The first three instalments in this series of VoxEU columns focused on trade in goods. The takeaway was that trade in goods as a share of GDP peaked around 2018, but the peak was not synchronised and some of the largest trading economies have not peaked. Sixty percent of the decline was due to a reduction in the value of commodities trade, all of which was due to a decline in prices from the mid-2010s to 2020 (the recent spike in commodity prices started after that). The rest was due to unwinding, or reshoring, of international supply chains (Antras 2021).

The global peak of trade in goods as a share of global GDP is a wake-up call. The alarm clock is telling us that globalisation has changed. The previous columns in this series focused on the part of the change that stems from changes in trade in goods. This was a natural starting point since trade in goods makes up almost 80% of all world trade.

In this column, I argue that the future of globalisation is not goods but services – in particular, intermediate services. I will present economic logic and facts that support the idea that international commerce will shift to being dominated by trade that I called ‘telemigration’ in my 2019 book, The Globotics Upheaval (Baldwin 2019).

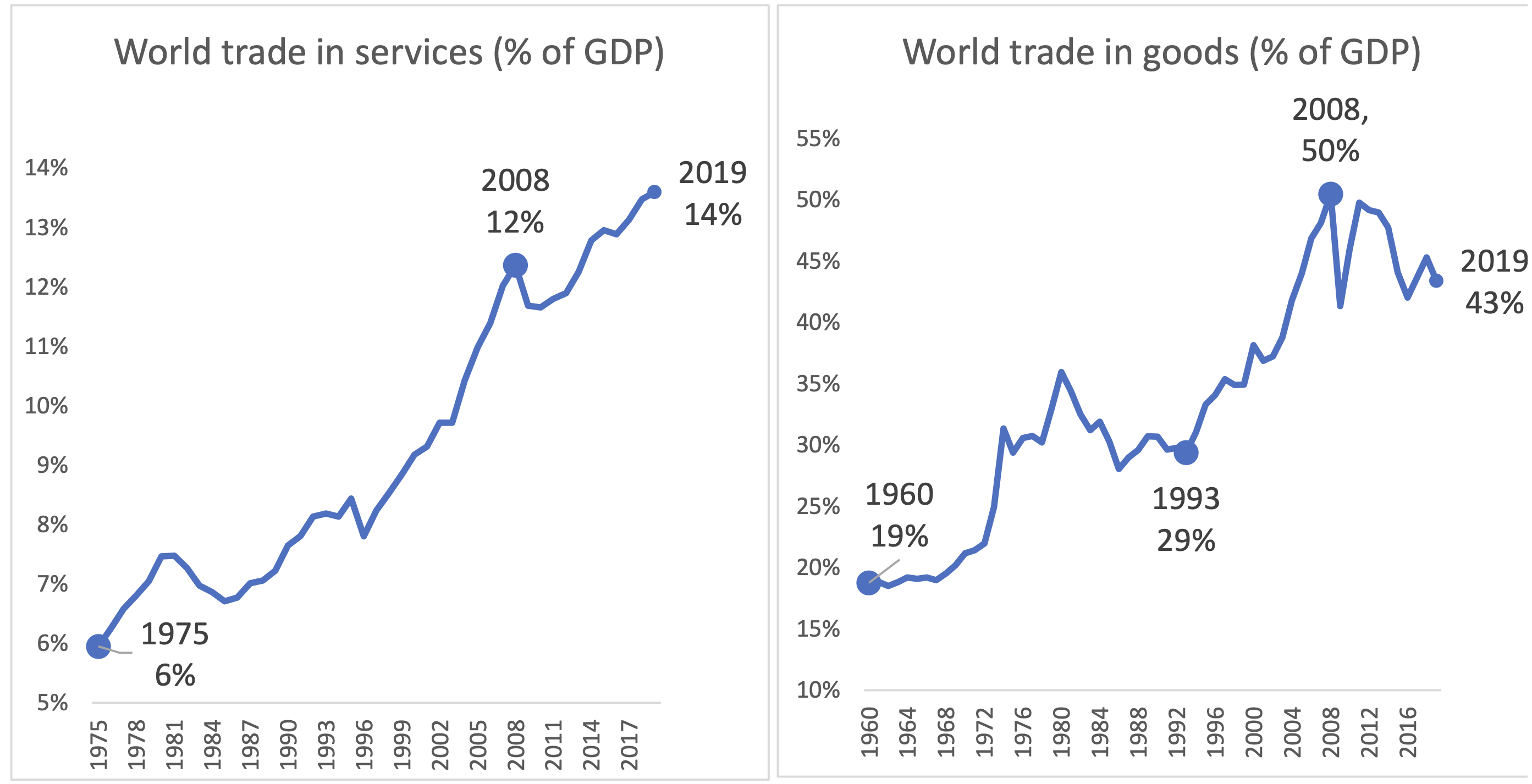

The key fact presented in this column is that trade in services has not peaked in the way goods trade has (Figure 1). In sharp contrast to trade in goods, trade in services continues to boom and shows no tendency to slow. Note that the scales are very different in the two panels.

Figure 1 Services trade vs goods trade (% of GDP)

Goods trade peaked; services trade did not

Source: Author’s calculations based on WTO (trade data) and WDI database (GDP data, current USDs).

