While 5,000 economists called for the rapid development of carbon taxation in the US and in Europe,1 the public often opposes this climate policy (Carattini et al 2018, Klenert and Hepburn 2018). In France, the government abandoned its plan for an ambitious carbon tax trajectory following the protests of the ‘yellow vests’.2

Why do citizens often oppose carbon taxation? Two common explanations are that citizens refuse to bear the full costs of climate change mitigation for lack of altruism, or that they disagree with the way those costs are distributed. In a new paper (Douenne and Fabre 2022), we argue that a third mechanism may come into play — even when people are expected to benefit from carbon taxation, pessimistic beliefs about the effect of the policy could lead them to oppose it. It is not intuitive that people could benefit from carbon taxation. Actually, carbon taxation alone is generally regressive because poorer households spend on average a larger share of their income on polluting goods. Yet, since they spend less on these goods than richer households in absolute terms, it is sufficient to transfer the proceeds of the tax as a uniform transfer (a policy known as a carbon tax and dividend) to design a progressive policy and make a majority of people better-off (Pizer and Sexton 2019, Douenne 2020, Paoli and van der Ploeg 2021).

Pessimistic beliefs and public support for carbon taxation

We assess attitudes towards a carbon tax and dividend in France during the yellow vests movement. We created a survey administered over 3,000 respondents representative of the French population in February/March 2019. We presented to respondents a budget-neutral €50/tCO2 carbon tax and dividend policy, with information on the effect on energy prices (e.g. +€0.11 per litre of gasoline) and the transfer that each household would receive (€110/year for each adult). We find that people largely reject this proposal — only 10% of our survey respondents approve, while 70% do not accept the reform. This level of rejection is very high compared to what has been measured before or after the yellow vests movement, where about half of the population is found to accept an unspecified increase in the carbon tax (ADEME 2020). Thus, a first insight from our survey is that public opinion can be very volatile and strongly reacts to contemporary events.

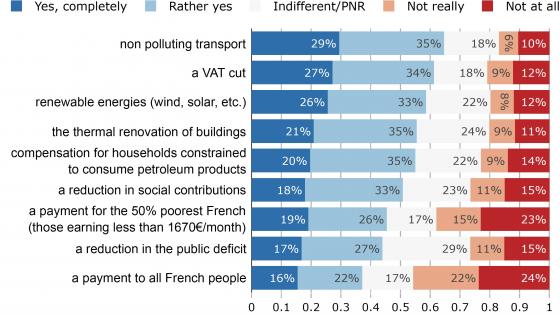

Figure 1 CDF of objective (dark blue) versus subjective (orange) net gains from our tax and dividend

Note: Dashed blue lines represent distributions of objective gains in the extreme case of totally inelastic expenditures. Vertical dotted orange lines show the limits of intervals answers of subjective gains.

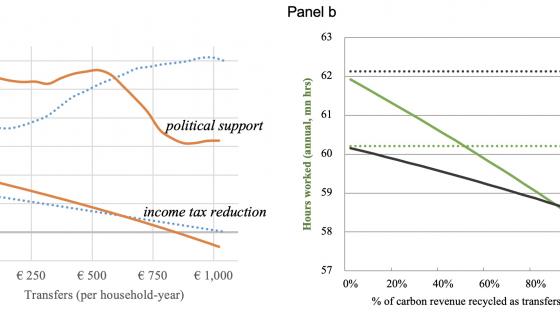

We then show that people hold pessimistic beliefs about the policy. Using household budget survey data, we estimate that 70% of households would benefit financially from the policy (see the solid blue line in Figure 1). In our own survey experiment, we ask respondents to estimate their expected gain or loss from the reform (we proceed step by step, asking separately for the impact on their heating and transport expenditures). Only 14% think that their household would benefit from the reform. This pessimism cannot be explained by an ignorance of price elasticities, as respondents correctly estimate them in another question, and the gap between perceived and actual net gains would still be too large if respondents assumed that their expenditures were inelastic. Similarly, respondents are pessimistic about the distributional and environmental effects of the policy. Only 20% believe that the policy would benefit poorer households and 17% think that the policy would be effective in reducing polluting and fighting climate change.

