Editors’ note: This column is part of the Vox debate on the economic consequences of war.

The havoc brought upon countries by violent warfare causes, next to immeasurable personal pain, heavy economic disruptions. Destruction of production sites, disrupted supply chains, and the displacement of people often provoke a sudden and durable rupture of economic activity. While we do not have much generalisable empirical evidence on the economic costs of international wars, which used to be a rare phenomenon in recent decades, the literature on civil wars coined the term ‘development in reverse’ to describe the often persistent, negative economic effects of sustained episodes of warfare (Collier et al. 2003).

Currently, we see such a development in reverse unfolding in Ukraine. Only weeks after Russian forces commenced their invasion of Ukraine, millions of people have left the country, and formerly prosperous towns lie in ruins (Skok and de Groot 2022). At the same time, the international community punishes Russia with sanctions of an unprecedented scale, which have the potential to hurt the Russian economy significantly and end decades of economic collaboration (Berner et al. 2022, Felbermayr et al. 2019). Nonetheless, an embargo on oil and gas imports from Russia has not yet been implemented despite intensive public discussion, as several large European countries fear the economic consequences of forfeiting these hard-to-substitute imports (Bachmann et al. 2022) . Looking at how the international economy coped with prior disruptions to economic exchange caused by violent warfare helps us form expectations about the economic future of Ukraine, Russia, and the sanctioning countries.

(How) do supply chains adopt to economic disruptions?

In a recent study, we investigate how international trade flows respond to unilateral economic shocks (Korn and Stemmler 2022). For this, we focus on national civil wars, which have been found to cause significant disruptions to countries’ production and export capabilities (Blattmann and Miguel 2010). Specifically, we ask whether and how importers adjust their trade flows if a civil war breaks out in one of their main trade partners (see Arezki 2022 on the international spillovers of the war in Ukraine). To answer this question empirically, we use bilateral trade data that include over 150 countries for the period 1995 to 2014.

