In their fight against inflation, central banks have raised interest rates dramatically since 2021. They have implemented these rate hikes by raising the rates of remuneration of bank reserves. These are highly liquid and risk-free deposits that banks hold at their respective central banks. As a result of the large purchases of government bonds since 2015, bank reserves are now very large. This has created a situation in which the fight against inflation has led to record high interest payments by the central banks to banks, creating several issues, which we discussed in previous contributions (De Grauwe and Ji 2023a, 2023b, and 2024.

Table 1 shows the latest information on the size of these interest payments for the Bank of England, the ECB and the Federal Reserve. Interest payments are particularly high in the case of the Bank of England, reaching 1.5% of GDP (in May 2024). This is why in this column we pay a particular attention to the Bank of England. We have another reason to do so. In the run-up to the election in the UK, the existence of these large transfers has become a political issue in the country (Chris Giles 2024), as many are questioning why the public sector transfers £40 billion a year to the banks while the UK government faces a budget deficit of £120 billion, which will necessitate large spending cuts.

Table 1 Bank reserves and interest payments to banks, May 2024 (billions)

The counterpart of these large transfers to banks are large losses for the central banks. For the UK, the yearly loss has been estimated at £23 billion (Giles 2024). This is lower than the interest transfer of £40 billion shown in Table 1 because the Bank of England realises a return of approximately 2% on its government bond holdings. These losses imply, however, that the Bank of England has stopped transferring the interest return on these bond holdings to the Treasury – something it would do in normal times when profits are made. This, as we will see, has further budgetary implications.

While these transfers are likely to decline in the future, they will remain at significant levels for years to come. Central banks are now in the process of reducing their government bond holdings through quantitative tightening, mainly by not reinvesting in maturing bonds. Hauser (2023) estimates that the stock of bank reserves at the Bank of England may reach a level of £200-£300 billion in 2028 (compared to the current £771 billion), but the Bank of England made it clear it wants to maintain a system of abundant reserves. This has been confirmed by the Governor of the Bank of England, Andrew Bailey, who declared that the Bank aims at maintaining a level of bank reserves of the order of £345-£490 billion (Bailey 2024).

Assuming a long-term neutral rate of interest of 3%, this means that in steady state the Bank of England is expecting to pay out £10-15 billion a year to banks indefinitely. It also means that the central bank intends to transfer to banks most of their seigniorage gains that should accrue to the Treasury, and this for the indefinite future. This is quite a change from the old days when central banks transferred seigniorage to the Treasury. All this seems to have been decided silently, under the veil of “operating procedures”, without any democratic accountability. Similar conclusions hold for the euro area and the US (Brandao-Marquez and Ratnovski 2024, Hauser 2023).

These new operating procedures raise important fiscal issues. When central banks pay interest on bank reserves, they create money which they transfer to banks. Today in the UK this transfer amounts to 1.5% of GDP, meaning that the Bank in England transfers 1.5% of GDP worth of newly created money to banks instead of to the Treasury. This money creation may exceed the money creation that is needed to maintain price stability. If that is the case, this will restrict the Bank of England from creating money in the future, thereby reducing future transfers of seigniorage to the Treasury. Table 1 reveals that this is a more severe problem in the UK than in the euro area or the US.

One particularity in the UK is that the Treasury is absorbing the losses of the Bank of England by transferring bonds (gilts) to the central bank and recording them as an additional budget deficit. Thus, one can conclude that the whole of the transfer to the banks is paid by the UK Treasury, and thus by British taxpayers.

Accounting procedures to deal with the central banks losses in the euro area are different. The central banks of the Eurosystem tend to hide these losses by deferring them to the future or by using up reserves. Ultimately, however, the fiscal implications are the same. The UK procedure makes these fiscal implications more transparent by forcing the Treasury to absorb these losses as they are realised. This probably also explains why this is more likely to become a political issue in the UK than in the euro area.

It is quite extraordinary that the fight against inflation has led these central banks to transfer large amounts of newly created money to banks at the expense of the Treasury.

The existence of such an extraordinary system continues to be defended by central bankers with the argument that reducing the interest payments to banks makes monetary policies less effective in reducing inflation (Bailey 2024, Lagarde 2023). The opposite is true. The transfer of large interest payments to banks lowers the effectiveness of anti-inflationary monetary policies. This has to do with the fact that the increase in the interest rate is coupled with an increase in the supply of base money, which, as with any money creation, reduces the effectiveness of monetary policy in fighting inflation.

The mechanism that leads to this reduced effectiveness is as follows. The money that flows to the banks improves the latter’s profits and equity positions. With higher equity positions, banks have an incentive to supply more loans (for empirical evidence, see De Grauwe and Ji 2024 and Fricke et al. 2023). Thus, while the interest hike by the central bank tends to lower the demand for bank loans, the transfers to banks (money creation) tend to increase the supply of bank loans, leading to a lower bank loan rate.

