Editor’s note: a preliminary version of this column was previously posted by mistake; this is the correct version. An addendum was added on 12 April to clarify points of agreement as well as disagreement with Svensson.

In the period 2005-2007, house prices in a number of countries such as the US, Ireland, and Spain became seriously overvalued. Their subsequent fall contributed to the financial crisis and recession that followed. Macroprudential authorities around the world have since focused on such overvaluations as one source of financial instability, though they typically track a comprehensive dashboard of risk factors, for example as published quarterly by the European Systemic Risk Board (ESRB). A tendency towards overvaluation would be a signal to tighten macroprudential policies such as limits on loan-to-value or debt service-to-income ratios, or higher capital requirements on lenders.

Svensson (2023, 2024) is rightly critical of reliance on the house price-to-income ratio as a measure of over-valuation, though the ESRB, for example, uses four different indicators. Instead of being over-valued, Svensson argues that house prices in Sweden have been, and continue to be, seriously undervalued. The gist of his argument is that housing in Sweden has become more affordable as measured by the ‘user cost-to-income’ (UCTI) ratio. This is a measure of housing affordability defined by multiplying the house price to income ratio by the following expression: the after-tax real interest rate plus a risk premium and a depreciation rate plus the ratio to the average value of a house of the cash costs of running a home – the property tax, repairs, maintenance and insurance.

