This column is a lead commentary in the VoxEU debate on "Populism"

The last two decades have seen vastly increasing levels of political polarisation in most Western democracies and the rise of populist politicians into positions of executive power. As Funke et al. (2021) highlight, the rise of populism has triggered much work on the determinants of populist voting (e.g. Colantone and Stanig 2019, Margalit 2019), but much less is generally known about its economic and political consequences.

This is also true for financial markets. Financial markets have shown contradictory reactions to the formation of populist administrations. While the election of Donald Trump was greeted with a stock market rally in November 2016, markets reacted in a decisively negative way to the Greek Syriza-led government of January 2015 or to the creation of a left-wing coalition in Spain that included the populist party Podemos in November 2019.

Do these radically different reactions follow some discernible logic, or are they simply pure coincidences? And if there is something systematic behind them, what might explain these radically different outcomes? We attempted to tackle some of these important questions in a recent publication (Stöckl and Rode 2021).

A new index of party populism

One big challenge for assessing the impact of populism on financial markets is that many measures of party populism are only available for rather short periods of time (see Norris 2020 or Meijers and Zaslove 2021 for good examples). This severely complicates the analysis of all populism-related phenomena with a relevant time dimension.

At first sight, an attractive solution might be to look at the outcomes produced by populist governments (as in Funke et al. 2021). This approach unfortunately is not ideal either. First, this strategy may miss out on the potential conditioning effect of populist parties becoming more important in a political system – even if they are not in government (Guriev 2019). Second, it also disregards that populism is in many ways a matter of degree rather than a binary phenomenon (Hawkins 2009).

To capture a continuous measure of populism, we construct a discursive indicator from data from the Comparative Manifesto Project by Lehmann et al. (2019), operationalising a populism concept that broadly focuses on anti-elitism, popular decision-making, and anti-pluralism (Müller 2016, Mudde and Rovira Kaltwasser 2017, Guriev and Papaioannou 2020).