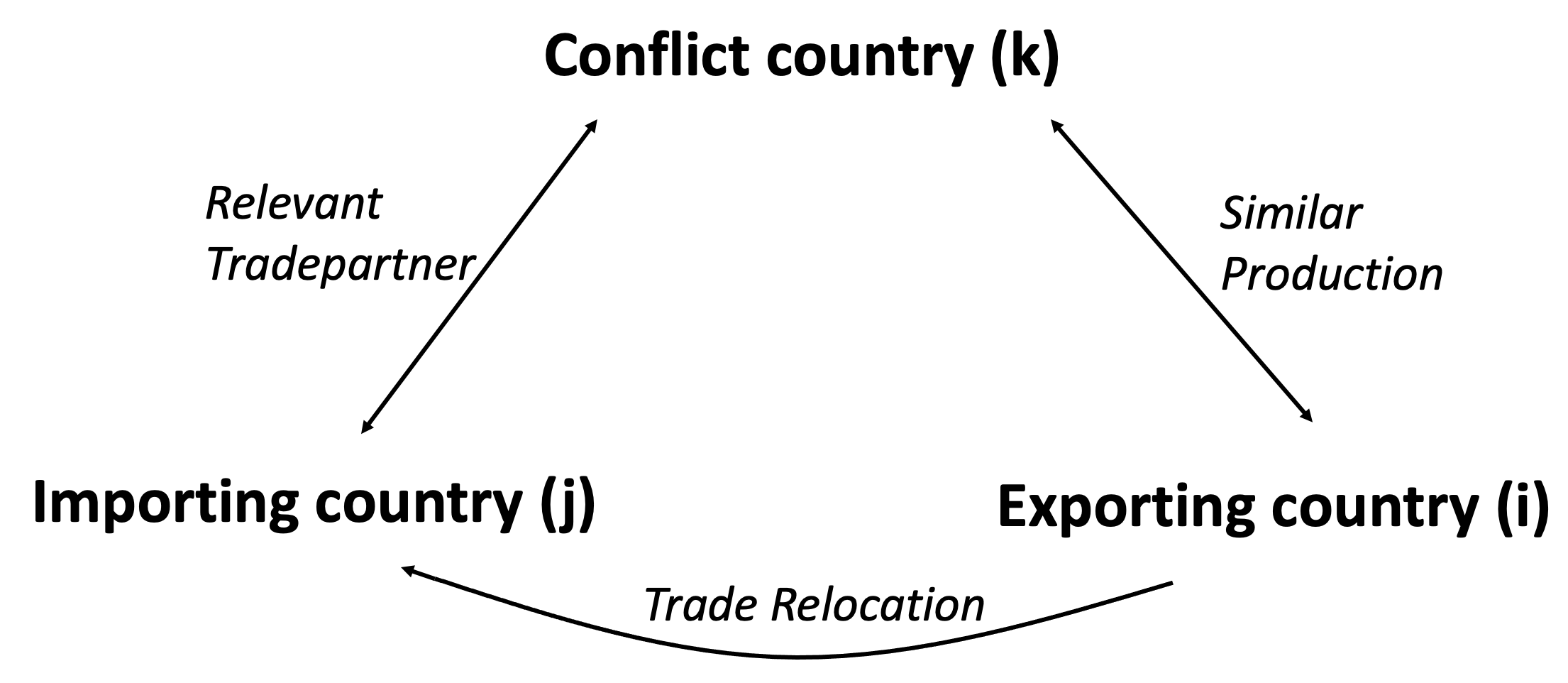

In this dataset, we first identify exporters that experience a civil war in a given year according to the civil war classification from the Uppsala Conflict Data Program (Sundberg and Melander 2013). Then, we code which trading dyads are most likely to be affected by trade relocation away from the conflict country. We base this coding on two characteristics, which we illustrate in Figure 1. First, we identify all countries for which the conflict country used to be a main trading partner (i.e. among the top seven exporters to this country).1 Second, we identify all countries that offer a variety of goods similar to the conflict country. Using various classification algorithms, we sort countries into clusters with similar production portfolios based on production volumes across 61 SITC product lines. We combine these relevance and similarity conditions to code which importer-exporter dyads are likely to experience trade relocation effects, as the importing country substitutes its demand away from the conflict country towards another exporter who offers a similar variety of goods. Finally, we investigate empirically whether trade values increase between these ‘relocation dyads’ in response to a civil war.

Figure 1 Illustration of trade relocation coding

Notes: This figure illustrates our coding of relocation propensity. For each conflict country k in a given year, we identify its main trading partners as well as all countries that provide a similar production portfolio. For each dyad ij where both conditions overlap, i.e. where the importer j is a relevant trading partner of conflict country k, and the exporter i produces similar products to conflict country k, we expect a trade relocation effect to materialise.

We find robust evidence that global supply chains adapt relatively quickly to economic disruptions from civil conflicts, but that this trade relocation effect exhibits a fair amount of heterogeneity. First, the reactions of supply chains in agricultural goods and the mining sector are exceptionally strong. On average, trade volumes between such ‘relocation dyads’ increase by 12% and 13%, respectively, already one year after the start of a civil war. In the manufacturing sector, trade values increase by 7% on average, and only if conflicts last for several years. Hence, manufacturing supply chains seem to be more hesitant to relocate compared to imports of primary goods. Interestingly, we find no evidence of supply chain adjustments in the fuels sector. If anything, importers cut back on fuel imports from alternative trading partners to maintain their current fuel imports of their main exporting partner who is now at conflict. This is a reaction we see again today, where countries highly dependent on Russian oil and gas struggle to scale back on these imports, even though they support various other sanctions. Our findings further add to the recent discussion in Kwon et al. (2022), who find evidence that sanctioning countries substitute for exports from third, non-sanctioned countries. If our results apply similarly to the economic effects of sanctions, and in light of the current debate on oil and gas embargos against Russia, we would not expect to find such a substitution effect for trade in fuels.