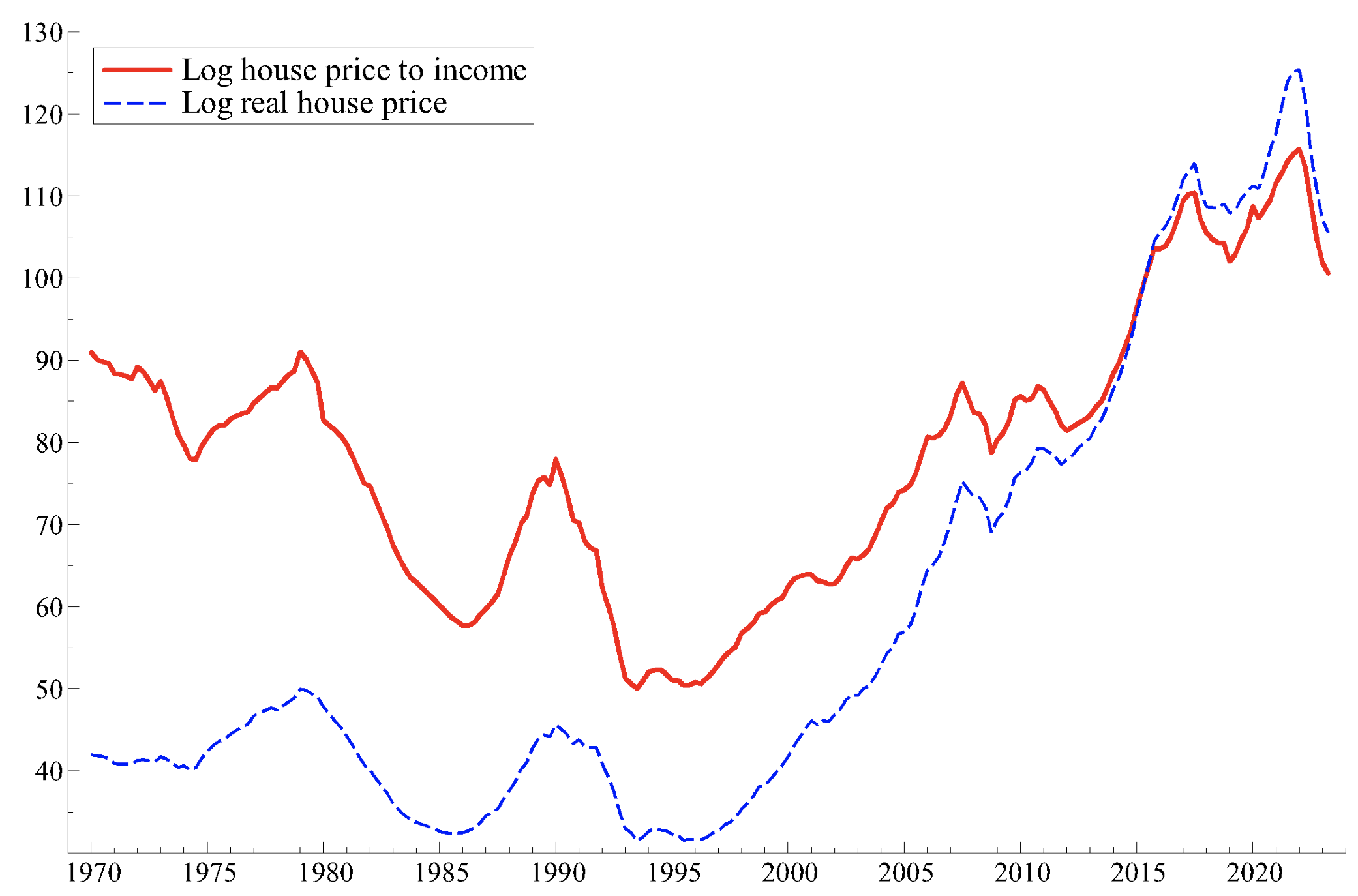

Repayments of principal are excluded and the real interest rate uses the expected CPI inflation rate over the next five years. This measure has fallen since 2010, at least to early 2022, with the decline in interest rates, and also a reduction in the cash costs of running a home relative to the values of homes. As a consequence, Svensson concludes that housing cannot be overvalued, and so the price-to-income (PTI) ratio (apparently showing such overvaluation) must be misleading. For context, Figure 1 shows the house price-to-income ratio and the real house price index (both in logs). Svensson says: “For Sweden, the UCTI and PTI indicators are in fact strongly negatively correlated and have opposite signs. If the UCTI indicator is right, the PTI indicator is consistently wrong” (Svensson (2023), Abstract, Paragraph 3). On this basis, he argues that Swedish house prices became increasingly undervalued, reaching a peak of undervaluation of 30% in 2019. Even with recent falls in Swedish house prices and higher interest rates, he argues that house prices in 2023Q2 were still undervalued by around 20%.

Our key point is that yes, the PTI indicator is consistently wrong, but not because the UCTI indicator is right. Neither captures the fundamental drivers of house prices. Moreover, the UCTI is NOT the only indicator of housing affordability.

Figure 1 The house price-to-income ratio and real house prices in Sweden (2015=100)

Source: OECD.

A cash-flow concept of affordability

For many people, especially first-time buyers, who usually account for around half of transactions, the most important consideration is cash-flow affordability. And a very important part of cash-flow is the repayment of mortgage principal, as well as the mortgage interest rate and expenditures on property tax, repairs, maintenance and insurance. Typical mortgage contracts with amortisation envisage a steady nominal debt-service charge over the lifetime of the mortgage. The effective interest rate (see Kearl, 1979, equation 8 for the standard formula for the per-period cost of an instalment loan) in Sweden, including repayment of principal, fell far less than the nominal or real mortgage interest rate as interest rates have come down. Moreover, as house prices have risen relative to income, a first-time buyer at the ceiling of the permitted loan-to-value ratio, which in Sweden has been at 85 percent since 2010, has had to take on a lot more debt relative to income. This has meant that cash-flow affordability relative to income has become substantially worse since 2010, even though other cash-flow costs have risen less than house prices to early 2022. On this measure, and in contrast to Svensson’s UCTI, housing in Sweden for first-time buyers has become less affordable.

User cost and expectations of appreciation

Svensson assumes that expected house prices adjust in line with the expected index of consumer prices,

so that real capital gains are always expected to be zero. Thus, he writes (p. 14), that “[u]nder the conservative assumption that the expected real after-tax capital gains are zero, the expression for the UCC simplifies …. This assumption is conservative in the sense that it is biased towards lower capital gains and higher user costs.”

To assume that house price expectations are the same as consumer price expectations makes little sense. There is a great deal of evidence for an extrapolative element in expectations of capital gains in housing, though its size differs across countries.

