Russia’s full-scale invasion of Ukraine since 24 February 2022 has caused many Ukrainian citizens to flee the country for security and safety reasons. According to the UN High Commissioner for Refugees (UNHCR), as of 15 November 2022, almost eight million Ukrainians were abroad, out of which about five million were in the EU, the biggest migration wave since WWII. Nearly 5.5 million Ukrainians are internally displaced, according to the International Organization for Migration (2023).

Amid strong public support, European countries have welcomed Ukrainian migrants by granting them temporary protection status with the right to work in the EU, access to health care and education services, and other social benefits. However, as the number of migrants has been growing and the war dragging on, the signs of migration ‘fatigue’ started to build up. That was evidenced from a number of opinion surveys in various countries. While in general public support for Ukraine continues unabated (De Vries and Hoffmann 2022), the surveys revealed growing concerns over the rising costs of living, tightness of the housing market (Leahy 2022), capacity of education and other social services, and sufficiency of financial resources (World Vision International 2022).

Based on available economic literature and unique data on spending of Ukrainian migrants abroad we concluded that despite short-term challenges, there are a number of positive economic effects for migrant-recipient countries in the medium term.

Effect on economic activity

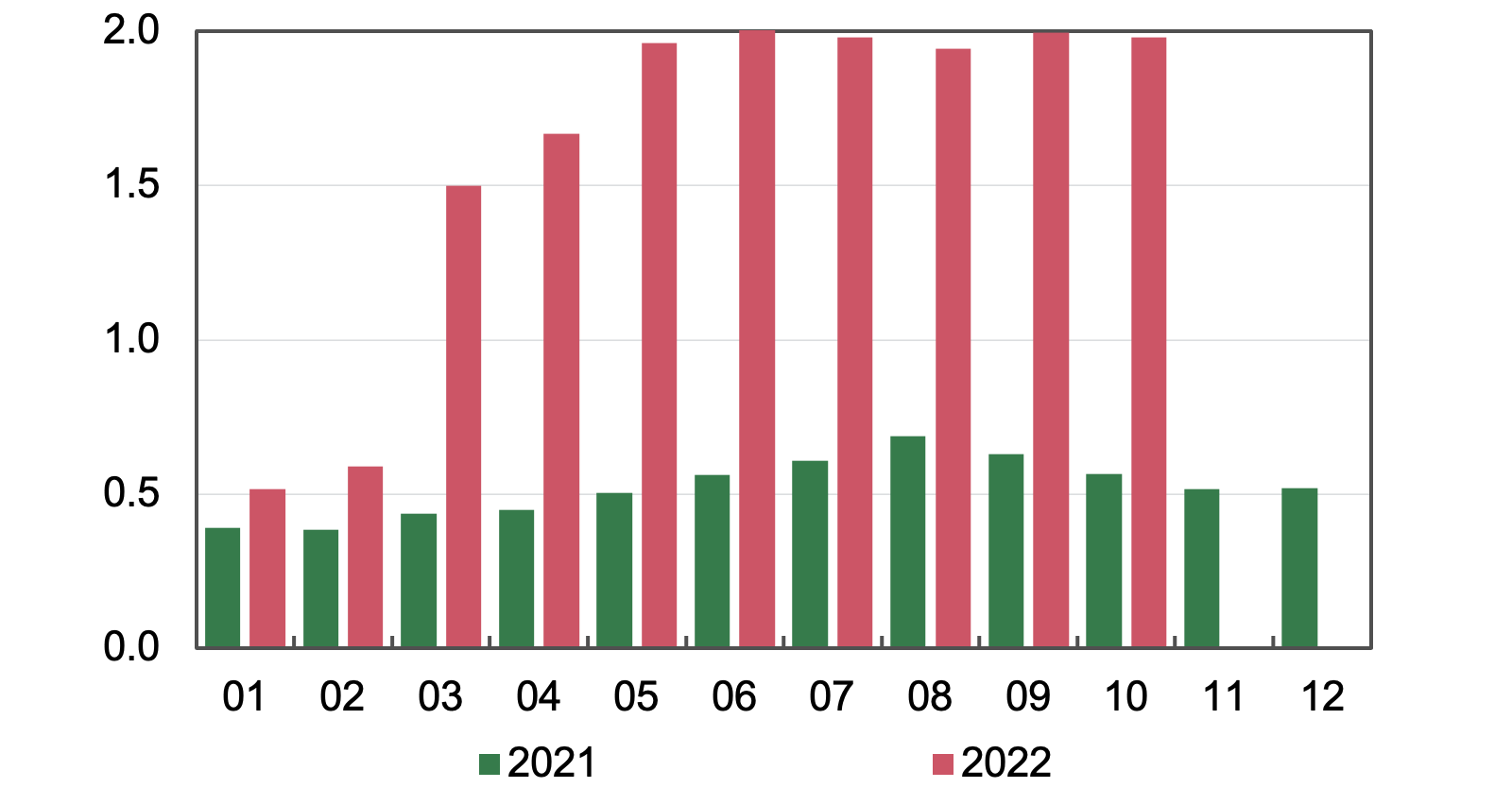

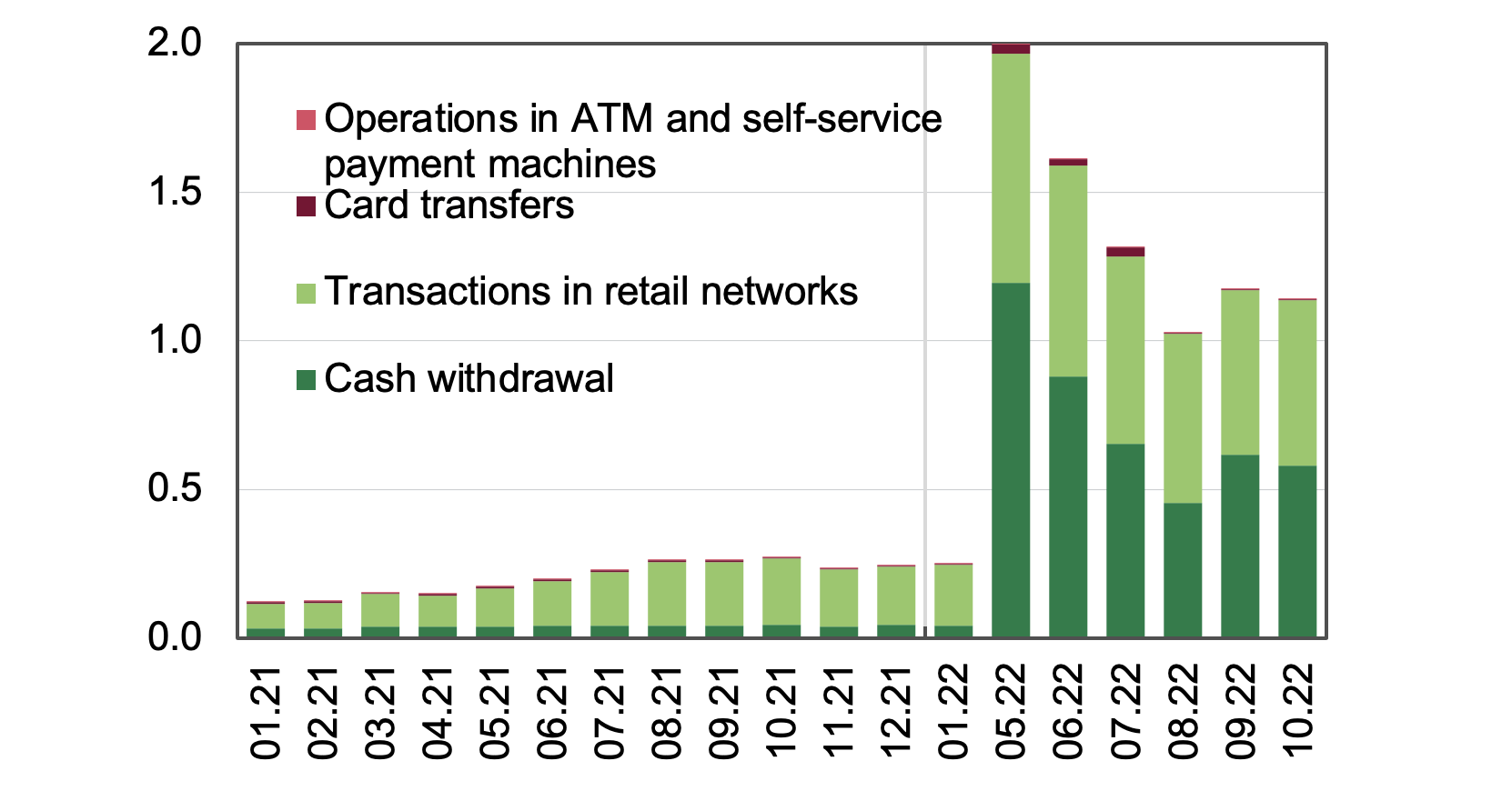

Ukrainian migrants’ spending abroad spurs private consumption in the recipient countries and, thus economic growth. According to the data collected by the National Bank of Ukraine, expenditures of Ukrainians abroad amounted to $2 billion per month in 2022, more than three times higher than in the previous year. At the start of the full-scale war in Ukraine, migrants mostly covered their expenses from their savings with Ukrainian banks using cards to make payments and withdraw cash. As Ukrainians started to be more actively employed abroad, wages earned in host countries have become the main source of financing migrants’ expenses.

Figure 1 Imports of travel services, USD billions

Source: National Bank of Ukraine

Figure 2 Usage of funds (hryvnia and foreign currencies) on Ukrainian banks’ cards abroad, USD billions

Note: *No data for February–April 2022.

Source: National Bank of Ukraine.