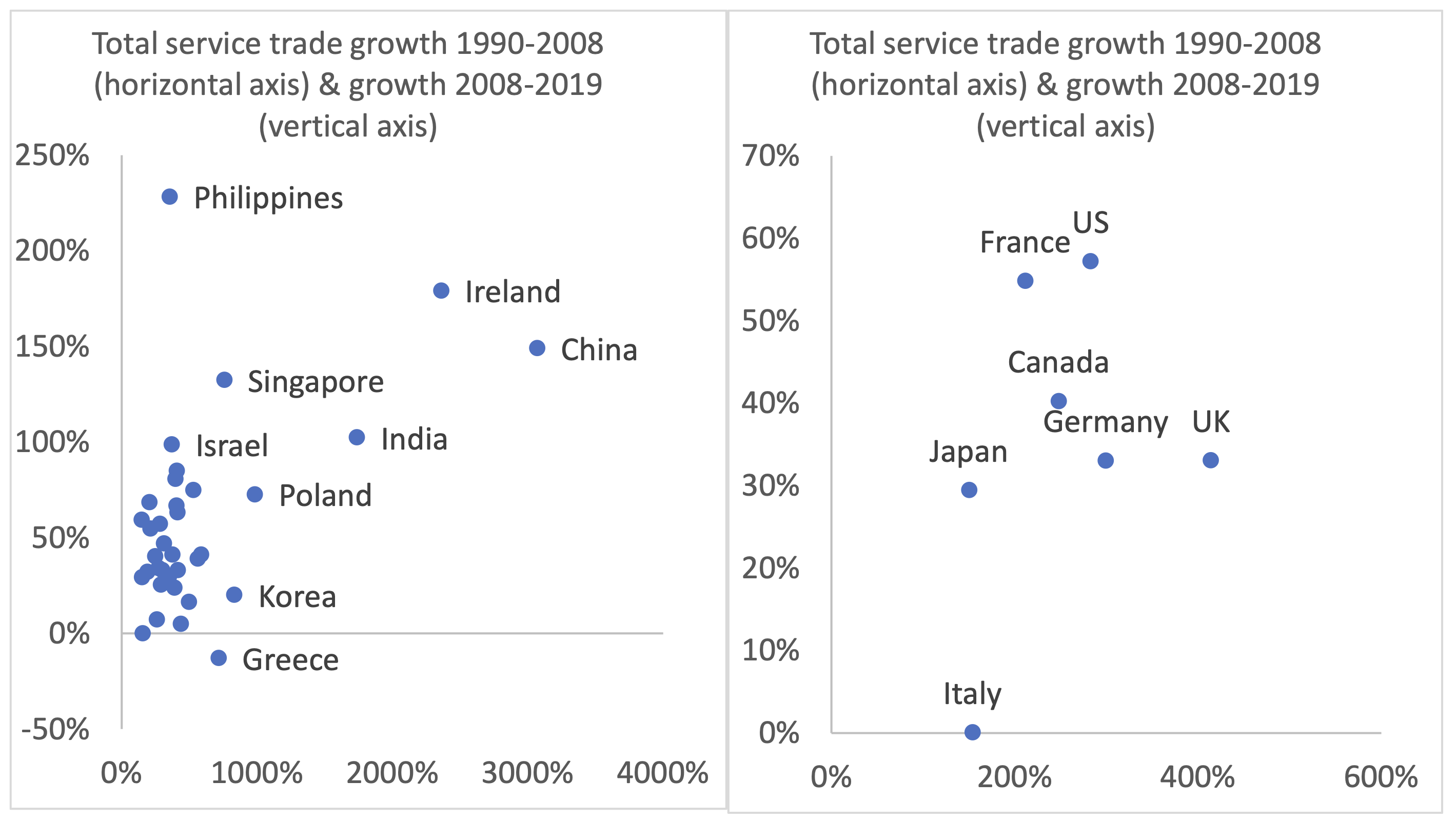

The individual economy trends show that non-peak behaviour is widespread when it comes to services trade. Figure 2 (left panel) shows scatter plots of the percentage-point changes in services trade for large traders (economies whose service trade amounts to at least half a percent of world services trade). All of the economies show growth both before and after 2008, except Greece, which recorded a slight decline after 2008.

Figure 2 Total service trade before and after 2008; largest traders (left) and G7 (right)

Note: The vertical axis plots cumulative growth after 2008 (2008 to 2019); the horizontal axis plots cumulative growth before 2008 (1990-2008). Covid-19 seriously distorted services trade from 2020, so the chart stops at 2019. The large traders are China, Ireland, India, Poland, Korea, Singapore, Greece, Brazil, Malaysia, Thailand, Denmark, Spain, Ukraine, Indonesia, the Netherlands (NL), Türkiye, Switzerland, Finland, Portugal, Israel, Philippines, Hong Kong – China, Australia, Germany, Sweden, US, Saudi Arabia, Norway, Canada, France, Chinese Taipei, Austria, Italy, Japan, Mexico. Together they account for over 85% of world trade.

Source: Author’s calculations based on WTO (trade data).

The pre-2008 growth is spectacular for many of the nations. While they started from low bases, China, Ireland, and India experienced miraculous growth rates from 1990 to 2008 – all over 1,000%. Those with over 500% growth include Poland, Korea, Singapore, Greece, Brazil, Malaysia, and Thailand. China’s growth rate was the highest at 3,070%.

Growth did not stop in the post-2008 period. In the 12 years from 2008 to 2020, several of the big traders enjoyed service-export growth over 100%. The Philippines was the league leader with its 228% rise but was a slow starter (only 86% growth before 2008). India’s trade in services rose 1,740% from 1990 to 2008, and 102% after 2018. For Ireland – which counts as a major service exporter since tech companies have moved their intellectual property there in pursuit of low taxes (and payments for intellectual property count as trade in services in today’s statistics) – the corresponding figures are 2,362% and 179%.

The right panel of Figure 2 spotlights the G7 nations, and again we see that all were non-peakers, although Italy’s service trade stagnated in the second period. The growth numbers, however, are more moderate than the emerging economies in the left panel.

The pandemic and services trade: Sectoral decomposition

The pandemic hit goods trade in 2020, but this was more than reversed in 2021. Services trade was hit much harder since it includes international travel, international tourism, and transportation, which were directly impacted by the lockdowns and mobility restrictions. Looking at the sectoral composition of services trade requires a bit of background.