Defining user costs with extrapolative expectations results, for example, in very low user costs in the US in 2005 just at the height of the property bubble, fuelled by laxer credit standards, income growth, and lower mortgage rates. Soon afterwards, as house prices turned down, user costs rocketed upwards, exacerbating the downturn. Indeed, low housing finance costs incorporating realistic expectations are often a better indicator of overvaluation than of undervaluation! This is because they embody an important house price over-shooting mechanism: in a sustained housing market upswing, many participants are still extrapolating past appreciation when fundamentals and negative shocks have turned against the market.

The example of the US

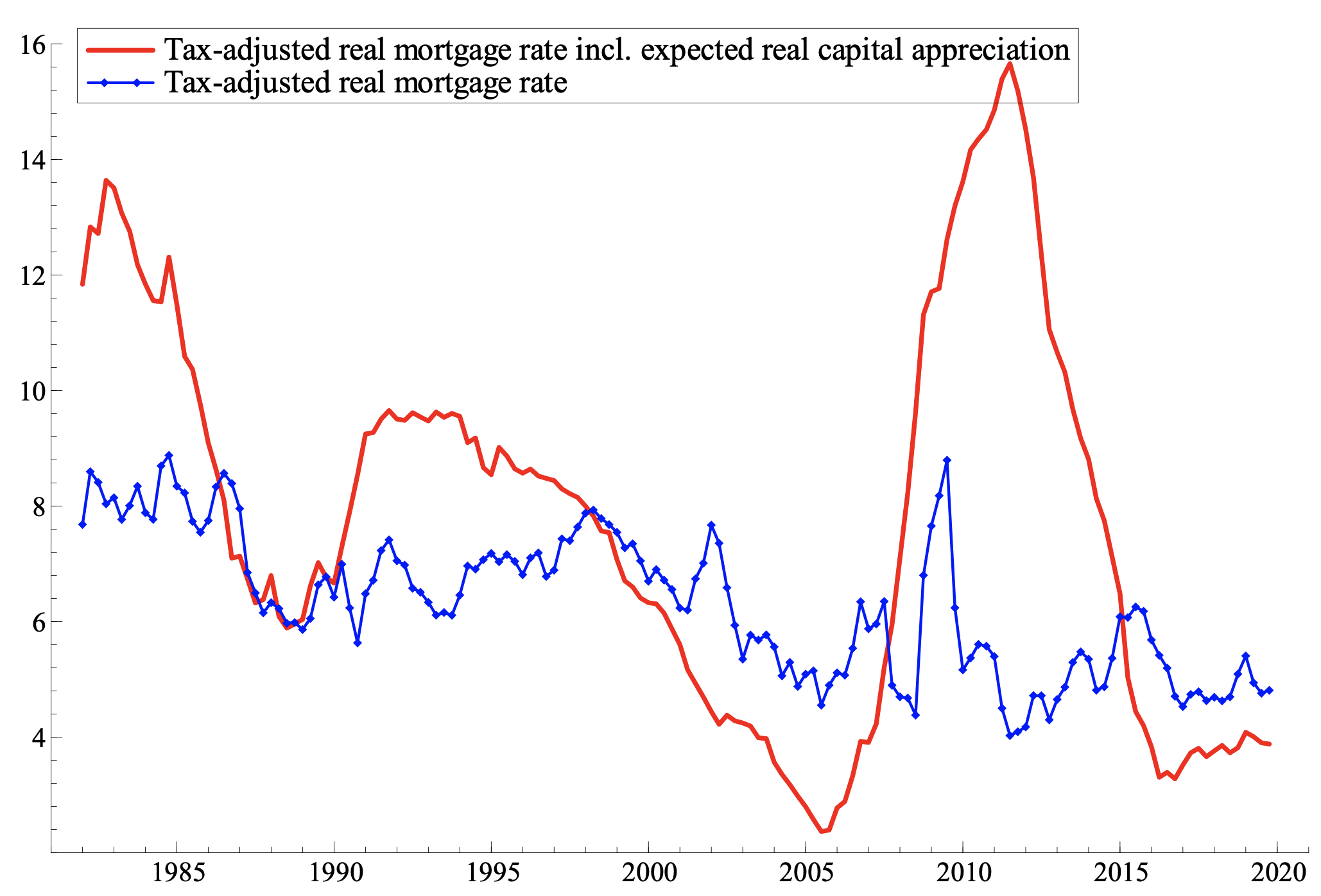

Svensson’s preferred measure of the interest rate component of user cost is the real mortgage rate defined by subtracting expected consumer price inflation from the nominal mortgage rate, adjusted for tax. He argues that expected consumer price inflation is a good proxy for expected house price appreciation, implying that real expected house price appreciation is zero. Figure 2 compares, for the US, the adjusted real mortgage interest rate using the expected annual inflation rate for the next five years, with the alternative that subtracts from this the average annual real house price appreciation for the previous four years.

