The far-reaching consequences of the US mortgage crisis have sent economists and policymakers searching for a better understanding of the roots of the housing bubble. Recent research shows substantial evidence that the unprecedented mortgage boom was fueled by a deterioration in lending standards, which was at least partly due to a moral hazard problem created by the process of securitising loans or, in other words, the “Originate to Distribute” (OTD) model (see, for example, Dell'Ariccia et al. 2008; Keys et al. 2010; Mian and Sufi 2009; and Purnanandam 2010). Yet despite the idea that enhanced regulation and supervision could have averted bad lending remains a theoretical premise with little empirical work to validate such link. The calls for tighter regulation are often met with criticism cautioning against an inefficient knee-jerk regulatory reaction to the financial crisis.

In a recent empirical paper, we examine the impact of regulation on lending standards by exploiting the difference in the regulatory structure of mortgage lenders (Dagher and Fu 2011). We show that lending by the less regulated mortgage lenders were associated with a sharper rise in foreclosures during the housing downturn.

Mortgage originators face uneven regulation

Depending on their status, mortgage lenders in the US operated, prior to the crisis, under different regulatory structures with differing degrees of oversight. This difference is most pronounced between bank and non-bank mortgage originators. It is widely recognised that non-bank independent lenders were only mildly regulated and supervised before the crisis, while their bank counterparts were subject to a range of federal laws and examinations (see, for example, Belskey and Retsinas 2008; Belsky and Richardson 2010; Immergluck 2009; Treasury Blueprint 2008). In fact, independent lenders escaped most federal laws and were only lightly regulated at state level. This stark difference in the extent of regulation has led to calls for establishing a federal regulator to develop uniform national mortgage standards and regulate independent mortgage lenders.

Independent lenders contributed disproportionally to the mortgage boom

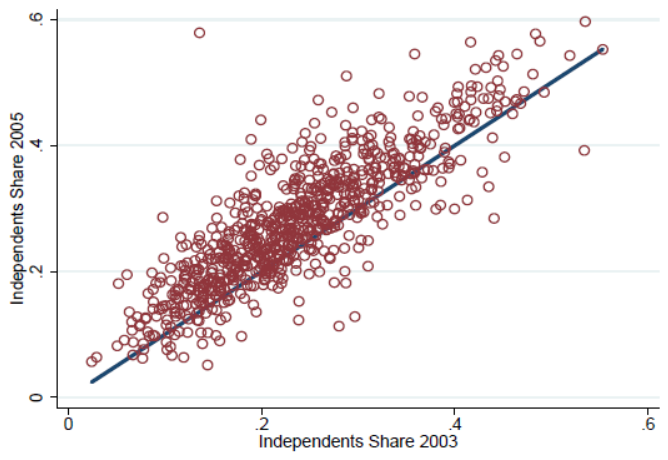

Using comprehensive data on home mortgage originations made available by the Home Mortgage Disclosure Act (HMDA) we can distinguish between originations by banks (banks and their affiliates) and non-bank independent lenders. Examining the unprecedented growth in mortgage origination during the period 2003-2005, we find that independent lenders contributed disproportionally to the credit expansion. Notably, from a market share of around 30% in 2003, independents contributed to around 60% of the increase in mortgage originations between 2003 and 2005. This expansion took place across most major US counties as shown in Figure 1. It is important to note that banks and independents served a similar clientele in that the distribution of income of borrowers from each type of lender is relatively similar with the exception that banks had a higher share of jumbo loans.

