In the last three decades, the US has witnessed a stark decline in per capita income convergence, with already rich cities experiencing greater income growth (Ganong and Shoag 2017) and higher prime-age male employment rates (Austin et al. 2018). Increases in spatial inequality have led policymakers to ask how incentives for corporate relocation might deliver long-lasting investment and improved opportunities for residents of economically declining regions. For instance, the Opportunity Zone programme enacted through the 2017 Tax Cuts and Jobs Act offers taxpayers immediate benefits through capital gains tax deferrals in exchange for investment in catchment areas approved by the Treasury Department.

Yet, evidence on the success of this new wave of place-based policies is mixed, with some researchers finding muted effects on employment, earnings, or poverty rates (Freedman et al. 2021). Others have noted short-run bumps in employment growth in designated zones (Arefeva et al. 2021). Targeting struggling areas at the risk of extending overly generous tax breaks to firms which plan to leave shortly after capturing the funds is a persistent concern. Further, place-based subsidies may be on net bad for the aggregate economy because they typically allocate government spending to unproductive areas (Gaubert 2018).

Evidence from place-based corporate income tax breaks in Japan

In new research, we consider the role of the corporate physical capital structure in the effectiveness of tax policy at retaining resources in targeted regions (LaPoint and Sakabe 2021). The physical capital structure consists of the geographic network spanned by production and office sites, together with how the firm combines capital inputs to produce its goods and services. It is well-known that multi-plant companies respond to shocks at one location by reallocating resources across plants (Giroud and Mueller 2015). But less is known about how firms may internally reshuffle people and capital when tax breaks alter the relative cost of capital across locations.