We also find that the more people are opposed to the policy, the more pessimistic they are, and that the causality between beliefs and opposition runs both ways. On the one hand, when provided with new information about the policy, people discard positive news but correctly process negative ones. This phenomenon is stronger for people who initially oppose the policy or who feel close to the yellow vests, which is consistent with the endogenous formation of beliefs through motivated reasoning. In other words, the less people like the policy, the less likely they are to assimilate positive information about it. On the other hand, our survey design enables us to show that beliefs also causally determine support for the policy. When convinced that they would gain financially, people’s likelihood of accepting the policy increases by 50 percentage points. Similarly, the likelihood of supporting it is 40 percentage points higher when people are convinced that the policy would effectively reduce emissions.

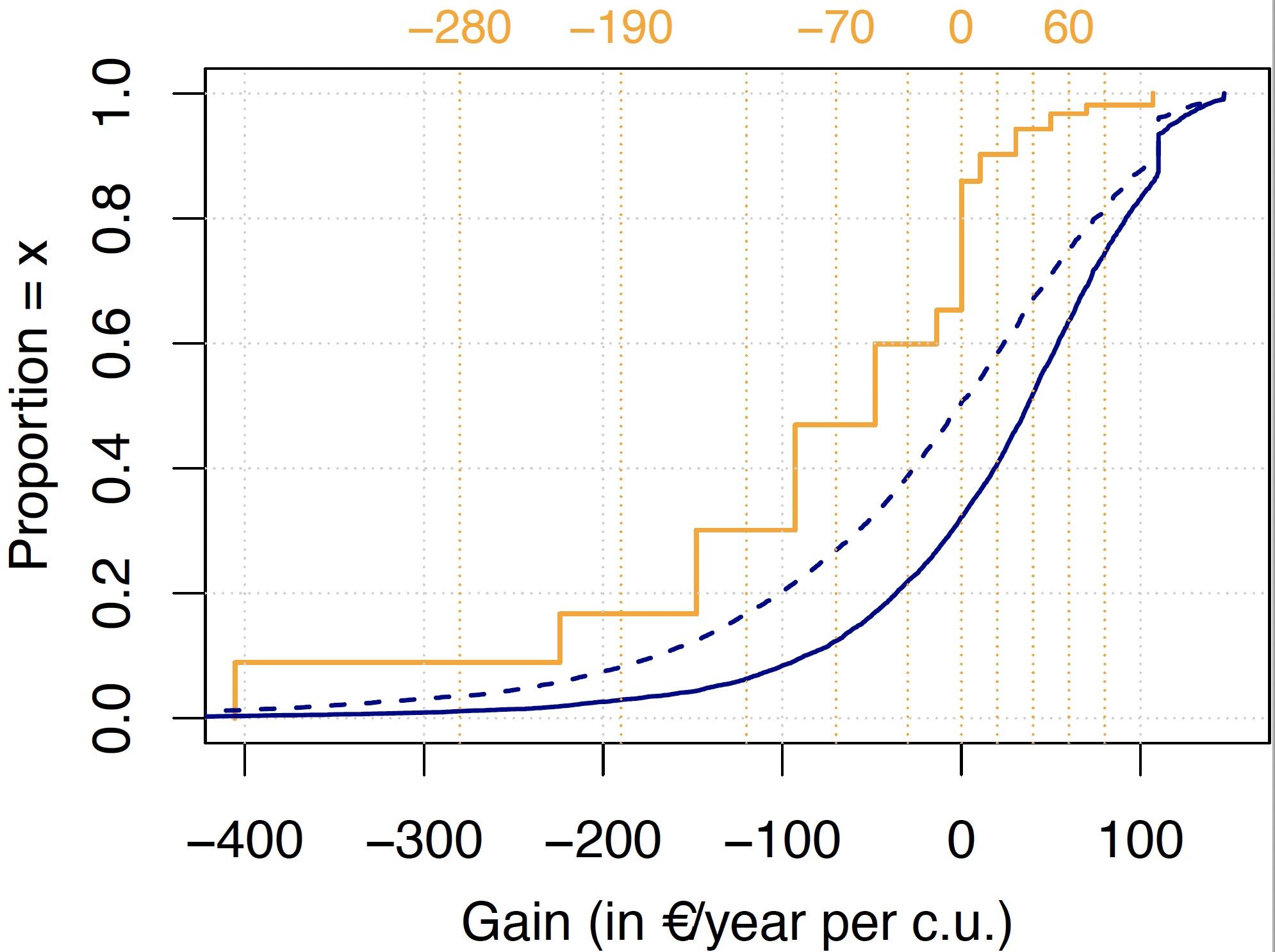

To obtain causal effects, beliefs about environmental effectiveness are instrumented by randomly providing (or not) information that there is a scientific consensus on the effectiveness of carbon taxation. Beliefs about one’s own gains are instrumented with two independent designs that both lead to very similar outcomes. Our preferred design uses variants of the main policy where the dividend is targeted at the bottom 20%, 30%, 40%, or 50% of the income distribution. Each respondent is randomly assigned a variant where he is either eligible for the dividend or not. For example, a respondent in the 35th. percentile of the income distribution has an equal chance of being assigned the reform targeted to the bottom 40% (where he is eligible) or 30% (not eligible). This random assignment creates an exogenous variation in the belief to win or lose from the tax and targeted dividend. Under the credible assumption that, conditional on income and controlling for the variant, eligibility affects acceptance only through the belief of one’s own gain, our fuzzy regression discontinuity design correctly identifies the causal effect of the belief that one loses on the acceptance of the reform. Figure 2 shows that acceptance of a given variant is indeed higher for those eligible to the dividend, i.e. on the left of the income eligibility thresholds.

Figure 2 Acceptance of a tax and targeted dividend in function of income (hence eligibility to the dividend) and of the variant’s target (one colour per variant)

Note: For example, acceptance rate is 43% for those eligible to the dividend in the reform targeted to the bottom 20%, while it falls at 36% for those who are not eligible.

The previous results can explain how widespread opposition can progressively build around carbon tax proposals. If opinions shape beliefs, that in turn determine opinions, people’s pessimism caused by previous (unfair) reforms could lead them to oppose new (fair) policies.