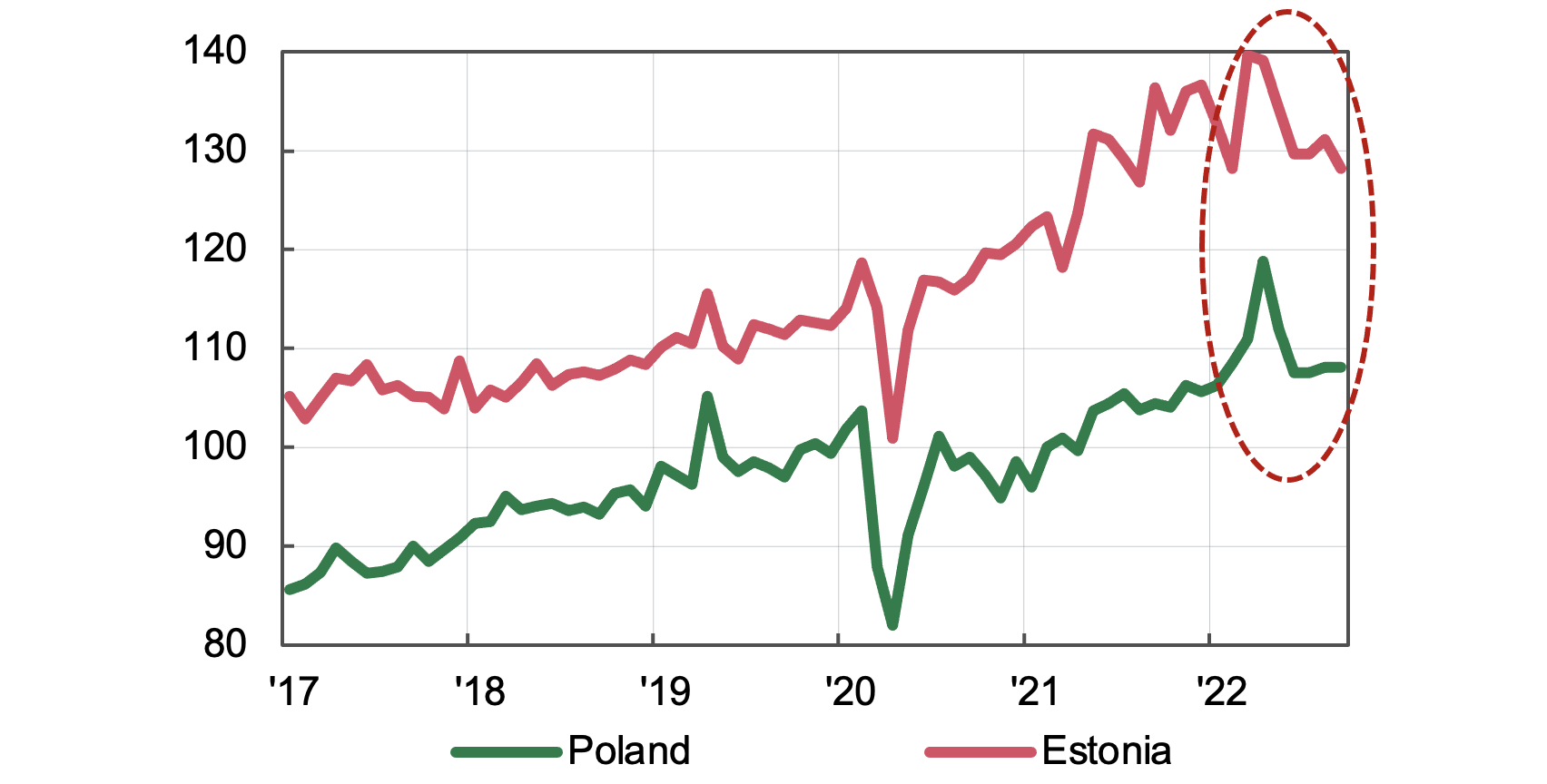

Thus, Ukrainian migrants drove a short-term surge in retail trade and private consumption in Poland and Estonia, although they returned to pre-war levels already in June. In particular, Credit Agricole (2022) determined inflows of migrants from Ukraine as the main driver of accelerated growth in retail sales in Poland in March, which offset the negative influence inflation and lower consumer confidence had on household expenditures. In other countries, the impact of migration from Ukraine can be assessed as rather small due to either a small number of migrants compared to the population of the recipient country (Germany), or higher cost of living (Germany, Czechia, Austria, France, Switzerland, the Netherlands, and the UK).