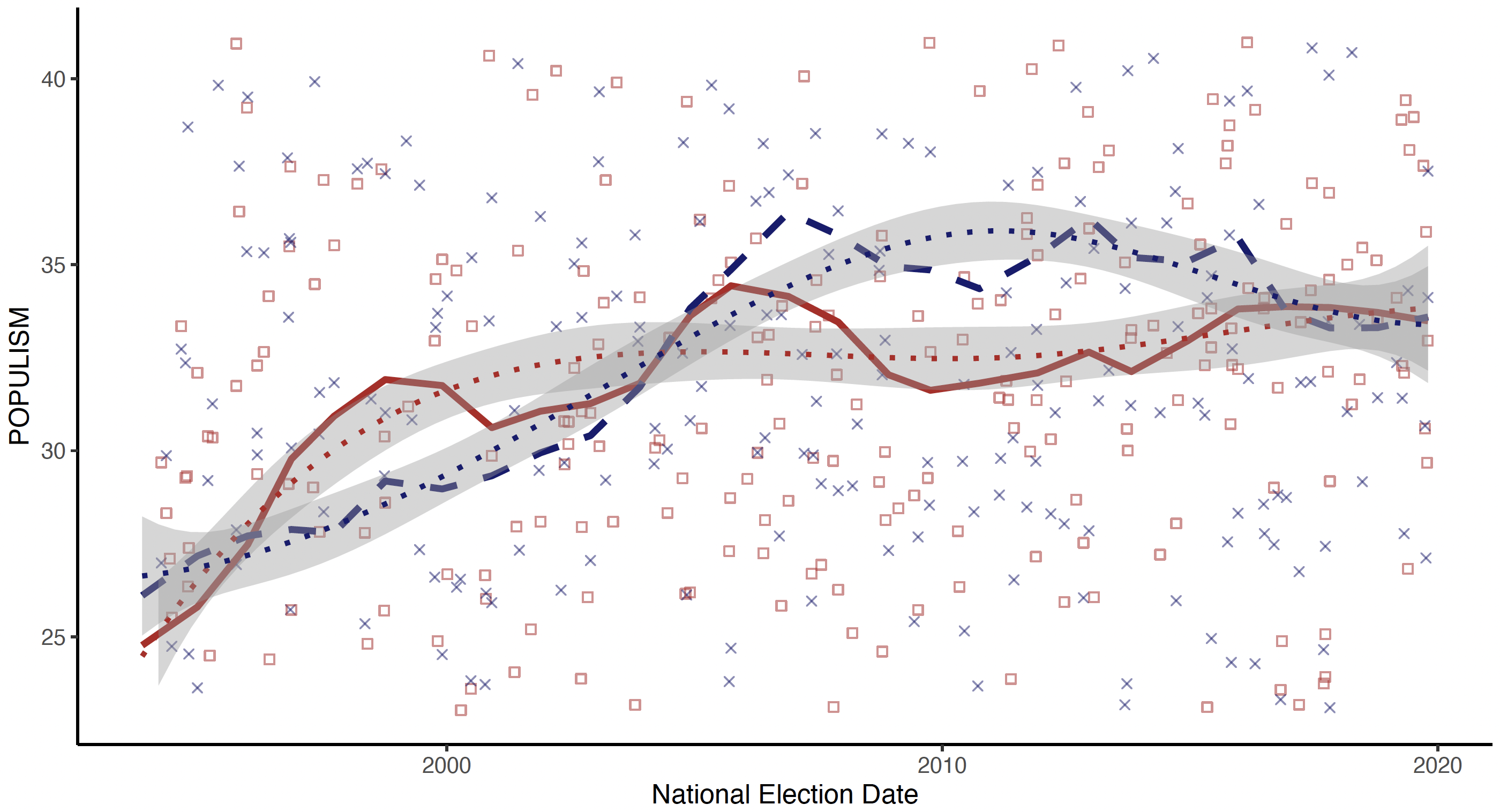

Figure 1 shows the average yearly evolution of our populism indicator over time for 331 elections in 41 EU and OECD countries, where parties are weighted by their seat-shares and separated by ideological orientation (data from Döring and Manow 2020). It can be seen here that the rise of populism, both on the right and the left, pre-dates its more recent ascent to political power.

Figure 1 The evolution of average populism over time by populist ideology

Note: The solid red line depicts the evolution of average yearly right-wing populism over time; the dashed blue line for left-wing populism. The dotted lines represent a smoothed version of the respective lines to more clearly observe trends in the data. Blue crosses depict the average populism score of left-wing parties during an individual election, while red squares depict the average populism of the right-wing parties.

Interestingly, the graphical evolution of our indicator confirms earlier research on the rise of populism (e.g. Mudde 2004), which argued almost two decades ago that populism was becoming a mainstream political phenomenon – long before the 2016 Brexit referendum and Donald Trump’s electoral victory.

Figure 1 also shows that this is evolution is not homogeneous across political ideologies: while left-wing populism seemed to make a first early rise in the late 1990s, the mid- to late-2000s were marked by the quick rise of right-wing populism. Only recently has left-wing populism once again caught up with populism on the right.

What is clear from the graphic though is how impressively populism has established itself as a political force inside the world’s democratic states.