An agenda for ambitious climate policies

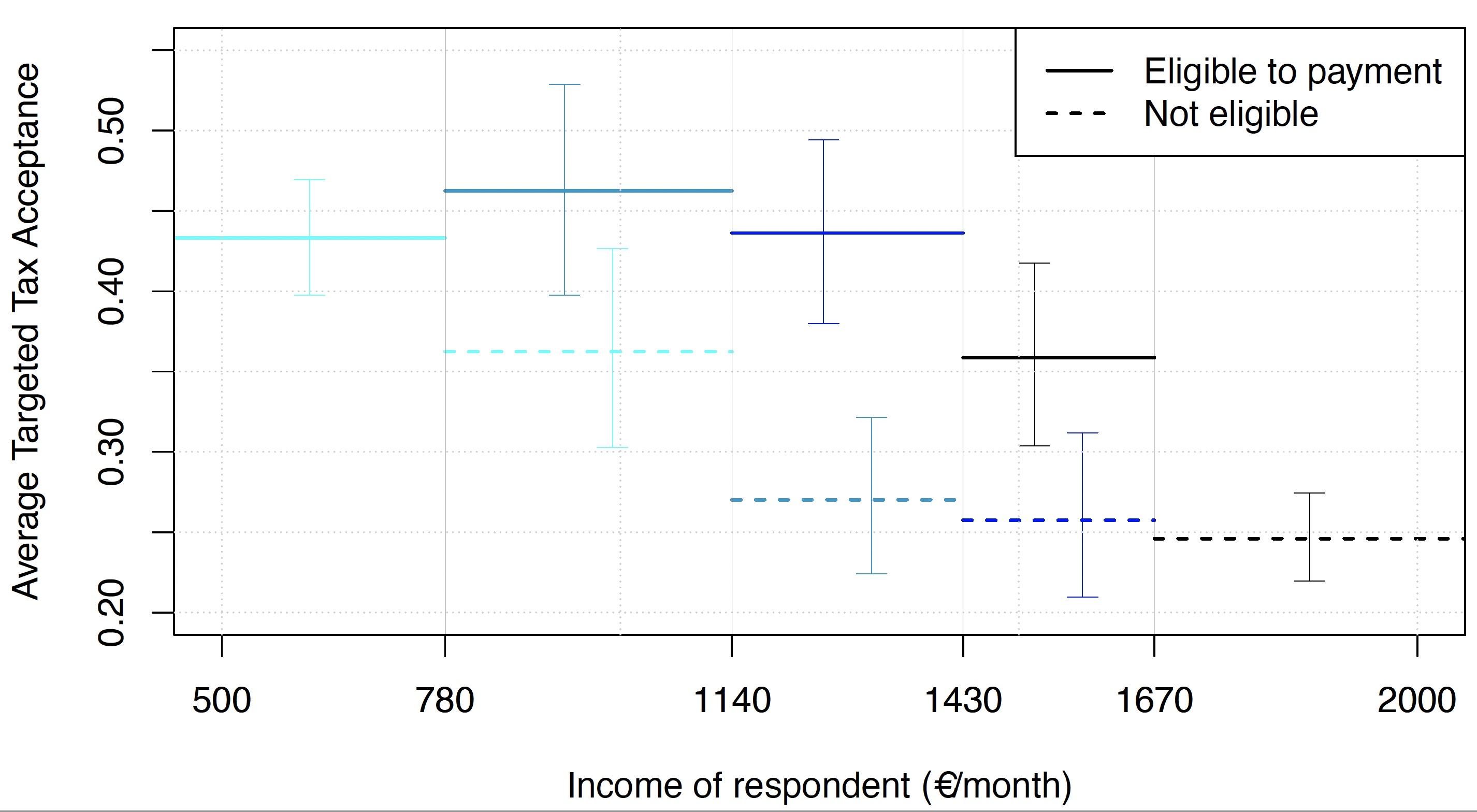

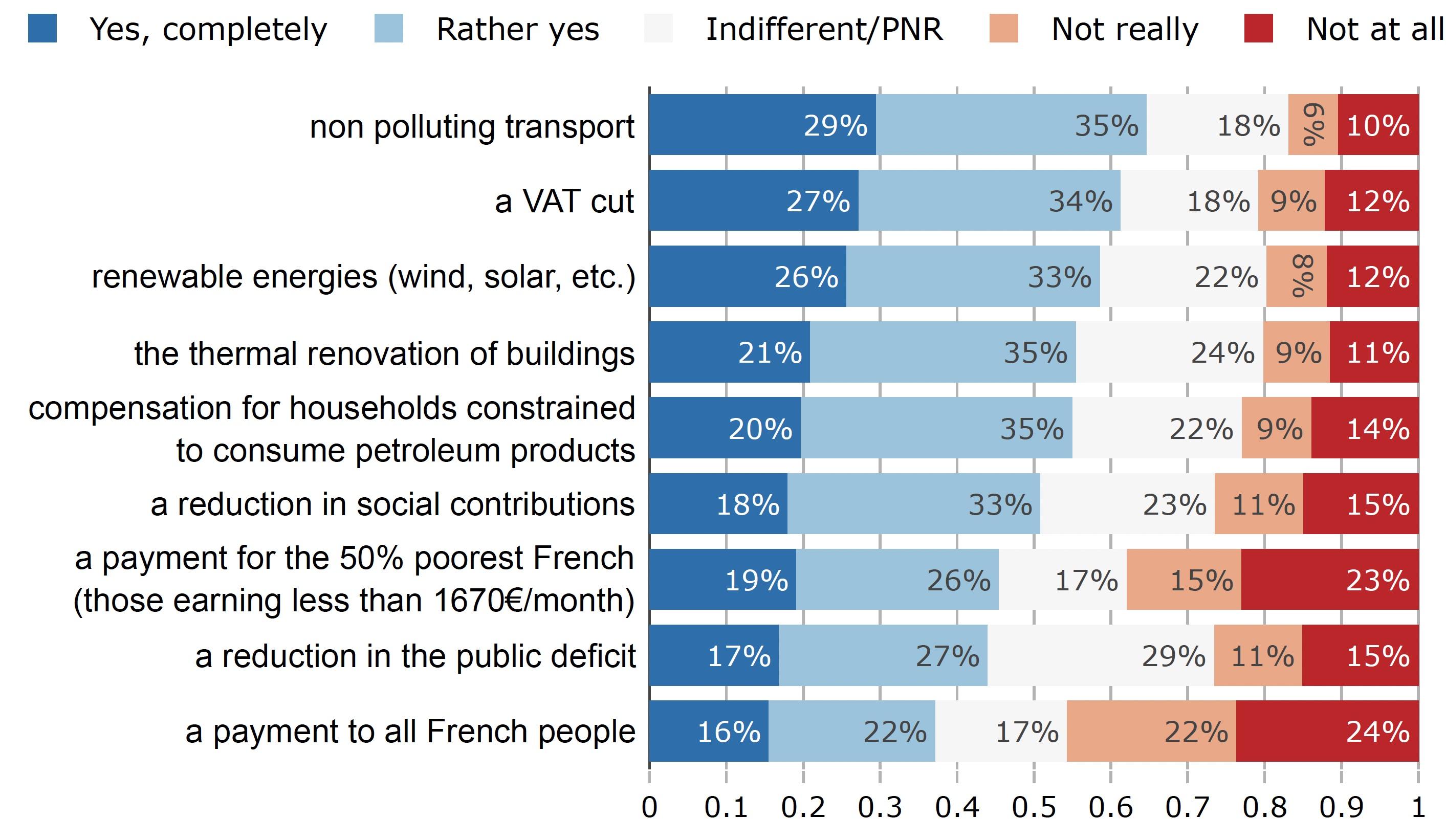

While many French people reject a carbon tax with dividend, the vast majority is concerned about climate change and supports other policies, as we show in a companion paper using the same survey data (Douenne and Fabre 2020). The main insights from this paper is that people favour measures that bring co-benefits (like reduced air pollution), prefer norms or subsidies to taxes, and strongly support public investments. A natural explanation for these preferences is that people favour policies whose costs are the least salient, even though they may be less cost-effective (Levinson 2018). Still, by providing alternatives to fossil fuels, these policies may also address critical obstacles to changing habits. Indeed, we find that a crucial obstacle to changing habits is the lack of alternatives to fossil fuels like public transportation. In line with the literature (e.g. Bergquist et al. 2020), we find that the progressivity of the policy package is also key for acceptance.

Figure 3 “Would you approve of an increase of the carbon tax if the revenues were used to...?”