The data on trade in services are in poor shape. They are not really fit to track the impact of trade in services on the global economy. One is, nevertheless, forced to work with the data that exist rather than the data one might wish for. In official statistics, the high-level categorisation divides total services into three baskets. The first two are well understood and easily interpreted – travel (which includes tourism), and transportation. The third is ‘other commercial services’ (OCS). This is harder to explain than it should be for such an important element of international commerce.

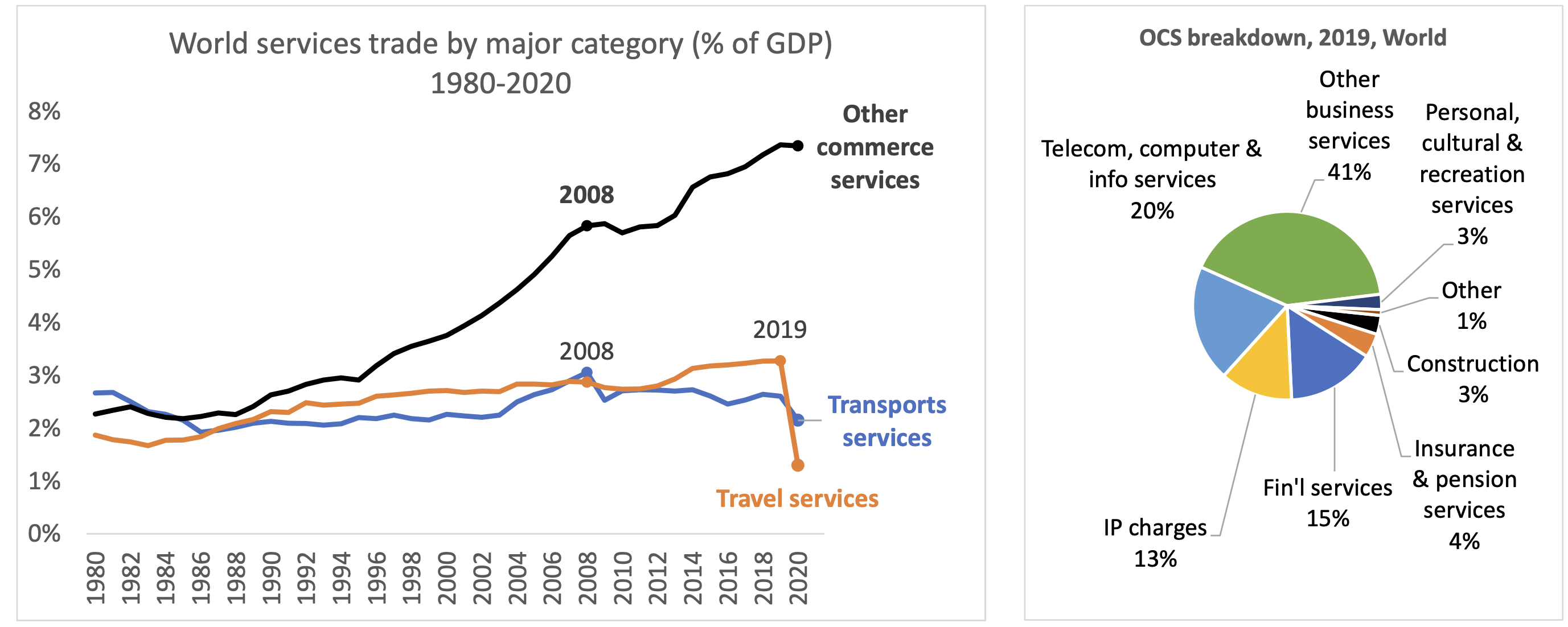

OCS is a grab-bag of things ranging from people paying for their Spotify subscriptions and US companies hiring call-centre workers in Manila to payments to the giant Indian outsourcing companies and Gazprom paying Ukraine for transit rights through its pipelines. The pie chart in the right panel of Figure 3 shows the next-level disaggregation of OCS. Some of the services are recognisable, but fully 40% is thrown into the ‘other business service’ category. All Indian service outsourcing and all the call centres are piled into ‘telecom, computer & info services’ along with payments for international telecommunications. Bunching utility-like services (telecom) together with offshored software development is typical of the non-analytic organising principle that seemed to have been used in collecting the statistics.

Figure 3 Services trade by major category (% of GDP)

Travel and transport dropped with Covid-19

Note: EU trade excludes intra-EU trade since here we take the EU as a mega-economy.

Source: Author’s calculations based on WTO (trade data) and WDI database (GDP data, current USDs).

Figure 3 shows trends of the three high-level categories. The first two categories were especially hard hit by Covid-19 and the accompanying lockdowns and travel restrictions. According to the latest data (2020), travel has still not recovered (for example, China is still not easily accessible to travellers and the government discourages Chinese from leaving the territory). Transport services also suffered and have not recovered.

Note that the travel category, like trade in goods, did peak in 2008. This is to be expected as international transport services are closely tied to trade in goods. Travel and OCS did not peak, and indeed OCS is still booming.