Note that since the transfers to banks relative to the total GDP are higher in the UK than elsewhere, this also implies that the monetary policies pursued by the Bank of England to fight inflation are likely to be less effective than in the euro area and the US. Clearly, the Bank of England would be more successful in its fight against inflation if it were less generous in handing out money to the banks.

Another often used argument for maintaining large interest payments to banks is that it is inevitable. Recently, even Labour’s shadow chancellor Rachel Reeves has warned against changing how the Bank of England pays interest on reserves (Financial Times 2024). We are told there is no other way to conduct monetary policy. This argument flies in the face of historical evidence. The monetary policies in the 1980s were effective in reducing inflation without making large transfers to banks (Humann et al. 2023). This is also possible today. Several proposals have been made to achieve this. These proposals come into two variants.

A first variant is to introduce a two-tier system of reserve requirements (De Grauwe and Ji 2023a). This would consist in imposing a minimum reserve requirement (defined as a percent of banks’ outstanding deposits) as the first tier. It would not be remunerated, or it would carry a lower rate of remuneration. The second tier would consist in the reserves exceeding the minimum required. This would be remunerated at the prevailing bank rate (5.25% in the case of the Bank of England). This system would allow the central bank to maintain its operating procedure, which consists in raising (or lowering) the rate of remuneration on bank reserves. In fact, this system is already in existence in the euro area, where the ECB applies a minimum reserve requirement of 1%, which is not remunerated, and in Switzerland, where the Swiss National Bank which has raised its (unremunerated) minimum reserve requirement for banks to 4.0%, thereby significantly reducing the size of the transfers to Swiss banks.

The second variant also uses a tiered system but defines it differently to reduce any incentive for banks to move their deposit base elsewhere. Instead of imposing a minimum reserve requirement defined as a percentage of outstanding deposits, bank reserves are split into two parts. The first tier would not carry a rate of remuneration; the second tier would be remunerated at the prevailing bank rate. This system would also allow the central banks to maintain their operating procedures (Tucker 2022, Van Lerven and Caddick 2022).

We conclude that an operating procedure based on tiered bank reserves could easily be implemented. Such a system would reduce the unwarranted large subsidies to banks and at the same time would make monetary policies more effective in combatting inflation.

Behind a technical façade, the Bank of England, along with other central banks, has silently decided to use an operating system that has the effect of transferring the seigniorage gains that belong to society to private agents (the banks). This is not a temporary problem but appears to be one that will remain in place for the indefinite future. These far-reaching decisions have been made without any political discussion, let alone an act of parliament. It is time to do away with this unacceptable system.

References

Belhocine, N, A Bahtia and J Frie (2023), “Raising Rates with a Large Balance Sheet, The Eurosystem’s Net Income and its Fiscal Implications”, IMF Working Paper, July.

Bailey, A (2024), “The importance of central banks reserves”, Lecture in honour of Charles Goodhart.

Brandao-Marques, L and L Ratnovski, (2024), “The ECB’s future monetary policy operational framework. Corridor or floor?”, IMF Working Paper 24/56.

De Grauwe, P and Y Ji (2023a), “Monetary policies with fewer subsidies for banks: A two-tier system of reserve requirements”, VoxEU.org, 13 March.

De Grauwe, P and Y Ji (2023b), “Monetary Policies without Giveaways to Banks”, CEPR Discussion Paper No. 18103.

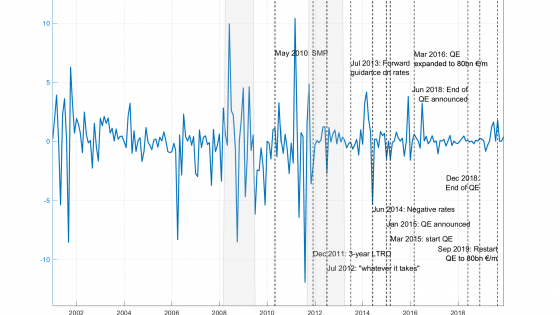

De Grauwe, P and Y Ji (2024), “How to conduct monetary policies. The ECB in the past, present and future”, Journal of International Money and Finance 143, 103048.

Fricke, D, S Greppmair and K Paludkiewicz (2023), “Excess Reserves and Monetary Policy Tightening”, Bundesbank Discussion Paper.

Financial Times (2024), “Rachel Reeves warns against changing how Bank of England pays interest on reserves”, 12 June.

Giles, C (2024), “An unnecessary banking subsidy whose time is up”, Financial Times, 6 June.

Hauser, A (2023), “‘Less is more’ or ‘Less is a bore’? Re-calibrating the role of central bank reserves”, speech at Kings College London’s Bank of England Watchers’ Conference.

Humann, T, K Michener and E Monnet (2023), “Do Disinflation Policies Ravage Central Banks’ Finances?”, Economic Policy (forthcoming).

Lagarde, C (2023), Letter to Members of the European Parliament, 22 September.

Tucker, P (2022), Quantitative easing, monetary policy implementation and the public finances, IFS Report R223.

Van Lerven, F and D Caddick, (2022), “Between a rock and a hard place. The case for a tiered reserve monetary policy framework”, New Economics Foundation, 15 June.