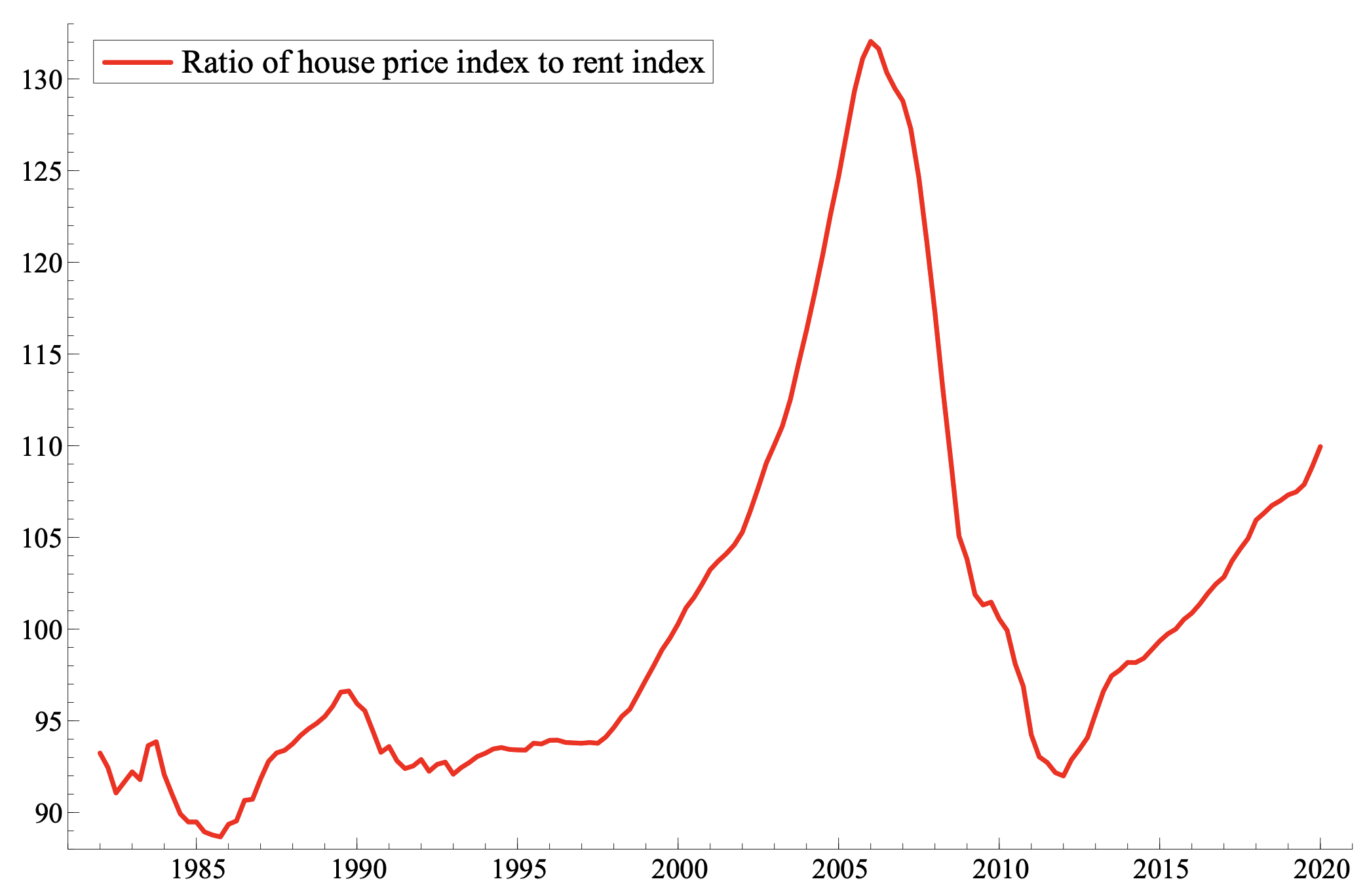

Figure 3 contrasts these with a graph of the US house price-to-rent ratio. It is clear that the 2005 trough in the real mortgage rate that includes the realistic house price expectations element is strongly associated with the peak in the house price-to-rent ratio. The figure illustrates the subsequent surge in the finance element of user cost, associated with the sharp fall in the house price-to-rent ratio. The measure of the finance component of user cost preferred by Svensson shows a much more moderate decline from the mid-1990s to 2005 with little warning of the overshoot or of the subsequent correction. It then declined further while house prices continued to fall.

Figure 2 Tax-adjusted real mortgage interest rate for the US with and without expected real capital gains

Note: See note 4 for details

Source: As in Duca et al. (2016)

Figure 3 The ratio of US house prices to rents (2015=100)

We certainly accept that Sweden is quite different from the US, with relatively stringent bank supervision and little sign of sub-prime exuberance in mortgage lending in the last 30 years. Moreover, the prudential authority has been quite cautious since the Global Financial Crisis. In 2010, it imposed a ceiling of 85% on the loan-to-value ratio for new mortgages, reducing household leverage. And in 2016 and 2018 it tightened amortisation rules, ensuring that riskier mortgage borrowers were required to repay at least a minimum amount of their loan every year. Indeed, since the early 1990s, the average real house price appreciation rate in Sweden over the previous three or four years had fairly moderate peaks under 10% per annum even in 2007 and under 8% in 2017. By the end of 2019, these rates were below 2.5%. This would be consistent with only very moderate levels of over-shooting of house prices in 2019, if expectations of housing market participants in Sweden were generated this way.

Svensson (2024) cites some sparse private sector survey data on expected house price appreciation, consistent with quite moderate levels.

A flexible method of estimating over- or undervaluation

Most economists would accept that house prices are driven by dynamic adjustment around fundamentals, so that over and undervaluation can occur while adjustment proceeds.

The inverse demand framework, where a housing demand equation is inverted, given the lagged supply of housing, is the most widely accepted framework for determining house prices in the long-run.