Populism and financial market outcomes

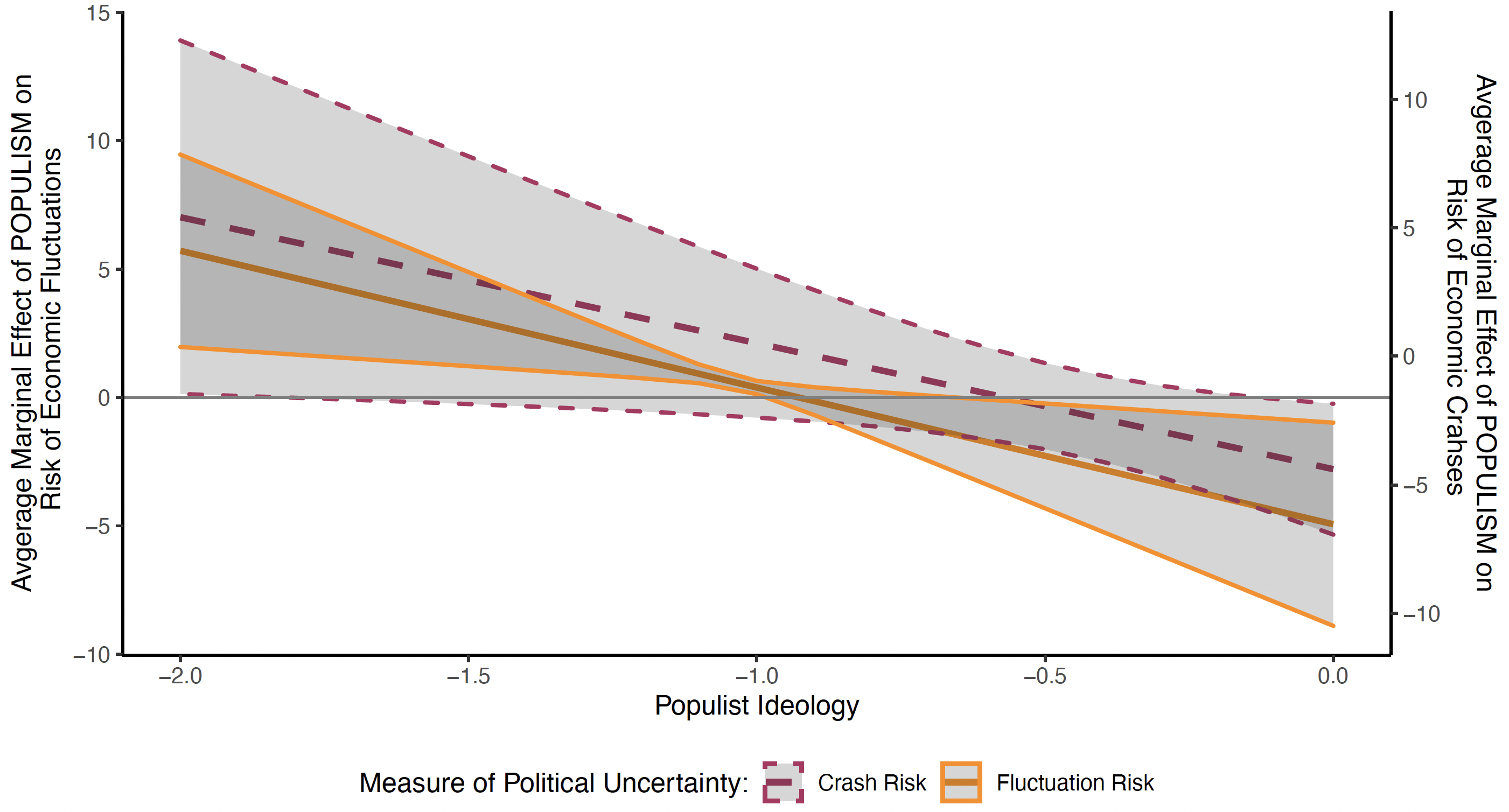

Turning back to the outcomes of political populism for financial markets, Figure 2 shows the marginal effect of populism on various dimensions of political uncertainty, following our findings in Stöckl and Rode (2021). Here, price risk can be interpreted as the possibility of economic fluctuation, while tail risk can be understood as the prospect of an economic crash.

On a more technical level, price risk is measured as the additional implied volatility paid for at-the-money options that span an election, whereas tail risk is measured by the additional fee market participants have to pay for far out-of-the-money puts to protect themselves against market crashes happening due to an election (outcome).

For both dimensions, we show in Figure 2 that the immediate uncertainty introduced into financial markets by an increase in populist vote shares varies according to the populist host ideology. Clearly, markets are mostly suspicious of left-wing populism, although this seems to be partially mitigated in the context of high-income democracies, where important institutional guardrails are usually in place.

These increased levels of political uncertainty are presumably driven by investors who buy out-of-the-money put options to protect themselves from severe market crashes because they are potentially exposed to the economic policies of left-wing populist parties. In turn, findings show the markets view the electoral success of right-wing populist parties as unequivocally favourable.

Figure 2 The average marginal effect of populism for political uncertainty by populist ideology

Note: The graphic shows the average marginal effect of populism disaggregated along populist ideology (populist left vs. populist right) on two specific types of financial risks: (i) the risk of economic fluctuations (solid lines), i.e. the risk of changing prices that investors protect against with certain call and put options; (ii) the risk of an economic crash (dashed lines), i.e. the risk of a severe economic downturn where investors use extreme out-of-the money puts to protect themselves against potential market crashes. The horizontal axis: populist ideology (populist left on the left-hand side and populist right on the right-hand side, see Stöckl and Rode 2021).

It is easy to see why populist governments on the left would be perceived as a potential threat by financial markets, given their dismal economic record (Edwards 2010). In turn, it is much more difficult to see why right-wing populism should be evaluated as uncertainty-reducing. A tentative answer might be provided by the ambiguous economic policy programmes of populism on the right: this often oscillates between a harsh anti-free trade programme and an expressive willingness to cater to the needs of big business.