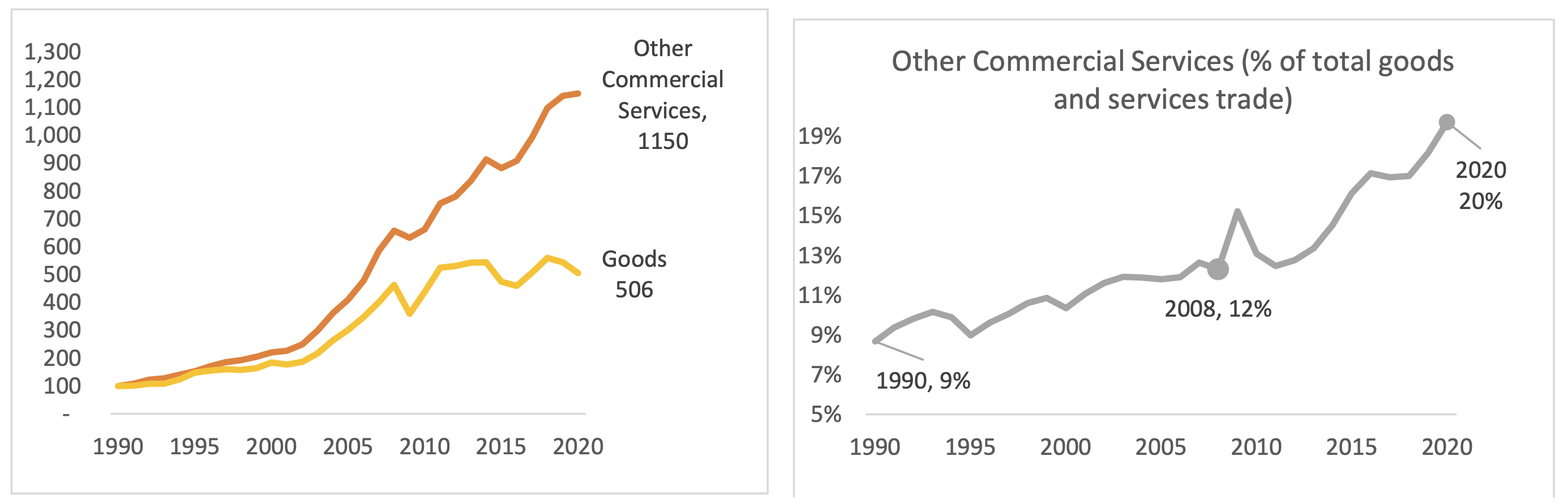

Other commercial services trade has grown much faster than goods trade

It is useful to focus on OCS trade since it is dominated by activities that – like trade in goods – are done in one economy and sold to another. Figure 4 shows that worldwide OCS flows have grown faster than trade in goods for decades (left panel), but the divergent paths became more pronounced after the 2008-09 Great Trade Collapse (Baldwin 2006). While trade in goods recovered in 2010, it has stagnated overall. By contrast, OCS has continued to grow rapidly. Between 1990 and 2020, goods expanded five-fold while OCS multiplied by 11 times.

Figure 4 Trade in ‘other commercial services’ (OCS) has grown twice as fast as goods trade since 1990, and now constitutes 20% of all international commerce

Note: The series here are not as a share of GDP; they are values indexed to 1990 = 100 to stress the trends.

Source: Author’s calculations based on WTO (trade data).

The right panel shows how this has shifted the importance of services in international commerce. In 1990, OCS accounted for only 9% of all trade in goods and services, but by 2020, that figure had tripled, and its rise shows no sign of abating.

The future of globalisation is trade in intermediate services

I turn now to the argument I first made in Baldwin (2022) that the future of trade is services, especially intermediate services. The argument boils down to four facts and a deduction.

First, barriers to trade in most services are now orders of magnitude higher than the barriers to trade in goods (Benz and Jaax 2022), but many of today’s service barriers are technological rather than fiscal or regulatory.

Services are hard to tax at the border, so most barriers arise from domestic regulation (OECD 2022). Much of this regulation, however, concerns ‘final’ services, not ‘intermediate’ services. For example, while there are strict rules for selling accounting services in the US, there are few rules concerning the qualifications of the service workers that do the paperwork behind the provision of such accounting services. A US accountant can employ pretty much anybody to tally up a client’s travel expenses and collate them with expense receipts. The quality control burden falls on the sellers of the final service, not government regulators.

Examples of occupations that provide intermediate as opposed to final services include bookkeepers, forensic accountants, CV screeners, administrative assistants, online client help staff, graphic designers, copyeditors, personal assistants, travel agents, IT security consultants, IT help staff, software engineers, lawyers who can check contracts, financial analysts who can write reports, and the list goes on and on.

The key point is that imported services are hard to tax when they cross the border. Protection of the domestic service sector relies on regulation. Most of the regulation, however, only applies to final services. Such regulation restricts who and how a service can be sold from a service provider to a final service customer. Generally, these don’t apply to intermediate services. As a result, the main barriers to trade in intermediate services are technical – for example, the difficulties of coordinating work teams that include faraway workers.

The second fact is that digitech is rapidly lowering the technological barriers to trade in intermediate services.

These first two facts mean that service-trade barriers are falling radically faster than goods-trade barriers and are likely to continue doing so for the foreseeable future.

The third fact is that export capacity in emerging markets is not as great a limiting factor in services as it is in goods, since every nation has a workforce that is already producing intermediate-service tasks.

All emerging market economies have lots of workers trained to do intermediate services domestically in all the occupations listed above. There is no need to develop whole new sectors, build factories, or develop farms or mines.

The fourth fact is that demand is not a limiting factor. Businesses in G7 nations spend a great deal on intermediate services – some of this could be provided by foreign-based workers.

A rough idea can be had by looking at all the tasks that were done remotely during the pandemic. Services are three times more important as intermediate inputs into domestic production than manufactures.