Fundamentals, in the inverse demand framework, include at least a real interest rate and income on the demand side and the lagged housing stock on the supply side. For the same reason that economists argue that permanent income should be one of the drivers of consumption, expected income growth could well be relevant too. And in the context of adjustable mortgage rates, as in Sweden, Kearl (1979) argued for the relevance of the nominal mortgage rate as reflected in the cash-flow measure of housing affordability discussed above. However, shifting loan standards are often omitted from demand drivers. Be that as it may, it is obvious that the user cost-to-income ratio, however defined, is not the sole fundamental driving house prices. It cannot, therefore, be the sole arbiter of where to position the estimate of the fundamental long-term level of real house prices.

Various papers (e.g. Duca et al. 2016) embedded past appreciation in user cost, tested for the most relevant memory length and included controls for loan standards. In Chauvin and Muellbauer (2018), loan standards are picked up as a latent variable in a system of equations and found to greatly improve forecasts of NPL ratios one and two years ahead.

Many other researchers do not embed lagged house price appreciation in user cost (e.g. Anundsen 2021) and instead follow the category of models discussed by Abraham and Hendershott (1996). A simple partial adjustment model implies, given lagged adjustment, overvaluation when fundamentals worsen and the opposite for undervaluation. Abraham and Hendershott (1996) make the crucial observation that including lagged changes in house prices in the model, one can have overshooting after a series of positive shocks, pushing prices above fundamentals – the ‘bubble builder’. When the fundamentals worsen, one can get a ‘bubble burster’, as the correction of the previous overvaluation gathers speed with falls in house prices adding to downward momentum. The empirical questions then concern the specification of the fundamentals and the specification and estimation of the lagged house price growth effects. An important conclusion about econometric models for evidence on potential overvaluation drawn in Muellbauer (2022: 207) is to model jointly house prices and mortgage debt to extract shifts in loan standards common to both.