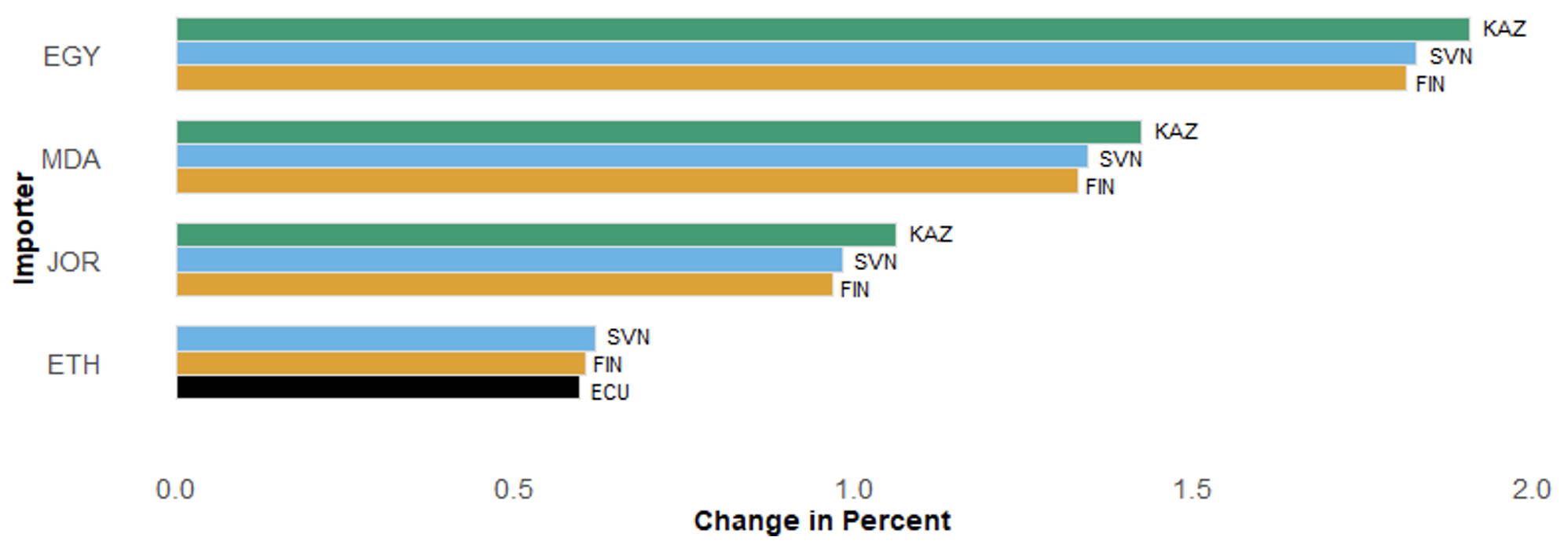

Figure 2 Trade relocation after Ukraine’s civil war

Notes: This figure reports the changes in bilateral trade values in 2015 compared to a hypothetical counterfactual world where the 2014 civil war in Ukraine never took place. On the y-axis, we report the four importers that reported the largest trade relocation effects in response to Ukraine’s civil war (Egypt, Moldova, Jordan, and Ethiopia). For each of these importers, we provide three bars, which indicate the size of the relative trade increase for the three main substitution partners (Kazakhstan, Slovenia, Finland, and Ecuador).

What do our findings imply for Ukraine’s global supply chains? Here, we can draw on case study evidence from Russia’s annexation of Crimea and the subsequent civil war that erupted in Ukraine’s Donbas region. Applying a similar structural gravity-general equilibrium estimation technique as in Kwon et al. (2022), we estimate the reduction in Ukraine’s exports following the outbreak of the civil war in 2014. We then use this estimate to compute hypothetical trade patterns and welfare levels of countries worldwide if this conflict would never have happened. Comparing actual to hypothetical trade flows and welfare levels, we get an idea of how this conflict affected the global economy. While we can hardly compare the scale of violence during the civil war to today’s situation, the qualitative tendencies are likely to be similar. We find that several dyads increase their bilateral shipments in response to the civil war. The countries most affected by the disruption of imports were Egypt, Moldova, Jordan, and Ethiopia. For most of them, Kazakhstan, Slovenia, and Finland resembled the main substitution partners, as they increased their imports from these countries by up to 2% in response to the civil war. Looking at welfare changes, however, we find that all countries are left worse off compared to the counterfactual where the civil war did not take place. While it is not surprising that Ukraine itself suffered the most, even those countries that benefit from trade relocation (e.g. Kazakhstan and Slovenia) become worse off overall from the civil war, as the increases in export demand do not compensate the loss relating to trade opportunities with Ukraine.