It is questionable whether such policies will improve the long-run economic performance (Rode and Revuelta 2015), but in the short run, they could nonetheless be perceived as positive by investors in financial markets because stock-market performance and the evolution of GDP are, in many ways, different things. Financial markets reflect expected future profits, so lower profit tax raises, for example, have the potential to raise stock prices, even if GDP is not affected in the short run. This is even more so if investors expect unusually high profits from politically favourable treatment.

So, perhaps, it is this explicit tendency towards political capitalism, defined as a system where the political and economic elite collude to their own benefit (Holcombe 2018), that financial markets evaluate as favourably in the electoral success of right-wing populist parties.

What next?

The agenda for further research of the impact of populism on financial markets includes the following obvious questions:

- Which companies are ultimately affected by the political uncertainty generated from the election of populists?

- How do financial markets value the political connections of specific companies?

- What expected rent-seeking payoffs might this generate in the event of a rise to power?

- How do these effects differ between left-wing and right-wing populism?

Recent contributions by Hanke et al. (2020) and Child et al. (2021) already give some tentative answers for the cases of Brexit and Donald Trump, but these questions need to be assessed in a much more general nature for the world’s democratic states.

For the moment, one thing that should be stressed much more in coming electoral campaigns is the ambiguous nature of right-wing populist parties towards free markets, international exchange, and social policy (Fenger 2018). Here, it must be especially stressed that a pro-business policy is not necessarily the same as policies directed towards more inclusive growth and the reduction of economic inequality.

On the contrary, just like populism on the left in Latin America, many of the policies proposed and enacted by right-wing populist governments will probably end up hurting exactly those groups that are also responsible for the electoral victories of that same parties (cf. Rode and Revuelta 2015, Fenger 2018).

Authors’ note: We would like to thank Sergei Guriev for his helpful feedback.

References

Child, T B, N Massoud, M Schabus and Y Zhou (2021), “Surprise election for Trump connections”, Journal of Financial Economics 140(2): 676–97.

Colantone, I, and P Stanig (2019), “Heterogeneous drivers of heterogeneous populism”, VoxEU.org, 10 December.

Döring, H, and P Manow (2020), Parliaments and governments database (ParlGov): Information on parties, elections and cabinets in modern democracies, Version 2020.

Edwards, S (2010), Left behind: Latin America and the false promise of populism, University of Chicago Press.

Fenger, M (2018), “The social policy agendas of populist radical right parties in comparative perspective”, Journal of International and Comparative Social Policy 34(3): 188–209.

Funke, M, M Schularick and C Trebesch (2021), “The cost of populism: Evidence from history”, VoxEU.org, 21 February.

Guriev, S (2019), “Moderator’s introduction to the Vox debate on populism”, VoxEU.org, 29 October.

Guriev, S, and E Papaioannou (2020), “The political economy of populism”, Journal of Economic Literature, forthcoming.

Hanke, M, S Stöckl and A Weissensteiner (2020), “Political event portfolios”, Journal of Banking and Finance 118: 105883.

Hawkins, K A (2009), “Is Chávez populist? Measuring populist discourse in comparative perspective”, Comparative Political Studies 42(8): 1040–67.

Holcombe, R (2018), Political capitalism: How economic and political power is made and maintained, Cambridge University Press.

Lehmann, P, J Lewandowski, T MatthieEß, N Merz, S Regel and A Werner (2019), Manifesto corpus. Version 2019-2, WZB Berlin Social Science Center.

Margalit, Y (2019), “Economic causes of populism: Important, marginally important, or important on the margin”, VoxEU.org, 20 December.

Meijers, M J, and A Zaslove (2021), “Measuring populism in political parties: Appraisal of a new approach”, Comparative Political Studies 54(2): 372–407.

Mudde C (2004), “The populist zeitgeist”, Government and Opposition 39(4): 541–63.

Mudde, C, and C Rovira Kaltwasser (2017), Populism: A very short introduction, Oxford University Press.

Müller, J W (2016), What is populism?, University of Pennsylvania Press.

Norris, P (2020), “Measuring populism worldwide”, Party Politics 26(6): 697–717.

Rode, M, and J Revuelta (2015), “The wild bunch! An empirical note on populism and economic institutions”, Economics of Governance 16(1): 73–96.

Stöckl, S, and M Rode (2021), “The price of populism: Financial market outcomes of populist electoral success”, Journal of Economic Behavior and Organization 189: 51–83.