According to the OECD, all trade that includes digital ordering processes or delivery is ‘digital trade’ (OECD 2020). Although there are difficulties in measuring digital trade, López-González et al. (2023) estimate that it accounted for 24% of international trade in 2018, a significant increase from 19% in 1995. While digital trade in physical goods is ordered digitally and delivered physically, digital services can be ordered digitally and delivered digitally, and such trade increased markedly during the pandemic. Since digital trade involves the transfer of data between buyers and sellers for ordering and/or delivery, ensuring free cross-border data transfers is an important factor in promoting digital trade.

Despite the importance of free data transfers, barriers to digital trade are high and there are marked differences among countries. Some recent empirical evidence has already shown that regulatory measures restricting such cross-border data flows hurt digital trade. For example, Gupta et al. (2022) report a negative impact of restrictions on digital trade using cross-country data from 60 countries during the period from 2006 to 2017. López-González et al. (2023) show that digital connectivity and digital trade policies play a significant role in reducing trade costs and increasing trade across countries. While these previous studies show country-level impacts, a firm-level analysis is required regarding how many firms are affected. Our survey of Japanese firms in 2019 shows only a limited fraction of the total population of firms, but many of the firms engaged in cross-border transfers of data, are affected by such regulations (Tomiura et al. 2019). However, the identification of the firm attributes that are determinants of cross-border data transfers has remained limited due to data availability issues.

Significant increase in cross-border data collection activities, led by high-productivity firms

To collect data on corporate activities related to cross-border data transfers, we conducted a questionnaire survey among Japanese firms in 2019 and 2021. The survey covered all large and medium-sized firms (defined as firms with 50 or more employees and capital of 30 million yen or more) in manufacturing, wholesale, and information-related service industries.

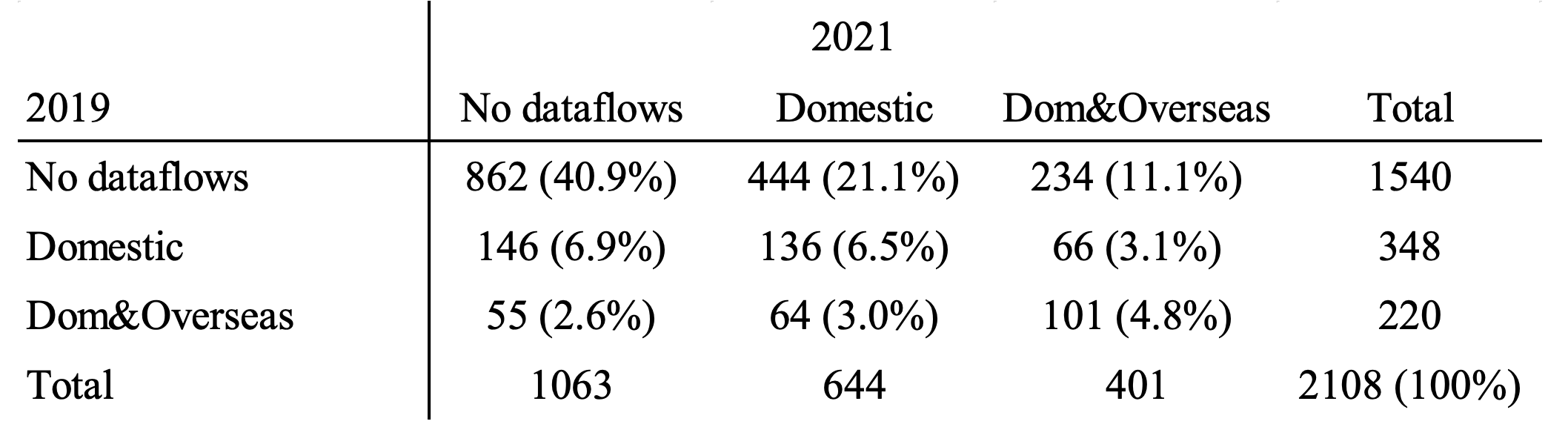

The distribution of firms responding to the question on data collection is shown in Table 1. The largest number of respondents are those that do not continuously collect data, followed by firms that are engaged in data collection only in Japan, and the group with the fewest number are firms that are engaged in overseas data collection. However, it is noteworthy that the percentage of firms engaged in data collection has increased dramatically from 30% to over 50%. In particular, the percentage of firms engaged in overseas data collection has doubled. The drastic changes in the last two years raise a question about what kind of firms started collecting overseas data.