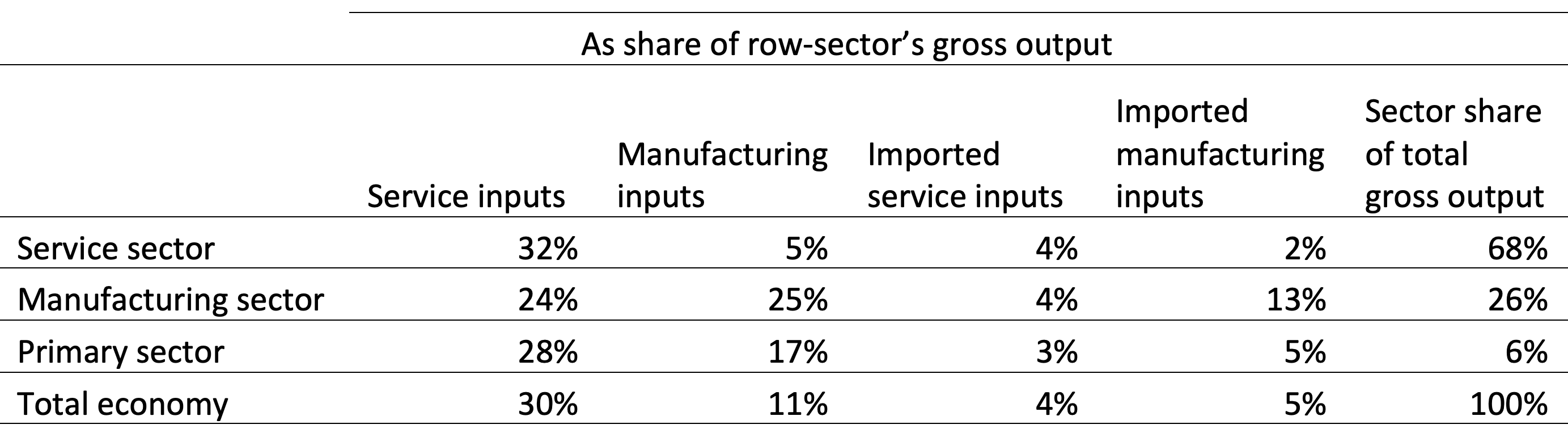

The key role of trade in intermediate goods is widely recognised in the whole global value chain debate (Johnson 2014). What is little known is that intermediate services are vastly more important in leading economies. Table 1 shows, for the French economy, that at the level of the whole economy (bottom row), intermediate service inputs account for 30% of the total gross output, while manufactured intermediates account for only 11%. Note that ‘gross output’ is GDP plus the use of all intermediates consumed in the production of the final value added.

Table 1 Intermediate services and manufacturing in the French economy, 2018

Source: Author’s manipulation of calculations produced by Rebecca Freeman and Angelos Theodorakopoulos using the OECD’s inter-country input-output database. See Baldwin et al. (2022).

The deduction is simplicity itself.

Barriers are radically higher and falling radically faster for services versus goods, and, unlike farm and factory goods, there is no capacity constraint when it comes to intermediate services. This suggests to me that the future of trade lies in services – in particular, intermediate services.

Concluding remarks

Trade in goods has stagnated for a decade and a half. Trade in services has not. Goods trade is still larger, but services now account for almost a quarter of export earnings globally. It also accounts for many export jobs, especially for women, since producing services is more labour intensive than producing goods.

The divergence between the growth of services versus goods happened because digital technology opened the door to trade in intermediate services, and high-income countries have few or no barriers to this sort of exports. India, for instance, performed its service-export miracle without signing a single trade agreement.

References

Antras, P (2021), “De-globalisation: Global Value Chains in the Post-COVID-19 Age”, paper written for the 2020 ECB Forum on Central Banking.

Baldwin, R (2006), “Globalisation: The great unbundling(s)", Economic Council of Finland 20(3): 5-47.

Baldwin, R (2016), The Great Convergence: Information technology and the new globalisation, Harvard University Press.

Baldwin, R (2019), The globotics upheaval: Globalization, robotics, and the future of work, Oxford University Press.

Baldwin, R, R Freeman and A Theodorakopoulos (2022), “Horses for courses: Measuring foreign supply chain exposure”, manuscript.

Baldwin, R (2022), “Globotics and macroeconomics: Globalisation and automation of the service sector”, paper presented at 2022 ECB Forum on Central Banking in Sintra.

ILO – International Labour Organisation (2021), World employment and social outlook 2021: The role of digital labour platforms in transforming the world of work.

Nayyar, G, M Hallward-Driemeier and E Davies (2021), At your service? The promise of services-led development, World Bank.

OECD (2022), OECD services trade restrictiveness index: Policy trends up to 2022, 31 January.

World Bank (2021), World development report 2021: Data for better lives.

Annex

This annex provides a more extensive look at some of the key empirical points in the main text. We start by looking at the key component of services trade: other commercial services (OCS).

Related work by international organisations

The most recent World Development Report leads to the same conclusion using a purpose-built categorisation of services trade (World Bank 2021). The publication points out that what they call ‘data-driven services’ have increased from about one-quarter to almost half of total service exports. In an important World Bank book, Nayyar et al. (2021) look at how OCS is enabling ‘service-led development’.

The International Labour Organization’s flagship report (ILO 2021), which focuses on international freelancing, points out that:

a trend has developed towards outsourcing work, both low-skilled and high-skilled, especially as traditional businesses look to digital labour platforms and digital tools to meet their needs for human resources. These platforms host workers from around the world, enabling businesses to complete their tasks at a faster pace and lower price than if the tasks were performed on site. In many instances, the work is outsourced on these platforms by businesses in the global North and performed by workers in the global South.