Swedish house prices could have been judged undervalued in 2019 on data available at the time if the empirical model finds small effects from past appreciation and if recent shifts in fundamentals were positive. A simple, indeed simple-minded, way of judging ex post whether real house prices were overvalued at time t is to see whether they fell afterwards. Unfortunately, for this simple test, the COVID pandemic arrived early in 2020 and, as Svensson argues, shifted preferences: many people began to work at home, increasing the demand for space and driving up the equilibrium level of real house price indices, in which land prices are the major determinant. Had the fundamentals not shifted with the pandemic, it is unclear whether at the end of 2019 prices were under-or overvalued without estimating a well-specified model. Given that shift, they were likely under-valued.

The same simple-minded test for the end of 2021, once the COVID crisis had largely been contained by vaccination, suggests that prices were then over-valued in the context of the shift in fundamentals that occurred in 2022. Real house prices in Sweden have fallen by around 15% (see Figure 1). This should be no surprise, given the rise in nominal interest rates and the impact of high inflation, mainly induced by Russia’s invasion of Ukraine, on real incomes. It does make rather surprising Svensson’s claim that real house prices continued to be undervalued - by around 20%. His claim would need a story about the fundamental level of nominal interest rates returning to end-2021 levels and a strong recovery of income, together with some assumptions about a further long-term impact on house prices of changed working from home patterns. It would also require the cash-flow measure of housing affordability discussed above to have little empirical relevance in Sweden. While not impossible, Svensson’s claim seems to us quite improbable.

Conclusion

In this column, we emphasise that both user cost and the price of any long-lived asset are affected by expectations about the future trend of the price of that asset. To complement and check on econometric estimates of such expectations, whatever methodology is followed, it is advisable to undertake regular surveys of such expectations (see Shiller and Thompson 2022, who confirm that house price expectations in the US in the 2000-2005 period were remarkably optimistic). The paradox is that low levels of user costs that include expected appreciation based on extrapolation of recent trends, while suggesting that housing is currently very affordable, are often a signal of the fragility of such an assessment. Moreover, because housing, unlike purely financial assets, is also a central consumption item, its cash-flow affordability is, for many credit-constrained households, of crucial importance, even if user costs look low.

References

Abraham, J M and P H Hendershott (1996), “Bubbles in Metropolitan Housing Markets”, Journal of Housing Research 7(2): 191–207.

Adrian, T (2017), “Macroprudential Policy and Financial Vulnerabilities”, speech to the European Systemic Risk Board Annual Conference, European Central Bank, Frankfurt.

Anundsen, A K (2021), “House price bubbles in Nordic countries?”, Nordic Economic Policy Review, 13-34.

Chauvin, V and J Muellbauer (2018), “Consumption, household portfolios and the housing market in France”, Economics and Statistics 58: 157–178.

Duca, J, J Muellbauer and A Murphy (2011), “House Prices and Credit Constraints: Making Sense of the US Experience”, Economic Journal 121(552): 533-551,

Duca, J, J Muellbauer and A Murphy (2016), “How Mortgage Finance Reform Could Affect Housing”, American Economic Review 106(5): 620-24.

Duca, J, J Muellbauer and A Murphy (2021a), “What Drives House Price Cycles? International Experience and Policy Issues", Journal of Economic Literature 59(3): 773-864.

Duca, J, J Muellbauer and A Murphy (2021b), “What drives house prices: Lessons from the literature”, VoxEU.org, 13 September.

Iacoviello, M and S Neri (2010), “Housing Market Spillovers: Evidence from an Estimated DSGE Model", American Economic Journal: Macroeconomics 2(2): 125-64.

Kearl, J R (1979), “Inflation, Mortgages, and Housing”, Journal of Political Economy 87(5): 1115-38.

Muellbauer, J 2022), “Real estate booms and busts: implications for monetary and macroprudential policy in Europe”, 142-244, in Challenges for monetary policy in a rapidly changing world, ECB Forum Conference Proceedings.

Shiller, R J and A K Thompson, (2022), “What Have They Been Thinking? Home Buyer Behavior in Hot and Cold Markets: A Ten-Year Retrospect," Brookings Papers on Economic Activity 53(1):307-366.

