting difference to the cost and availability of funding. And they should also be universal. Otherwise, the green preferences of some in the financial sector would stimulate arbitrage forces or dubious, possibly even fraudulent, practices by others, negating the benefits.

An example of such practices is greenwashing, i.e. attempts to misrepresent the CO2 emission intensity of projects or activities in order to obtain cheaper financing or to market the final products more effectively. As the preference for green assets grows, so does the incentive to greenwash. Allegations of such instances have already prompted several investigations (Fletcher and Oliver 2022, The Economist 2021) and have led to policy initiatives designed to improve disclosure and its enforcement, both nationally and internationally (NGFS 2022).

More generally, evidence suggests that so far financial markets have contributed little to steering the economy towards a path to sustainability (Elmalt et al. 2021). For instance, the premium at which debt instruments trade increases only marginally with the issuer’s CO2 emissions (Scatigna et al. 2021). More generally, “[even though] there is some evidence [that green finance has had an] impact on stock prices, bank lending conditions, and bank credit flows, [there is] no overwhelming evidence that this is moving the needle” (Weder di Mauro 2021).

Risks to financial stability

There is a consensus that the transition raises financial stability risks of its own (BCBS 2020, Bolton et al. 2021). But that analysis has not been comprehensive enough.

Fundamentally, financial instability arises when the financial and real sectors are out of sync, as exemplified by the financial boom-bust phenomenon. Financial expansions, on the back of aggressive risk-taking, fuel economic activity and overstretch balance sheets. In the process, asset prices and the volume of credit become increasingly disconnected from the capacity of the real economy to generate the corresponding cash flows. Since this disconnect is inherently unsustainable, the process goes into reverse at some point, generally abruptly and violently.

Seen in this light, the risks to financial stability linked to the transition are two-sided. One side is what has attracted attention so far – exposures to overvalued ‘brown’ assets, which should lose their value (become ‘stranded’) as the transition proceeds. The concern here is that investors either sleepwalk into ‘brown vortices’ or act rashly, generating disorderly ‘brown runs’ (e.g. Delis et al. 2018). But there is another side that has received far less attention and is more similar to the familiar boom-bust pattern. This relates to exposures to either overvalued ‘green’ assets or to assets that purport to be green – a ‘green bubble’, for short (Carstens 2021, Aramonte and Zabai 2021, Cochrane 2021, Tett and Mundy 2022). The first side reflects an underestimation of the scope and speed of the transition; the second an overestimation.

The risk of a green bubble is material. In principle, private investors and lenders more generally have a clear incentive to ride bubbles, lured in by self-reinforcing returns. In some respects, policy and social pressures heighten the danger. With government measures in the real economy having so far fallen short of CO2 commitments, the official sector has strongly encouraged green investments. Partly as a result, it is likely that private agents will expect some form of public support in case things go wrong – a kind of ‘government put’. Social pressures, in turn, can reinforce emulation, or herding, further boosting the demand for green assets, even when the bubble is recognised as such. The bursting of a green bubble would not only carry direct social costs but could also undermine the credibility of the transition process itself.

Conclusion

The primary role of private financial markets is to reflect the underlying condition of the real economy. Thus, it would be unrealistic to expect them to induce the green transition unless the right signals come from the real economy. Unrealistic expectations can set the financial sector up for failure and derail the transition. As a key channel for the reallocation of resources, the financial sector has an essential supporting role to play and must avoid adding to transition risk.

Authors’ note: The views expressed are those of the authors, not necessarily those of the Bank for International Settlements.

References

Aramonte, S and A Zabai (2021), “Sustainable finance: trends, valuations and exposures”, BIS Quarterly Review, September, pp 4–5.

BCBS – Basel Committee on Banking Supervision (2020), Climate-related financial risks: a survey on current initiatives, April.

Bolton, P, M Kacperczyk, H Hong and X Vives (2021), Resilience of the financial system to natural disasters, The Future of Banking 3, CEPR PRess.

Carstens, A (2021), “Transparency and market integrity in green finance”, introduction and opening panel remarks at the Green Swan Conference on “Coordinating finance on climate”, Basel, 2 June.

Cochrane, J (2021), “The fallacy of Climate Financial Risks”, Project Syndicate, 21 July.

Delis, M, K de Greiff, S Ongena (2018), “The carbon bubble and the pricing of bank loans”, VoxEU.org, 27 May.

Elmalt, D, D Igan and D Kirti (2021), “Limits to private climate change negotiation”, VoxEU.org, 23 June.

Fisher-Vanden, K and K Thorburn (2008), “Voluntary corporate environmental initiatives and shareholder wealth”, CEPR Discussion Paper 6698.

Flammer, C (2021), “Corporate green bonds”, Journal of Financial Economics 142(2): 499–516.

Fletcher, L and J Oliver (2022), “Green investing: the risk of a new mis-selling scandal”, Financial Times, 20 February.

IEA – International Energy Agency (2021), World energy outlook 2021.

Network for Greening the Financial System (2022), Enhancing market transparency in green and transition finance, April.

Pisu, M, F M D’Arcangelo, I Levin and A Johansson (2022), “A framework to decarbonise the economy”, VoxEU.org, 14 February.

Scatigna, M, D Xia, A Zabai and O Zulaica (2021), “Achievements and challenges in ESG markets”, BIS Quarterly Review, December, pp. 83–97.

Tett, G and S Mundy (2022), “Should we worry about a green bubble?”, Financial Times, 24 January.

The Economist (2021), “Sustainable finance is rife with green wash. Time for more disclosure”, 22 May.

UNEP – United Nations Environment Programme (2021), Emissions gap report 2021: the heat is on – a world of climate promises not yet delivered, 26 October.

Weder di Mauro, B (2021), Combatting climate change: a CEPR collection, CEPR Press.

Endnotes

1 Taxes and subsidies on the financing of specific industries or the direct provision of financing could modify risk-adjusted returns just enough to align private incentives with the sustainability objective. Of course, as experience indicates, calibrating such interventions is not straightforward, and the interventions could be ineffective if they do not concur with clear signals from the real economy as to which types of production need to be stimulated or penalised.