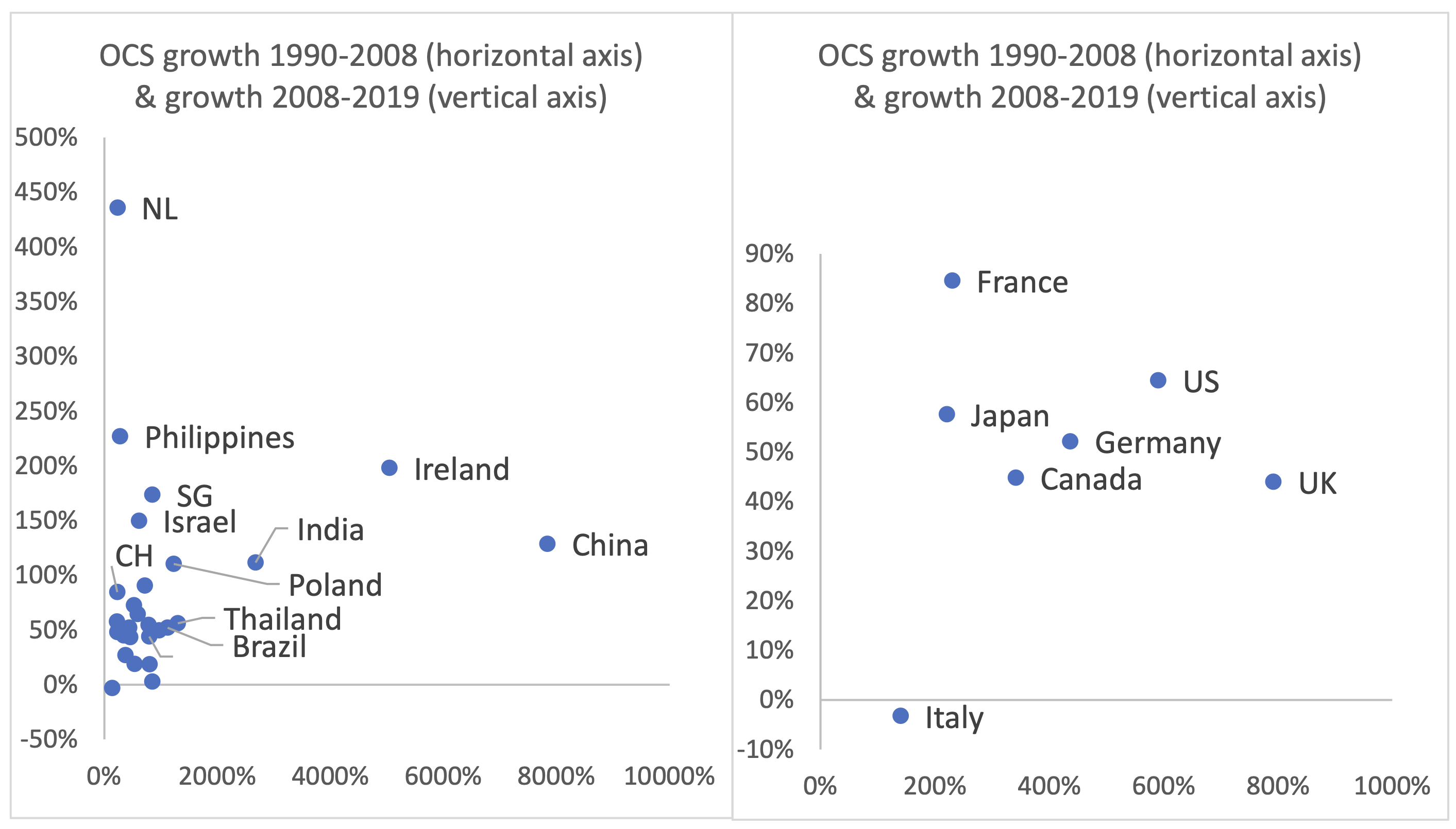

OCS scatter plot for large traders and the G7 economies

The main text of this column presented the facts for total services trade, but that includes the peculiar categories of transport and travel services. Here we look at the OCS category alone, since it presents a closer analogy to trade in goods, i.e. where trade means things made in one country and sold in another.

Figure A1 (left panel) confirms the Figure 2 finding that individual economies generally do not display peaking behaviour. Thus, in contrast to goods trade, the non-peaking result is almost universal among large economies. The figure shows the scatter plots of the percentage-point changes in services trade for large traders (economies whose service trade amounts to at least half a percent of world services trade). All of the economies show growth both before and after 2008, except Italy, which recorded a slight decline after 2008.

Figure A1 Other commercial service (OCS) trade before and after 2008; largest traders (left) and G7 (right)

Note: The vertical axis plots growth after 2008 (2008 to 2019); the horizontal axis plots growth before 2008 (1990-2008). Covid-19 seriously distorted services trade from 2020, so the chart stops at 2019. The large traders are US, Ireland, UK, Germany, Netherlands, China, France, Japan, India, Singapore, Switzerland, Canada, Italy, Korea, Spain, Sweden, Hong Kong, China, Austria, Brazil, Denmark, Israel, Poland, Finland, Taipei, Norway, Australia, Thailand, Philippines, Malaysia. Together they account for over 80% of world trade.

Source: Author’s calculations based on WTO (trade data).

As with overall services trade, the pre-2008 growth (cumulative from 1990 to 2008) is spectacular for many of the nations. China, Ireland, India, Thailand, Poland, and Brazil had rates over 1,000%. In the 12 years from 2008 to 2020, several of the big traders enjoyed service export growth over 100%. The Philippines was the league leader with its 227% rise but was a slow starter (only 230% growth before 2008). India’s trade in services rose 2,680% from 1990 to 2008, and 110% after 2018. The right panel breaks out the G7 nations for better visibility. All but Italy were non-peakers.