Svensson, L E O (2023), “Are Swedish House Prices Too High? Why the Price-To-Income Ratio is a Misleading Indicator”, NBER Working Paper 31862. (latest version here).

Addendum

To avoid misleading readers, we should say that we are in agreement on many points in Lars Svensson’s paper, including the latest March revision and his VoxEU column. Svensson states quite plainly that his UCTI indicator of housing over or undervaluation “is not a precise theory of how house prices depend on all the relevant fundamentals, and how house prices may change when those fundamentals change. Such a theory needs to take into account the supply of housing, the liquidity and credit constraints facing households, the role of housing cash payments for liquidity-constrained households as distinct from user costs, and other frictions and imperfections in the housing and mortgage markets.” We share this point of view exactly.

As our column makes plain, we share his criticism of excessive reliance by macroprudential authorities on the deviations from long historical averages of the house price to income as an indicator of overvaluation. We also admire the care Svensson has taken to improve on previous measures of the financial cost component of user cost by including more accurate measures of the costs of running a home, such as insurance and maintenance, which are often not proportionate to the market value of a home, see our first footnote.

His working papers show that he is well aware of other indicators of housing affordability, including indicators on the OECD’s Housing Affordability Database. In recent presentations, the OECD have used (private correspondence) what they call the ‘annuity to income ratio’ to focus on the problem of increasing housing affordability and the role of the jump in nominal mortgage rates. For comparisons over time, this is the same as the cash-flow concept of affordability explained in our column, but without the inclusion of cash costs of maintenance and insurance.

His discussion of cash-flow constraints for first-time buyers in Sweden in Svensson (2020) indicates his awareness of the issue. We welcome the statement in his VoxEU column: “I see no problem but an advantage with having several indicators and models of overvaluation. Ideally, they should be ranked according to their reliability and usability.”

Svensson is quite cautious on the usefulness of estimates of overvaluation based on house price models and rightly complains about the lack of transparent documentation by macroprudential authorities on these models. In the March revision of his article, he points to a remarkable instability of estimates for Sweden. Indeed, many of the models apparently used by the ECB, ESRB and European Commission appear to be quite badly specified, even on the basic idea of incorporating the demand-supply principle. This is because they use recent residential investment as a supply indicator, rather than the housing stock. This often has the ‘wrong’ sign in empirical estimates, as investment responds positively to recently higher house prices. Moreover, these models apparently make no attempt to control for shifts in credit conditions or loan standards. This is why we recommend a two-equation approach for house prices and mortgage debt in which common dummies or ‘latent variables’, informed by institutional knowledge of regulatory shifts and microdata, if available, control for shifting loan standards.

Future work on such models should also incorporate insights from the valuable work Svensson has done on measuring user costs. The contribution of his measure, and variations on it, to the explanation of variations in house prices, alongside the cash-flow cost, the housing stock relative to income, shifting loan standards and appropriate lags in past house price dynamics then becomes an empirical question. As our column emphasises, the degree to which such dynamics are consistent with extrapolation of past appreciation will vary across countries. The four-year memory supported by US evidence, is less strongly supported for France, with a larger weight on recent appreciation, and extrapolative expectations contribute rather less than in the US to the overall fluctuations in house prices, Chauvin and Muellbauer (2018). Sweden is probably different again.

Since there are so many points of agreement, we end by explaining the issue on which we fundamentally disagree. He says “the simple user-cost approach applied here is appropriate for assessing whether a given combination of current and past house prices, user costs of capital, disposable incomes, and rents indicate that owner-occupied housing is overvalued or undervalued—in which case over- or undervaluation is measured in terms of the cost of living in owner-occupied housing relative to disposable incomes and to rents.” We argue that a single indicator is not appropriate and favour better model-based estimates, also to be used to explore different risk scenarios.

References

Svensson, Lars E O (2020), “Macroprudential Policy and Household Debt: What is Wrong with Swedish Macroprudential Policy?” Nordic Economic Policy Review 2020, 111–167.

Svensson, L E O (2024) “Are Swedish house prices too high?”, VoxEU.org, 29 March.

Svensson, L E O (2024), “Are Swedish House Prices Too High? Why the Price-to-Income Ratio is a Misleading Indicator,” working paper, Stockholm School of Economics, (March revision of Svensson 2023).