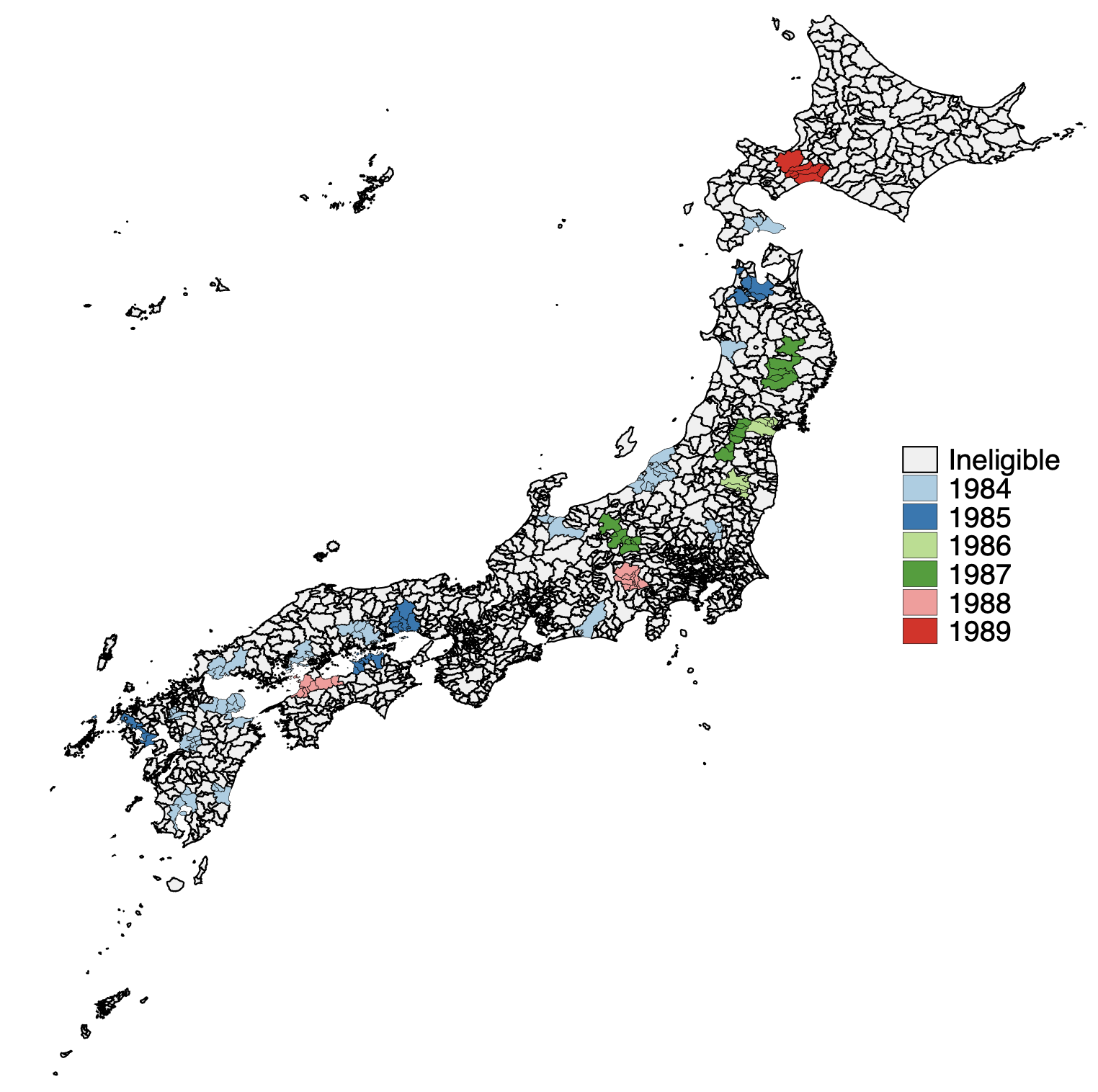

We use as our laboratory a place-based policy campaign in 1980s Japan, dubbed ‘Technopolis’. With a staggered rollout between 1984 and 1989, the Japanese government allowed high-tech manufacturing companies write-offs against their national corporate income tax liability if they invested in one of 26 regional clusters. These write-offs were offered as bonus depreciation, which allows firms to deduct an additional fraction of physical capital costs in the first year of an asset’s tax life. The objective of this policy was to jump-start manufacturing capacity after the OPEC crisis in cities geographically removed from the main metropolises of Tokyo, Osaka, and Nagoya (Figure 1).1

Figure 1 Map of areas eligible for bonus depreciation

Notes: Map reflects municipal boundaries as of 2015 to account for town mergers. Color-coded municipalities indicate the implementation year. Bonus depreciation rates offered through Technopolis are uniform across all eligible municipalities.

Existing research on place-based and industrial policies has documented positive labour market effects of bonus depreciation schemes (Garrett et al. 2020) and manufacturing subsidies (Siegloch, et al. 2021). While we also find an uptick in firm hiring in our setting, we focus on capital investment responses. To this end, we link a database containing balance sheets for all publicly listed Japanese firms with corporate facility locations from a manufacturing census survey, and hand-collected information on physical capital investment by asset type and by location which firms report in their annual securities filings (LaPoint 2021).

Key to our analysis is our ability to separate physical capital investment into six categories: construction projects, machines, tools, vehicles, buildings, and land. This allows us to identify firms relying more on long-lived capital (buildings and machines) versus short-lived capital (tools and vehicles). Long-lived capital firms gain more in an immediate cash flow sense from becoming eligible to claim spatial bonus depreciation, since normally the tax code would require them to recoup costs over a much longer period (Zwick and Mahon 2017).

Another distinction is that we study the investment and location decisions of large, multi-plant firms for which we can directly observe take-up of the policy through deductions claimed on the tax bill. Our empirical strategy is an event study design comparing firms in eligible high-tech manufacturing sectors and operating in eligible areas with firms in different combinations of ineligible groups.2 Accordingly, firms in ineligible groups (e.g. non-manufacturing firms) do not experience an uptick in cash flows from bonus depreciation claims following policy enactment.