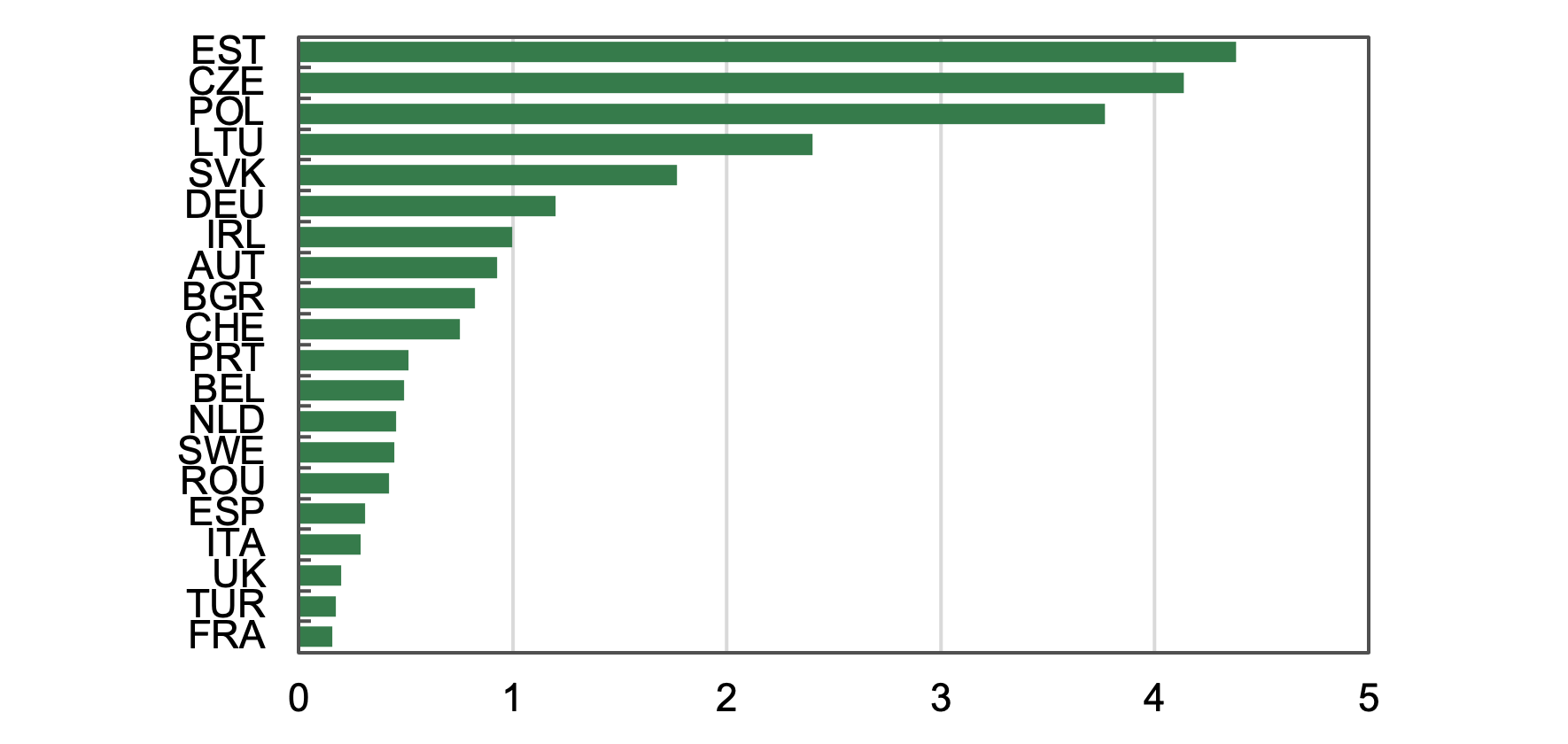

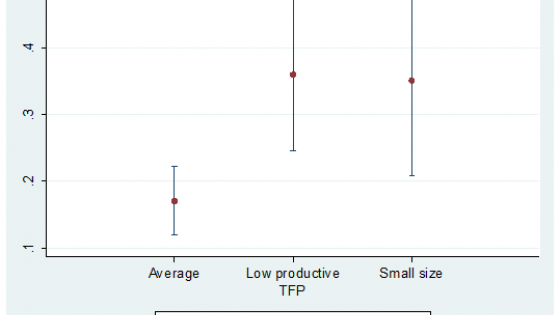

Based on estimates from the IMF research (IMF 2020) and surveys by the UN, all other things being equal, the contribution of Ukrainian migrants will boost the output in 2026 compared to the baseline scenario with no migration by 2.2%–2.3% in Estonia, Poland, and Czechia, and by 0.6%–0.65% in Germany. For the calculations, we used data from UN data about the number of Ukrainian migrants by countries and UN surveys, which determined the share of women with children in the total number of migrants at 87%, and the share of migrants aged 18–59. We also took into account the ratio of 1.2 children per one woman in Ukraine and the assumption that 70% of working-age migrants would be employed over the entire period. It was also assumed that the above proportions were equal for all countries.

Figure 3 Retail turnover, December 2016=100, seasonally adjusted data

Source: state statistics offices, National Bank of Ukraine staff estimates.

Figure 4 Ratio of the number of Ukrainian migrants* to population of recipient countries,** in percent

Note: * As of 3 October. ** Population in 2021.

Source: WorldBank , Antezza et al. (2022), National Bank of Ukraine staff estimates.

Despite the positive medium-term effects, the presence of migrants causes some short-term challenges. In particular, expenditures of Ukrainian migrants was an additional factor for high growth rates of inflation in the EU, where it was already decade-high on the back of the surge in energy prices. Thus, inflation was more than 20% year-on-year in Lithuania, Estonia, Latvia, and Hungary, around 18% year-on-year in Czechia and Poland, and almost 10% year-on-year in the euro area.

Impact on labour markets

Integration of Ukrainian migrants will influence the labour market performance of recipient countries. In particular, the ECB expects 25% to 55% of Ukrainian working-age migrants to participate in the euro area’s labour force over the medium term (Botelho 2022).

Although migrants create additional challenges for state finances in the short run, they are likely to make a positive impact on the budget and economy of recipient countries if migrants stay in these countries longer than several years and actively participate in the labour market.

Ukraine’s geographical and cultural proximity to Europe, the existence of a Ukrainian diaspora, and the temporary protection status will contribute to increased participation of displaced persons in the labour force. In particular, OECD estimates show that labour force of all EU countries will cumulatively grow by 0.5% by the end of 2022, which is two times more than during the previous migration wave in 2014–2017 (OECD 2022). The impact is expected to be the strongest in Czechia (2.2%), Poland (2.1%), Estonia (1.9%), and in several other countries (1%–1.5% in Hungary, Latvia, Slovakia, Lithuania, and Romania). In turn, employment in the EU can grow by 0.4%.