Table 1 Distribution in status change from 2019 to 2021

Source: Ito and Tomiura (2023), Table 2 (a).

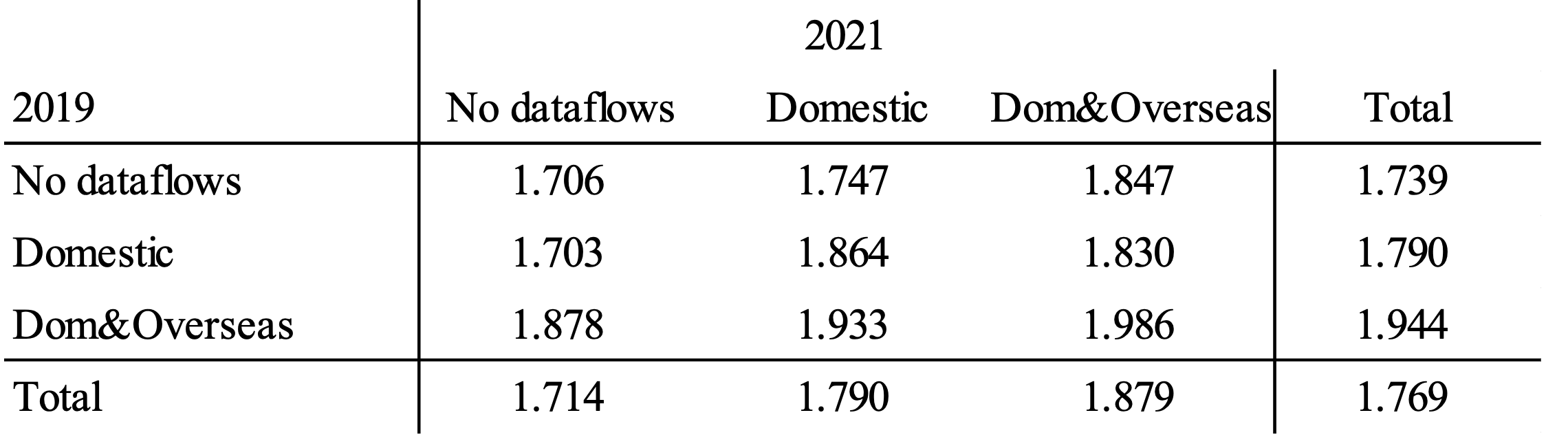

Since Bernard and Jensen (1995), a series of studies on firm globalisation have demonstrated both theoretically and empirically that productivity leads to exports and FDI. In the same way, firm productivity provides resources that are necessary for the installation of data centres and servers, which would allow highly productive firms to engage in overseas data collection. Consistent with this idea, firm productivity is closely related to the evolution of cross-border data collection activities. Table 2 shows the average labour productivity level measured as the log value of value-added per employee in 2019 for firms in each cell. As shown in the top row, the productivity of firms that have started data collection is higher for firms that engage in overseas data collection (1.847) than for firms that only engage in data collection in Japan (1.747). As shown in the second row, among firms engaged in domestic data collection in 2019, the productivity of firms that started collecting data overseas in 2021 (1.830) was higher than the average (1.790), but slightly lower than firms that only continued to engage in data collection in Japan. The reason for the difference here is not clear. Regarding the firms that were already engaged in overseas data collection in 2019, as shown in the third row, the productivity of firms that continued in 2021 is highest (1.986), while the productivity of firms that withdrew from overseas data collection is relatively low (1.933 or 1.878).

Table 2 Productivity in 2019 over the status change

Source: Ito and Tomiura (2023), Table 3 (a).