Effects of spatial bonus depreciation on corporate resource allocation

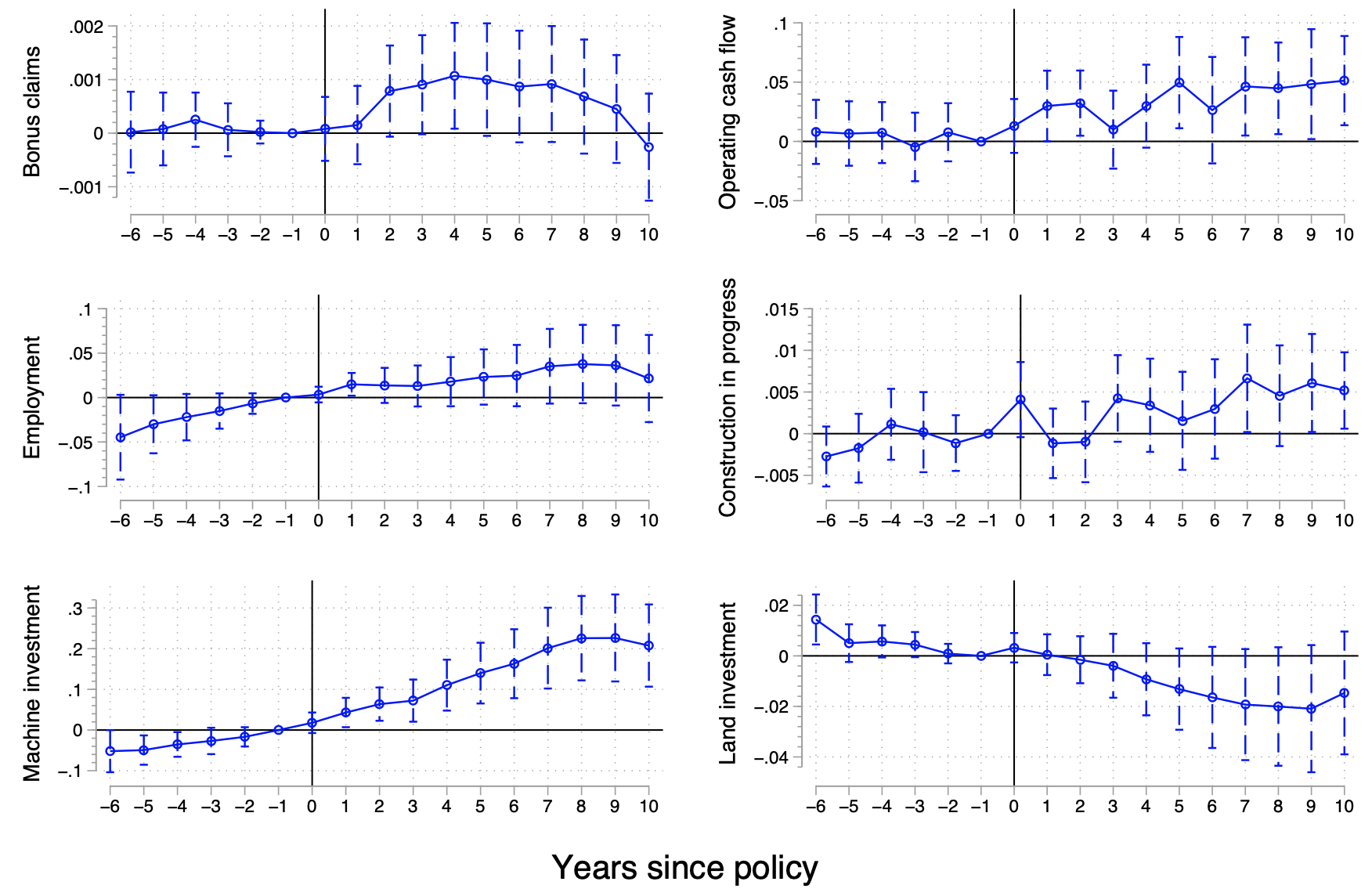

Figure 2 shows how firm cash flows, employment, and capital investment evolve with respect to the implementation of a Technopolis area. These are economically large responses. A firm which became eligible to claim bonus depreciation on investments at one of its plant locations increased the dollar amount of its bonus depreciation claims by 0.18 standard deviations, outlays for construction by 0.29 standard deviations, and spending on machinery by 0.40 standard deviations. There is a spike in operating cash flow, a measure of earnings which includes cash obtained through tax breaks, at five years after policy implementation. This is not a coincidence; firms lock in a higher bonus depreciation rate, and therefore more immediate cash flow, if they make qualifying investments within the first five years of a Technopolis site’s creation.

Figure 2 Dynamic corporate responses to Technopolis eligibility

Notes: The figure shows the effect of a firm becoming eligible to claim bonus depreciation through Technopolis on various outcomes. Each monetary variable is scaled by the book value of corporate assets in 1975, the first year of our sample. Employment is scaled by its value at the firm level in 1975. To account for variation in the price of land across locations, we deflate land investment by the city-level commercial land price indexes constructed in LaPoint (2021). We bin the policy dummies at the end of the effect windows. Capped spikes represent upper and lower limits of 95% confidence intervals based on standard errors that are clustered at the firm level.

We also find an increase in firm-level hiring of roughly 5% (0.13 standard deviations) relative to the pre-policy baseline. This suggests complementarity between high-tech capital and labour, contrary to recent concerns that machines may be displacing workers in certain sectors (Acemoglu and Restrepo 2020). Firms substitute away from investment in land (0.11 standard deviation decline), which does not depreciate and thus becomes more expensive relative to other types of capital after the reform.