Meanwhile, however, available data show that displaced persons’ integration in their labour markets is moderate. Whereas 63% of surveyed migrants were employed before the full-scale invasion, only 28% were employed in September (UNHCR 2022). The situation in Poland is somewhat better. Out of about 1.2 million migrants that received social insurance numbers in Poland, around a half has found employment (Vorozhko 2022). However, these migrants mostly worked in the areas with lower wages – logistics, industrial production, agriculture, construction, hotel business – although many of them were highly qualified. The International Labour Organization (ILO) report showed that employment statistics of Ukrainians’ recipient countries started to reflect the impact of migration on their labour markets, but the labour markets showed no signs of structural changes – in many countries unemployment rate continued to decline (ILO 2022).

Impact on public finances

Government expenditures of the recipient countries on migrants' education, healthcare, and housing, while having a positive impact on economic growth, will increase the challenges for public finances of these countries.

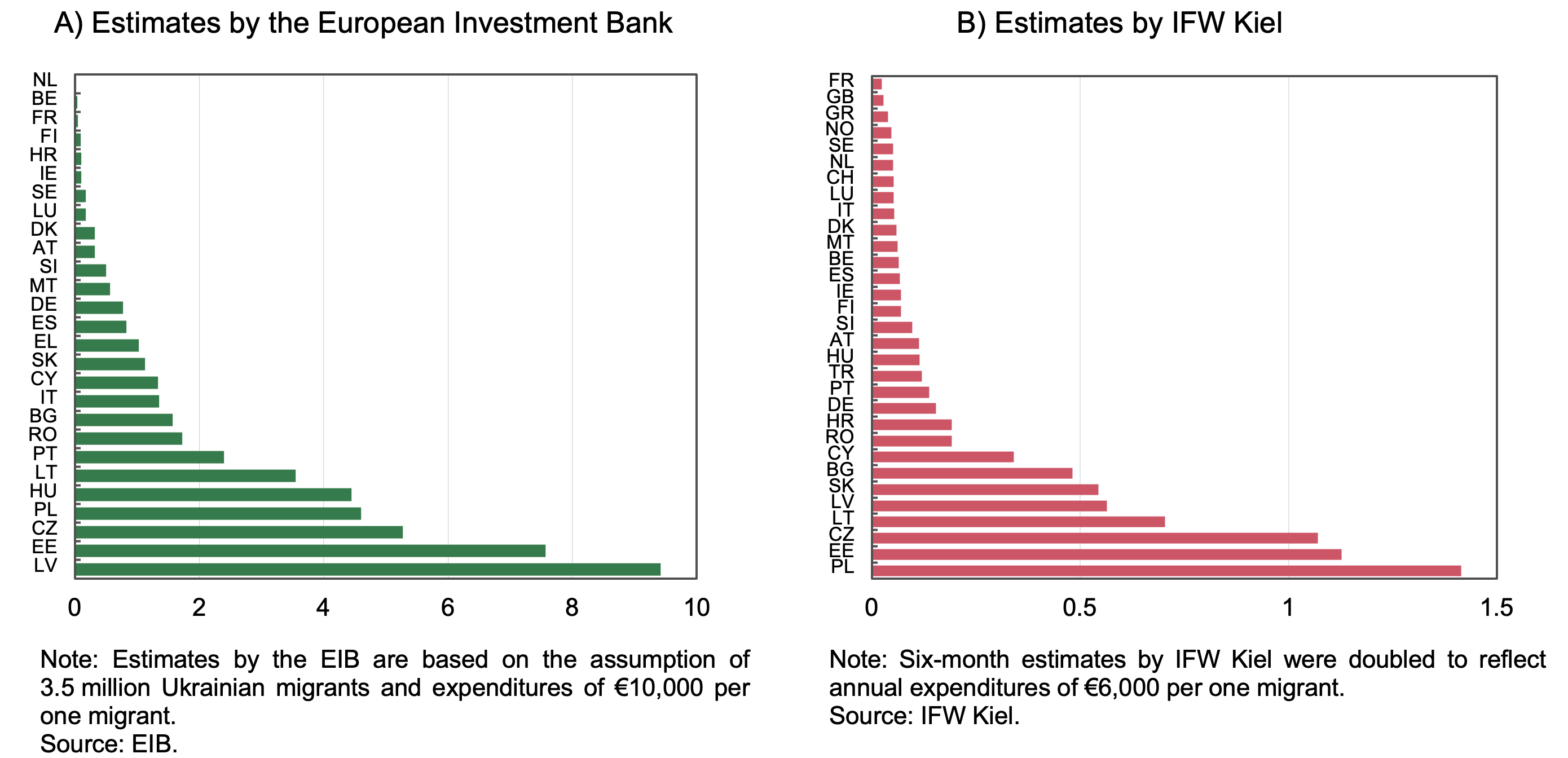

Bird and Amaglobeli (2022) estimated the short-term fiscal impact of Ukrainian migrants on economies of EU countries at around €30–37 billion, or 0.19%–0.23% of the EU’s GDP. That said, countries bordering Ukraine and Baltic countries will bear the largest expenditures. According to calculations by the European Investment Bank (2022), 9% of GDP could be spent on migrant adaptation by Latvia, more than 7% of GDP by Estonia, and 4%–6% of GDP by Hungary, Poland, and Czechia. On the other hand, IFW Kiel provides estimates that are much more moderate: expenditures could exceed 1% of GDP only in Poland, Estonia, and Czechia. Such a difference may reflect different assessments of both the number of migrants and expenditures per one person (€10,000 according to the European Investment Bank and €6,000 according to Kiel).

Figure 5 Expected spending on hosting migrants in the EU in the first year of their stay, estimates by various expert organizations, % of GDP

Overall, the actual short-term fiscal impact can be both lower and higher than the preliminary estimates. On the one hand, reduced bureaucratic procedures, lower expenses on initial accommodation, and faster integration of Ukrainians in labour markets of respective countries will lead to a decline in expenditures of host countries. On the other hand, the demographic structure of Ukrainian migrants (the percentage of children ranged by country from 28% to 44%) differs compared to previous waves of migration, which could cause large increases in expenditures on education, healthcare, and adaptation.