The future of the global economy

We conclude this column by looking ahead. How can the Ukrainian and Russian economies recover from the war once the violence ends and the sanctions are lifted? As far as international trade is concerned, it highly depends on how long the war and sanctions will go on, and on how the rest of the world reacts. In our study, we estimate how trade relationships behave after a civil war ends. Here, we find that the trade relocation effects we estimate during a civil war remain of almost the same magnitude up to nine years after a civil war ended. Our 20-year sample unfortunately does not allow us to look for much longer periods. Especially in the manufacturing sector, the relocation effects robustly remain unchanged after peace is established. That is, whereas manufacturing supply chains tend to remain intact during shorter periods of violence, they also stay relocated once a substitution took place. As a possible explanation of this persistence, we provide evidence that (sustained) periods of violence and the resulting trade relocation effects increase the likelihood that the substituting importers persistently decrease the bilateral trade costs with their substitution partners by signing Preferential Trade Agreements with them. Hence, relocation persists because the world economy reaches a new equilibrium, in which the (former) conflict countries’ relative trade costs have increased compared to the pre-war situation.

This has implications should the war in Ukraine continue for so long that the relocation of supply chains and the subsequent conclusion of new international cooperation agreements cement a new structure of the world economy. In that situation, our analysis suggests that both Ukraine and Russia would find it hard to recover their international economic standing from before the conflict (Chepeliev et al. 2022). The recent visit of Germany’s Secretary of Economic Affairs to Qatar and negotiations on better trade relationships may be one of the first steps in this direction. Nevertheless, current considerations to foster economic and political relations with Ukraine, and even to initiate the process of Ukraine joining the EU, can be a valid measure to counteract the loss in trade access brought upon them by Russia’s declaration of war.

References

Arezki, R (2022), “War in Ukraine, impact in Africa. The effect of soaring energy and food prices”, Video Vox, 17 March. s

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Löschel, B Moll, A Peichl, K Pittel and M Schularick (2022), “What if Germany is cut off from Russian energy?”, VoxEU.org, 25 March.

Berner, R, S Cecchetti and K Schoenholtz (2022), “Russian sanctions: Some questions and answers”, VoxEU.org, 21 March.

Blattman, C and E Miguel (2010), “Civil War”, Journal of Economic Literature 48: 3-57.

Chepeliev, M, T Hertel and D van der Mensbrugghe (2022), “Cutting Russia’s fossil fuel exports: Short-term pain for long-term gain”, VoxEU.org, 9 March.

Collier, P, H Hegre, A Hoeffler, M Reynal-Querol and N Sambanis (2003), “Breaking the Conflict Trap: Civil War and Development Policy”, World Bank Publications.

Felbermayr, G, C Syropoulos, E Yalcin and Y Yotov (2019), “On the Effects of Sanctions on Trade and Welfare: New Evidence Based on Structural Gravity and a New Database”, LeBow College of Business Working Paper Series, Drexel University.

Korn, T and H Stemmler (2022), “Your Pain, My Gain? Estimating the Trade Relocation Effects from Civil Conflict”, Hannover Economic Papers.

Kwon, O, C Syropoulos and Y Yotov (2022), “Extraterritorial sanctions. A stick and a carrot”, VoxEU.org, 4 March.

Skok, Y and O de Groot (2022), “War in Ukraine: The financial defence”, VoxEU.org, 17 March.

Sundberg, R and E Melander (2013), “Introducing the UCDP Georeferenced Event Dataset”, Journal of Peace Research 50: 523-532.

Endnotes

1 On average, the top seven exporters are responsible for the first quartile of a country’s overall imports.