Heterogeneous effects by physical input composition

Using several accounting identities and the schedule of effective corporate income tax rates, we recover for each firm the shares of six physical capital input types used in production. Our approach leads to intuitive facts about sectoral differences in the use of intermediate goods; heavy manufacturing firms make the most use of machinery in their production process, while electronics firms have the highest input share for tools and precision instruments. We conclude the bonus claiming and hiring behaviour in Figure 2 is driven almost entirely by firms with an above-median share of long-lived assets.

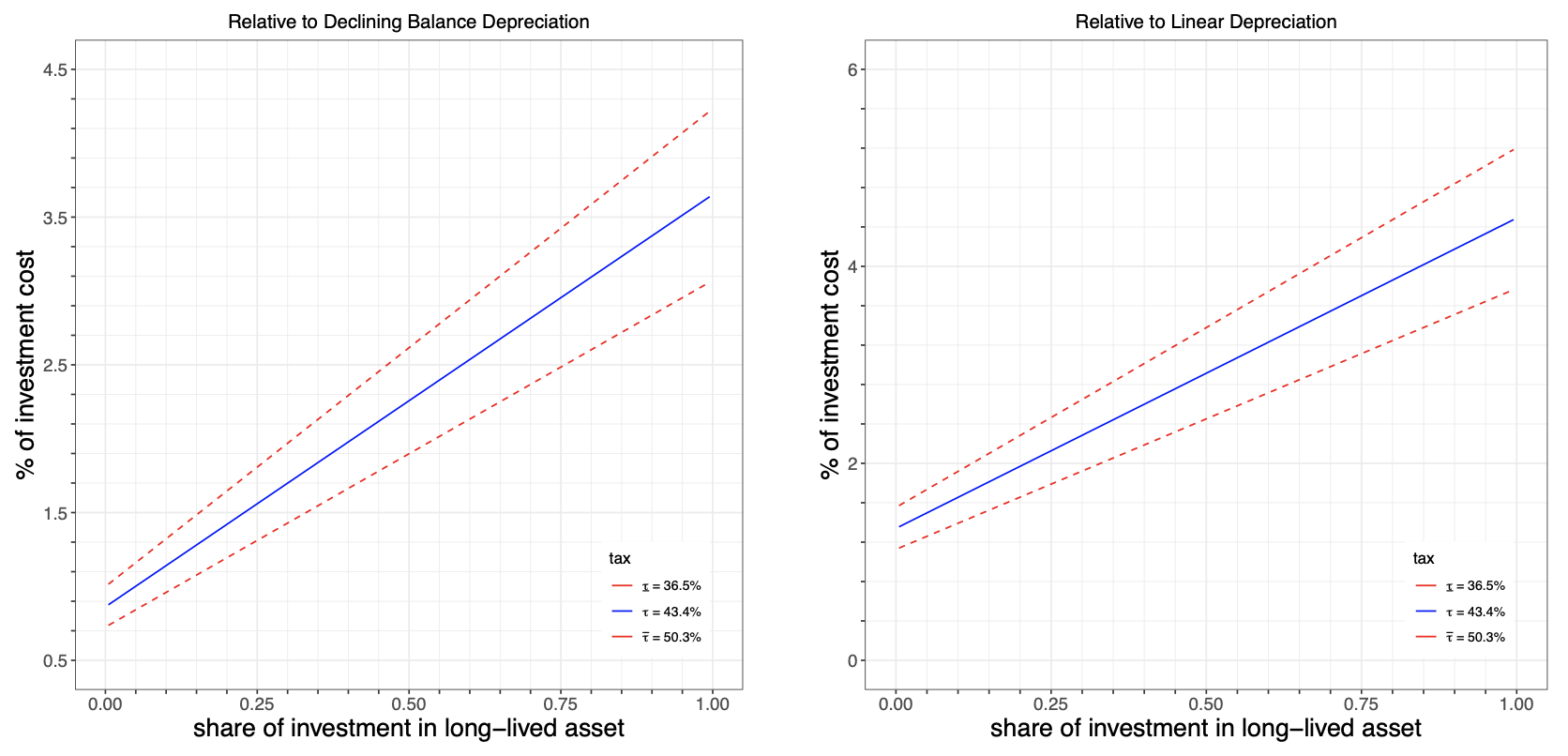

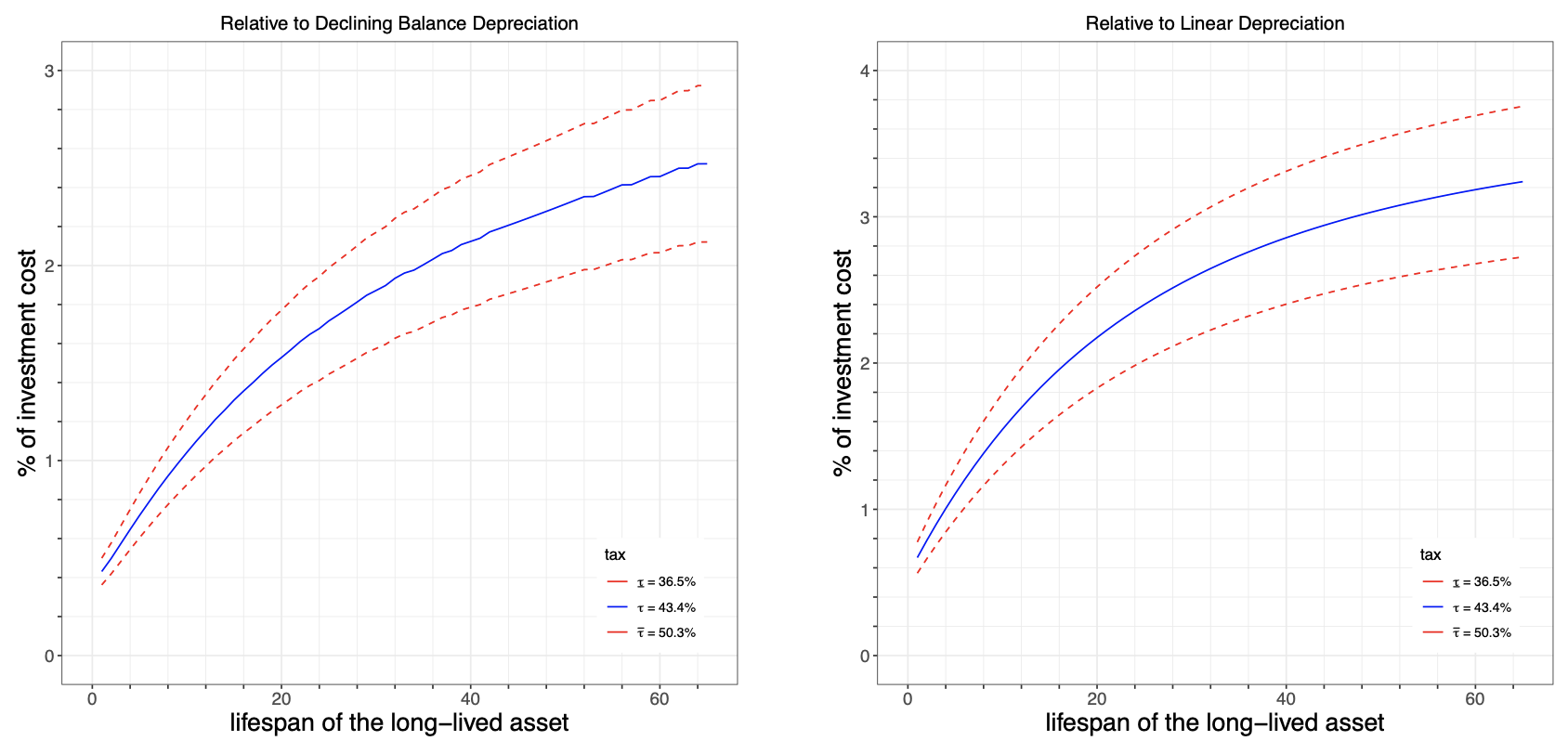

To illustrate why we observe these differential responses by input composition, we conduct a simulation exercise to quantify the cash flow benefits to firms using different investment strategies. Figure 3 considers an example inspired by our main results: a firm invests in computers – a short-lived asset which depreciates over four years – and building a new office site – a long-lived asset which depreciates over 65 years. We plot the cash flow benefit from claiming bonuses via Technopolis as a percentage of the initial investment cost (i.e. the subsidy rate). We compute this benefit relative to two accounting methods that were available in the tax code to all firms regardless of their Technopolis eligibility: declining balance (left panels) and linear depreciation (right panels).3

Figure 3 Simulated benefits from bonus depreciation claims

A) Varying the cost share of the long-lived asset

B) Varying the lifespan of the long-lived asset

Notes: Each panel presents the simulated present discounted value benefit of bonus claims relative to one of two standard accounting methods: declining balance or linear cost accounting. We plot the benefit as a percentage of a $2 million investment split between a short-lived asset (i.e., computers), and a long-lived asset (e.g., an office building). Red lines show the simulated benefit for the upper and lower-bound effective corporate income tax rates during the policy period, while the blue line shows the benefit for the midpoint effective tax rate. We assume a 7% real discount rate.