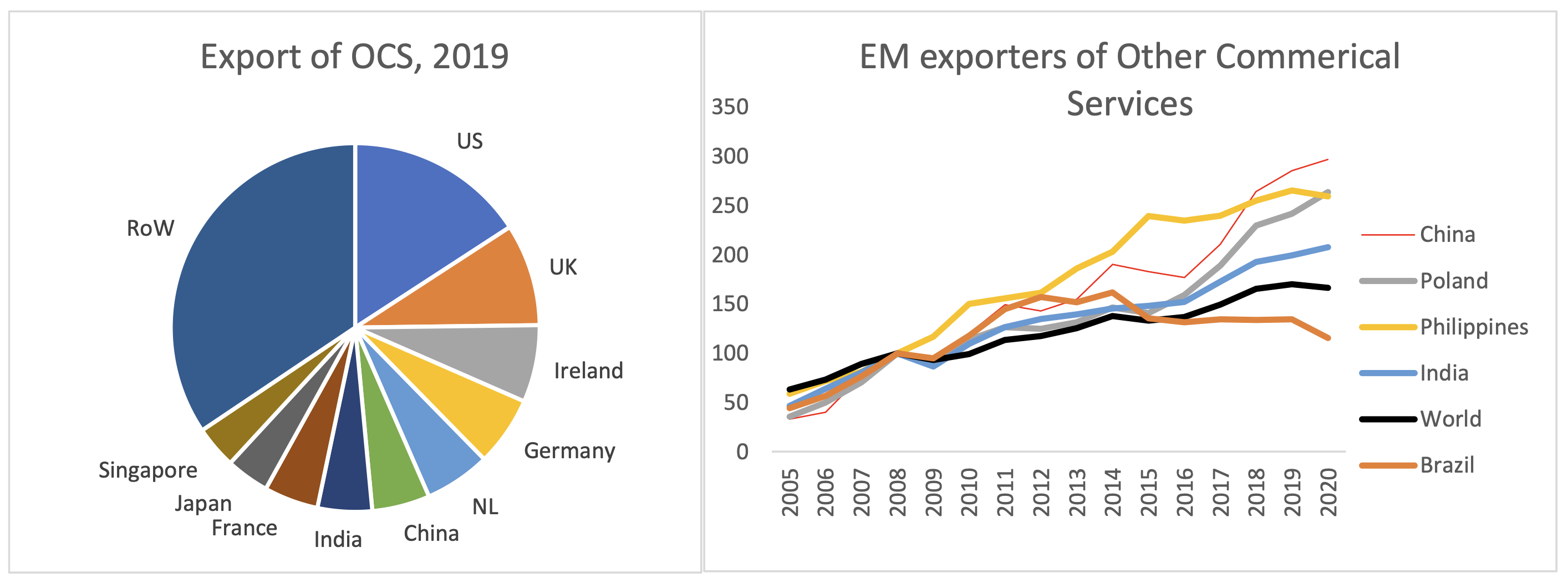

Who are the big players in the trade in services arena?

The global shares of the largest OCS exporters are shown in Figure A2 (left panel). The top ten exporting nations account for about two-thirds of all service exports. The US, UK, Ireland, Germany, and the Netherlands alone account for about 40% of world exports. Adding in India and China brings the total to over half. The right panel shows that most of the large emerging economies are seeing faster-than-average growth in their service exports.

While advanced economies still account for the bulk of service exports worldwide, the role of emerging economies is fast gaining pace. The biggest emerging market exporters of services are – in order – China, India (with 5% of the world total each), Korea, Poland, the Philippines, and Brazil. The world export of OCS has risen by 1.7 times since 2005, but the OCS exports from China and India, for instance, have almost tripled.

Figure A2 Largest exporters of OCS and emerging market (EM) trends since 2005

Source: Author’s calculations based on WTO (trade data).

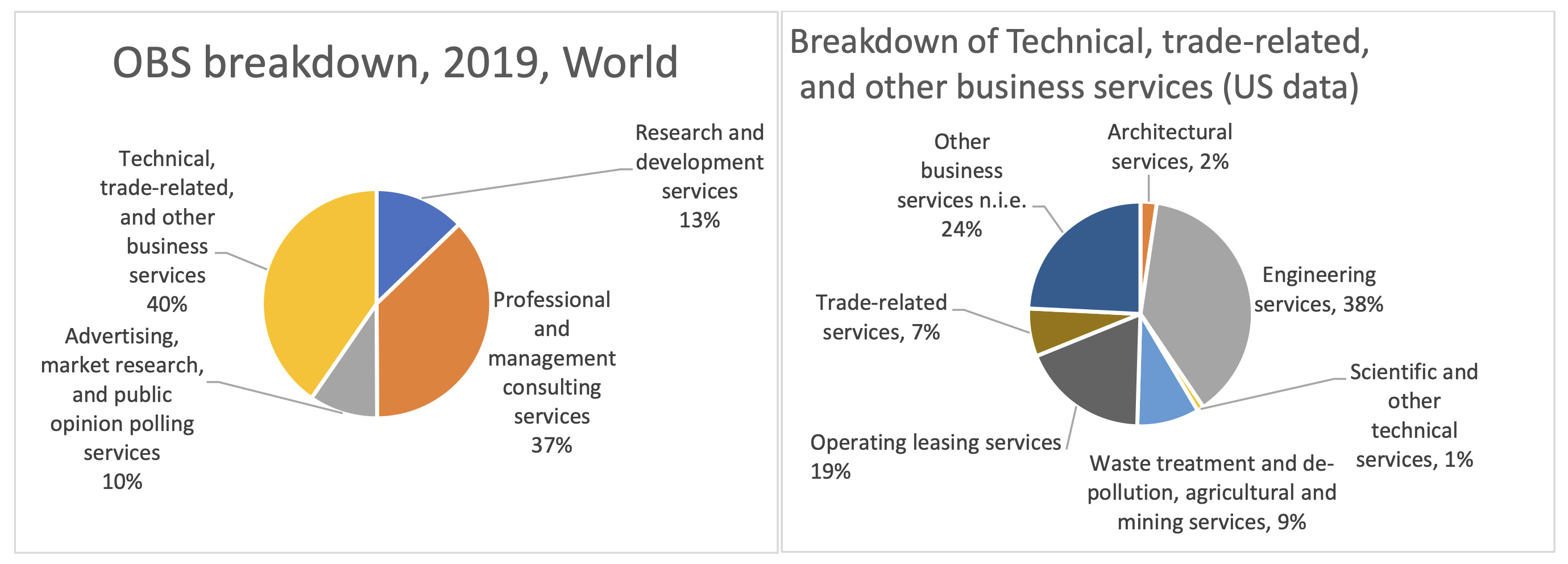

A more disaggregated look at trade in services

The OCS category consists of a few big items and many small items, as Figure 3 illustrated. The largest sub-category (24%) is ‘other business services’, or OBS (Figure A3). Peeling off another layer of the onion, the left panel of the figure shows the components of OBS. The largest categories are: professional and management consulting services (37% of OBS), and technical, trade-related, and other business services not elsewhere included. Disaggregated figures for the ‘technical, trade-related, and other business services not elsewhere’ category are not available for the whole world, but some nations – like the US – provide more detail.