These observations suggest the following path towards a successful decarbonisation in France and Europe. First and foremost, an information campaign could be launched to improve understanding about climate policies – which we find to be positively associated with the support for measures – and show that the European Green Deal addresses people’s fairness concerns. Second, the government could develop alternatives to fossil fuels through diverse policies: investments, subsidies, and regulations in favour of public transport, cleaner vehicles and thermal insulation, and so on (see Pisu et al. 2022 for an assessment of various policies). Last but not least, the extension of carbon pricing proposed by the European Commission should soon complement these policies, as people get convinced by the progressivity of a carbon price with dividend and by the EU's commitment to a fair decarbonisation.

References

ADEME (2020), “Représentations sociales du changement climatique: 21ème vague”.

Bergquist P, M Mildenberg, and L C Stokes (2020), “Combining climate, economic, and social policy builds public support for climate action in the US”, Environmental Research Letters 15(5)

Carattini S, M Carvalho, and S Fankhauser (2018), “Overcoming public resistance to carbon taxes”, Wiley Interdisciplinary Reviews: Climate Change 9(5).

Douenne T (2020), “The vertical and horizontal distributional effects of energy taxes : A case study of a French policy”, The Energy Journal 41(3).

Douenne T and A Fabre (2020), “French attitudes on climate change, carbon taxation and other climate policies”, Ecological Economics 169(C).