According to the IMF’s estimates (Bird and Amaglobeli 2022), the net fiscal effect will be positive for Europe in the long run, as Ukrainians are actively integrating into the European labour market. In particular, tax payments by Ukrainian migrants in Poland are a vivid example of such integration into the labour market. In particular, according to estimates by the Center for Migration Research at the University of Warsaw, Ukrainians in Poland paid 10 billion Polish zloty (around $2.4 billion) in taxes (Ukraininan World Congress 2022).

Summing up, in spite of the initial challenges put on recipient countries by inflows of migrants from Ukraine, gains for the economies of these countries are higher over the medium and long term thanks to migrants’ active integration in the labour market and in the society as a whole.

References

Antezza, A, C Trebesch, K Bushnell, A Frank, P Frank, L Franz, I Kharitanov, B Kumar, E Rebinskaya and S Schramm (2023), “The Ukraine Support Tracker: Which Countries Help Ukraine and How?”, IFW Kiel Working Paper, February.

Bird, N and D Amaglobeli (2022), “Policies to Address the Refugee Crisis in Europe Related to Russia’s Invasion of Ukraine”, IMF Notes No 2022/003, 8 September.

Botelho, V (2022), “The impact of the influx of Ukrainian refugees on the euro area labour force”, ECB Economic Bulletin, Issue 4/2022.

Crédit Agricole (2022), “The inflow of refugees from Ukraine supports retail sales”, 22 April.

De Vries, C E and I Hoffmann (2022), “Under pressure: The war in Ukraine and European public opinion”. Bertelsmann Stiftung, 5 October.

European Investment Bank (2022), “How bad is the Ukraine war for the European recovery?”, Economics – Thematic Studies.

International Labour Organization (2022). “ILO Monitor on the world of work. Tenth edition. Multiple crises threaten the global labour market recovery”, 31 October.

International Monetary Fund (2020), “The Macroeconomic Effects of Global Migration”, in World Economic Outlook, April 2020: The Great Lockdown, Chapter 4.

International Organization of Migration (2023), Ukraine - Internal Displacement Report.

Leahy, P (2022), “Irish Times/Ipsos opinion poll: Strong support for Ukraine, but worries over refugee numbers”, The Irish Times, 28 October.

OECD (2022), “The potential contribution of Ukrainian refugees to the labour force in European host countries”, 27 July.

Ukrainian World Congress (2022), “Ukrainian Refugees Uphold Rather Than Burden Polish Economy”, 9 November.

UNHCR (2022), “Lives on Hold: Intentions and Perspectives of Refugees from Ukraine #2”, 23 September.

Vorozhko, T (2022), “How Displaced Ukrainians in Poland Find Work While Benefiting Its Economy”, Voice of America, 6 October.

World Vision International (2022), Warm Welcomes, Lurking Tensions.