The right pie chart (which is based on US data since it includes a finer disaggregation than world data) shows the breakdown of ‘technical, trade-related, and other business services not elsewhere’. The big items are engineering services (38%); leasing services (19%); and other business services not included elsewhere (24%).

Figure A3 Breakdown of ‘other business service’, 2019, world (left panel) and US (right panel)

Source: Author’s calculations based on WTO (trade data).

Evidence on trade in intermediate services

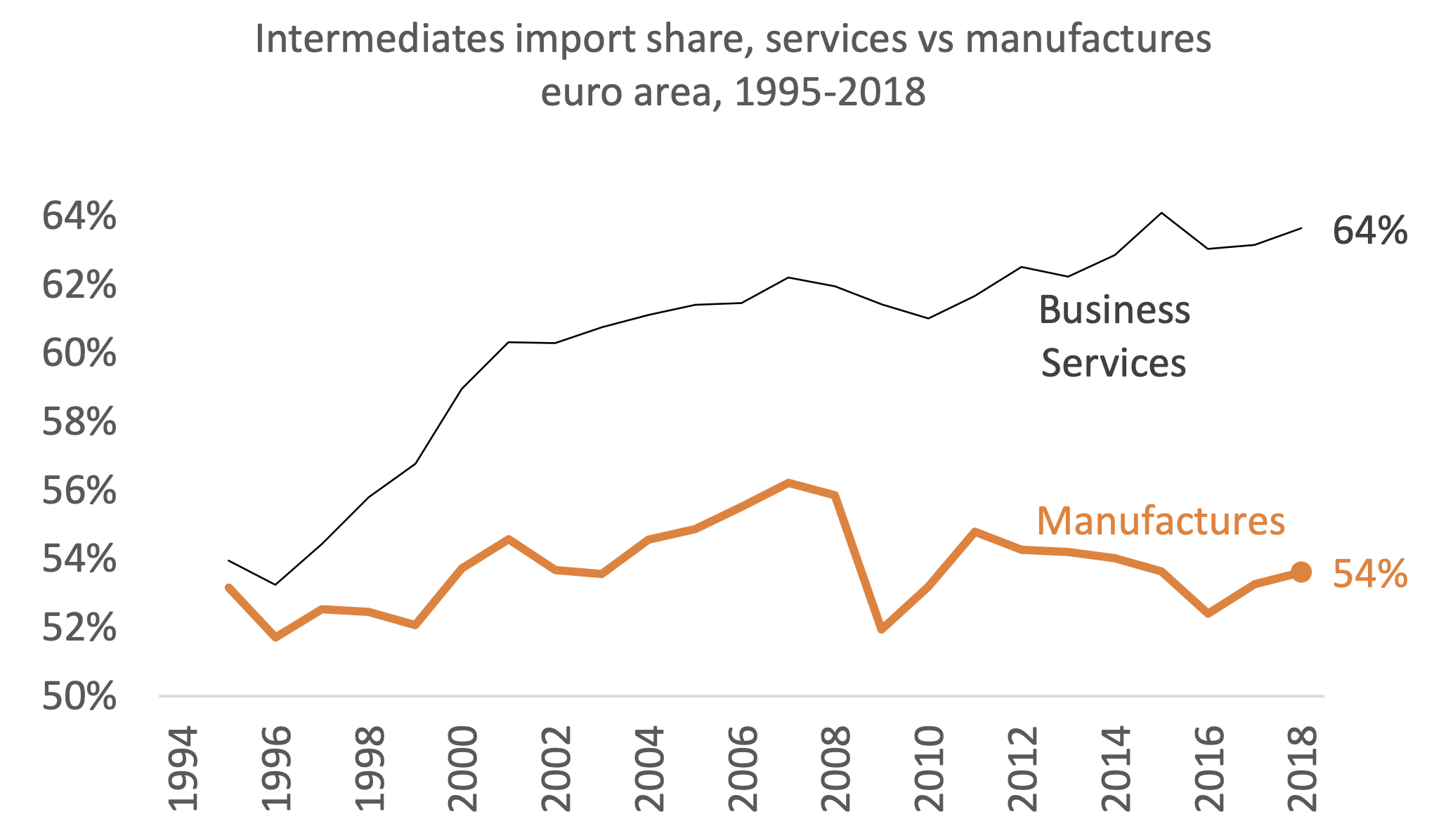

While official services-trade data fail to distinguish between final and intermediate services, the OECD TiVA database does. Figure A4 shows that intermediates are more important in imported services than imported manufactures. For manufacturing, intermediates account for about half, and there has been some decline since 2008. For services, the share starts out a bit higher and the gap widens.

Figure A4 Intermediates as share of imported services and manufactures, 1995-2018, euro area 19 and UK (shares of own-sector imports, 1995-2018)

Notes: TiVA data are only available for the 1995-2018 period. Imports in the charts are measured on the usual ‘gross’ basis (not value-added basis). Business services encompass all non-governmental services (the TiVA database categories of services do not line up with standard trade in services categories, like OCS).

Sources: Author’s calculations based on OECD TiVa data, downloaded from stats.oecd.org.