Douenne T and A Fabre (2022), “Yellow vests, pessimistic beliefs, and carbon tax aversion”, American Economic Journal: Economic Policy 14(1).

Klenert D and C Hepburn (2018), “Making carbon pricing work for citizens”, VoxEU.org, 31 July.

Levinson A (2018), “A carbon tax would be less regressive than energy efficiency standards”, VoxEU.org, 5 July.

Paoli, M C and R van der Ploeg (2021), “Recycling revenue to improve political feasibility of carbon pricing in the UK”, VoxEU.org, 4 October.

Pisu M, F M D’Arcangelo, I Levin, and A Johansson (2022), “A framework to decarbonise the economy”, VoxEU.org, 14 February.

Pizer, W and S Sexton (2019), “The distributional impacts of energy taxes”, Review of Environmental Economics and Policy 13(1).

Endnotes

1 In 2019, the Climate Leadership Council published a column signed by 3,354 American economists in the Wall Street Journal to support carbon taxation. A similar statement from the European Association of Environmental and Resource Economists was signed by 1,772 economists.

2 Initially introduced in 2014 at a level of 7€/tCO2, the French carbon tax had grown to 44.6€/tCO2 in 2018 and was supposed to further increase to reach 86.2€/tCO2 by 2022. This plan was abandoned in November 2018, following the large-scale protests of the Yellow Vests—at the time largely supported by the public opinion—in a context of high fuel prices.