The early rise in foreclosures and the lender type

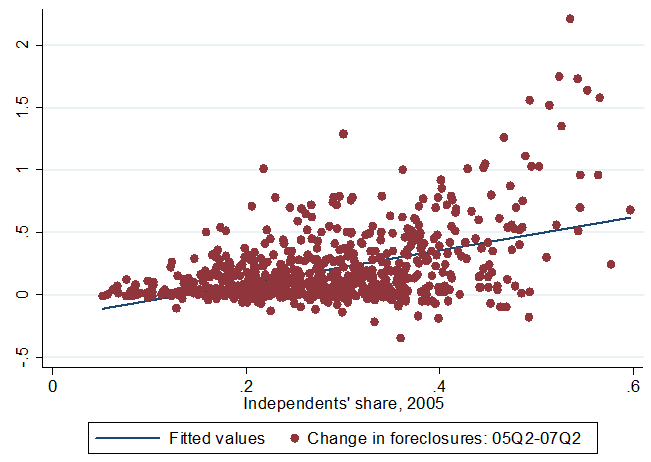

Our paper investigates whether foreclosure outcomes, in addition to being determined by county characteristics and the extent of the housing boom, were also dependent on the type of the lender. In other words we ask whether, everything else equal, lending by independents was associated with worst outcomes. A first look at the data suggests that there is indeed a positive relation between the market share of independents on the mortgage market in a county and the rise in foreclosures as can been be seen in Figure 1. To answer this question we use a matching methodology. This approach allows us to carefully control for county characteristics that could be potentially correlated with both the geographical distribution of lenders and the rise in foreclosures. For example, if independent lenders self-select into lower income counties, or counties with lower average credit score, or low housing supply elasticity (leading to more volatility in house prices) then the correlation between the market share of independents and the rise in foreclosures could be attributed to these factors (although one might rightly argue that self-selection is also a sign of low lending standards). The matching methods we use (in which we refine the standard matching technique by performing several robustness tests) allow us to control for these factors by comparing characteristically similar counties.

Our results consistently show a strong positive relation between the presence of independents and the rise in foreclosures. Furthermore we find this relation to be economically meaningful in that the rise in foreclosure associated with one standard deviation increase in the market share of independents is around one half of the increase in foreclosure filing rates between 2005 and 2007. We also find that this relation cannot be explained away by differences in securitisation rates between the two types of lenders. Since the rise in foreclosure pre-dated and fueled the subsequent collapse in house prices, the contraction in mortgage credit and ultimately the rise in unemployment in 2008, we also find that the market share of independents as of 2005 is a strong predictor of these events.

Is it really regulation?

Can the association between lending by independents and the rise in foreclosures really be attributed to their lack of regulation and supervision? The paper further exploits variations of regulations across states using proxies for the extent of state regulation on the mortgage market. The premise being that any state regulation that constrains risky lending is likely to have a more significant impact on the lending standards of the otherwise less constrained lenders, i.e., independents, as banks are tightly regulated and supervised by federal agencies as an addition. We use two recently computed indicators found in the literature as proxies for regulation: the Pahl (2006) index of broker regulation and the Bostic et al. (2008) index of anti-predatory lending state laws. Using these two indexes separately leads us to the same finding which is that the impact of independents on foreclosures is significantly more severe in the less regulated states.

Overall the findings support the view that more stringent regulations could have averted some of the volatility on the housing market during the recent boom-bust episode. While we do not study the impact of specific regulations, the results of the paper suggest that enhanced supervision, which is what ultimately differentiated banks from non-banks, could be a first step in the right direction. However, enhanced supervision alone is unlikely to be effective at substantially reducing risky lending without additional mortgage-specific regulations that set higher lending standards and eliminate some of the perverse economic incentives that were behind the boom in risky lending.

The views expressed herein are those of the authors and should not be attributed to the IMF, its Executive Board, or its management.

Appendix

Figure 1. The expansion of the market share of independent in US counties during 2003-2005

Figure 2. A scatter of the change in foreclosure filing rates and the market share of independents

References

Belsky, E and NP Retsinas (2008), Borrowing to live: consumer and mortgage credit revisited, Brookings Institution Press, 2008.

Belsky, E and N Richardson (2010), “Understanding the boom and bust in the nonprime mortgage market”, Harvard University Working Paper.

Bostic RW, KC Engel, PA McCoy, A Pennington-Cross, and SM Wachter (2008), “State and local anti-predatory lending laws: The effect of legal enforcement mechanisms”, Journal of Economics and Business, 60:47-66.

Dagher, J and N Fu (2011), “What Fuels the Booms Drives the Bust: Regulation and the Mortgage Crisis”, IMF Working Paper.

Dell'Ariccia, G, D Igan and L Laeven (2008), “Credit booms and lending standards: Evidence from the subprime mortgage market”, IMF Working Paper.

Immergluck, D (2009), Foreclosed: high-risk lending, deregulation and the undermining of America's mortgage market, Cornell University Press.

Keys, B, T Mukherjee, A Seru and V Vig (2010), “Did securitization lead to lax screening? Evidence from subprime loans”, Quarterly Journal of Economics, 125.

Mian, A and A Sufi (2009a), “The Consequences of Mortgage Credit Expansion: Evidence from the US Mortgage Default Crisis”, Quarterly Journal of Economics.

Pahl, C (2007), “A Compilation of State Mortgage Broker Laws and Regulations, 1996 to 2006”, Federal Reserve Bank of Minneapolis.

Purnanandam, AK (2010), “Originate-to-distribute model and the subprime mortgage crisis”, Review of Financial Studies.