Exploration of firm attributes that encourage entry into overseas data collection

What firm attributes drive entry into overseas data collection? Exploring the determinants of firms’ overseas data collection is essential for our understanding of digital trade, but a firm’s productivity doesn't necessarily explain everything. On the other hand, other factors are not clear. In Ito and Tomiura (2023), we used variable selection techniques that employ machine learning-based LASSO regression generalised by Tibshirani (1996) to discover firm attributes that strongly determine entry into overseas data collection.

The results from LASSO regression show that of the 43 variables representing firm attributes in 2019, the 11 variables listed below were deemed useful variables to explain entry into overseas data collection from 2019 to 2021.

- Log of labour productivity (value-added per employee)

- Log of total sales

- Firm age (from establishment year)

- Log of overseas investment in stocks

- Log of intangible fixed assets per employee

- Costs for capacity-building over total sales

- The N of employees in the headquarters’ planning dept. over the N of total employees at headquarters

- Intra-exports in services over total sales

- Arms's-length imports in services over total sales

- Costs for foreign outsourcing (to unrelated foreign suppliers) in manufacturing tasks over total subcontracting cost for manufacturing

- Costs for foreign insourcing (to related foreign suppliers) in service tasks over total subcontracting cost for services

With the exception of firm age, these selected attributes are all positively associated with entry into foreign data collection. In particular, the predictive power of the overseas investment in stock was outstanding, suggesting that MNEs have a higher tendency to start collecting data overseas. The reason why FDI is the main reason for entry into overseas data collection is that the establishment of overseas bases such as data centres and servers and/or the intensive information sharing between subsidiaries and parent headquarters is indispensable for maintaining the global activities of MNEs.

The attributes that appeared above suggest a tendency towards service-oriented firms. Increasing servitisation is characterised by engagement in service trade, relatively large stocks of intangible assets, and a comparatively high percentage of foreign outsourcing of manufacturing tasks. Another noteworthy result is that costs for capacity-building over total sales were apparent. This indicates that skill development within firms will be required to shift from conventional trade in goods and services to digital trade.

The introduction of regulations on cross-border data flows should have a serious impact on our economies, as these service-intensive multinationals with skilful employees tend to be large, productive, and innovative, and pay high wages in many countries. While this column focuses on the determinants of the entry into data collection based on pre-entry firm attributes, it would be informative to examine which firm attributes will be affected by cross-border data flows if relevant data are collected in future independent studies.

Editor’s note: The main research on which this column is based (Ito and Tomiura 2023) first appeared as a Discussion Paper of the Research Institute of Economy, Trade and Industry (RIETI) of Japan.

References

Bernard, A and J Jensen (1995), “Exporters, jobs, and wages in U.S. Manufacturing, 1976–1987”, Bookings Papers on Economic Activity, Microeconomics 26: 67–119.

Gupta, S, P Ghosh and V Sridhar (2022), “Impact of data trade restrictions on IT services export: A cross-country analysis”, Telecommunications Policy 46(9): 102403.

Ito, B and E Tomiura (2023), “Firm-level Determinants of Cross-border Data Flows: An econometric analysis based on a variable selection technique”, RIETI Discussion Paper No. 23-E-052.

López-González, J, S Sorescu and P Kaynak (2023), “Of Bytes and Trade: Quantifying the Impact of Digitalisation on Trade”, OECD Trade Policy Paper No. 273.

Organisation for Economic Cooperation and Development (OECD) (2020), “Measuring the economic value of data and cross-border data flows”, OECD Digital Economy Papers No. 297.

Tibshirani, R (1996), “Regression Shrinkage and Selection via the Lasso”, Journal of the Royal Statistical Society. Series B (Methodological) 58(1): 267–288.

Tomiura, E, B Ito and B Kang (2019), “Effects of regulations on cross-border data flows: Evidence from a survey of Japanese firms” RIETI Discussion Paper No.19-E-088.

Tomiura, E, B Ito and B Kang (2020), “Characteristics of firms transmitting data across borders: Evidence from Japanese firm-level data”, RIETI Discussion Paper No. 20-E-048.