Panel A demonstrates that under either alternative depreciation method the gains from claiming bonus depreciation are increasing in the investment share in long-lived assets like new buildings. At the extreme, a firm investing only in a new building, but no computers, receives a 4% subsidy. Panel B shows that the subsidy rate is increasing in the lifespan of the long-lived asset. Hence, if we applied the 39-year tax lifespan of commercial buildings in the US to the Japanese tax code, the construction subsidy under Technopolis would have been between 2-3%.

Finally, combining our estimates in Figure 2 with these cash flow projections, we compare the cost of Technopolis in terms of lost corporate income tax revenue to the number of jobs the policy generated. We estimate a fiscal cost per job of $17,000, which is comparable to the $20,000 per job estimate of Garrett et al. (2020) for bonus claims offered nationally in the US between 2002 and 2012. Overall, we conclude Technopolis was highly cost-effective relative to similar manufacturing subsidies and bonus depreciation schemes enacted elsewhere. Our findings suggest spatially targeted tax breaks for long-lived capital goods help stimulate the labour market while encouraging local retention of corporate capital.

References

Acemoglu, D and P Restrepo (2020), “Robots and Jobs: Evidence from U.S. Labor Markets”, Journal of Political Economy 128(6): 2188-2244.

Arefeva, A, M A Davis, A C Ghent and M Park (2021), “Job Growth from Opportunity Zones”, SSRN Working Paper 3645507.

Austin, B, E Glaeser and L Summers (2018), “Jobs for the Heartland: Place-Based Policies in 21st-Century America”, Brookings Papers on Economic Activity: 151-232.

Borusyak, K, X Jaravel and J Spiess (2021), “Revisiting Event Study Designs: Robust and Efficient Estimation”, arXiv: 2108.12419.

de Chaisemartin, C and X D’Haultfœuille (2020), “Difference-in-Differences with Multiple Time Periods”, American Economic Review 110(9): 2964-2996.

Freedman, M, S Khanna and D Neumark (2021), “The Impacts of Opportunity Zones on Zone Residents”, NBER Working Paper 28573.

Ganong, P and D Shoag (2017), “Why Has Regional Income Convergence in the U.S. Declined?”, Journal of Urban Economics 102: 76-90.

Garrett, D G, E Ohrn and J C Suárez Serrato (2020), “Tax Policy and Local Labor Market Behavior”, American Economic Review: Insights 2(1): 83-100.

Gaubert, C (2018), “Firm Sorting and Agglomeration”, VoxEU.org, 14 November.

Giroud, X and H M Mueller (2015), “Capital and Labor Reallocation within Firms”, Journal of Finance 70(4): 1767-1804.

LaPoint, C (2021), “You Only Lend Twice: Corporate Borrowing and Land Values in Real Estate Cycles”, SSRN Working Paper 3633606.

LaPoint, C and S Sakabe (2021), “Place-Based Policies and the Geography of Corporate Investment”, SSRN Working Paper 3950548.

Siegloch, S, N Wehrhöfer and T Etzel (2021), “Regional Firm Subsidies: Direct, Spillover, and Welfare Effects”, VoxEU.org, 4 June.

Sun, L and S Abraham (2021), “Estimating Dynamic Treatment Effects in Event Studies with Heterogeneous Treatment Effects”, Journal of Econometrics 225(2): 175-199.

Zwick, E and J Mahon (2017), “Tax Policy and Heterogeneous Investment Behavior”, American Economic Review 107(1): 217-248.

Endnotes

1 Due to declining population in rural areas, the number of distinct Japanese municipalities collapsed through a series of mergers from 3,278 in 1980 to 1,741 as of 2015. We show our results are quantitatively similar when we instead fix geographic boundaries according to 1980 definitions.

2 Given that the Japanese government implemented the policy at different times in different areas, we show that our results are robust to heterogeneous effects by Technopolis year cohort using several alternative approaches, including the estimators introduced in de Chaisemartin and D’Haultfœuille (2020), Sun & Abraham (2021), and Borusyak et al. (2021).

3 Both declining balance and linear depreciation methods are available to taxpayers under the U.S. tax code. Although less generous than bonus depreciation, declining balance methods also allow taxpayers to immediately deduct a larger fraction of investment costs relative to the linear method.