While politicians are nowadays focused on a revival of industrial policies, often with the side effect of a growing trend in protectionist interventions, economists tend to follow the money and are excited about the potential offered by trade in services, as the most dynamic engine of the ‘new globalisation’. Richard Baldwin, for instance, argues that services are not only the future of globalisation but also a more promising path for developing countries interested in export-led growth than old-fashioned industrialisation (Baldwin et al. 2024). The Economist recently ran an article also exploring the development potential of services sectors (The Economist 2024). So far, the focus of political attention and economic evidence do not always dovetail well. The relative neglect of services in policy debates is not that new; in the past, services used to be called ‘non-tradables’.

Services: From ‘non-tradables’ to the biggest traded sector

Despite their relative neglect, services were always key to globalisation. In fact, it is hard to imagine our world without services trade. We tend to ignore the crucial importance of maritime transport services, one of the earliest manifestations of globalisation. Exporting and importing knowledge-based services took place since the 12th century when English scholars were studying at Sorbonne University in Paris.

Nowadays, global trade in services is governed by a comprehensive set of trade rules affecting the nature and the modalities in which companies engage in trade in services across borders. The fundamental logic of services trade rules relies on the so-called ‘modes of supply’, the idea being that the same type of service can be supplied internationally under different modes. The General Agreement on Trade in Services (GATS), and pretty much all the existing bilateral free trade agreements (FTAs), define four modes of supply for services trade:

- Mode 1: Cross-border supply. This mode typically covers digital services trade and international transport (shipping, air transport).

- Mode 2: Consumption abroad. This mode of supply primarily captures international tourism activities.

- Mode 3: Commercial presence. Under this mode, companies establish a physical presence abroad, such as an office or subsidiary, to deliver services to foreign customers.

- Mode 4: Temporary movement of natural persons. This mode refers to the temporary movement of service suppliers, or natural persons, into a foreign country to deliver a specific service. Companies utilise this mode by sending their workers abroad to perform and deliver the service in person.

Despite clearly defined modes of supply concepts, getting the trade statistics for all of them is harder than it seems. Particularly problematic are the mode 3 services, which are not usually captured in balance of payments (BoP), the main source for services trade statistics. That leads to one of the most misleading gaps in trade statistics: mode 3, the biggest mode of supply for services trade, is systematically missing from official trade statistics. The omission of this ‘hidden giant’ significantly undervalues global trade in services and leads most trade experts to wrongly conclude that world trade in services is less than a third of global trade in goods. Based on these incomplete services trade statistics, the prevailing but erroneous view both among many policymakers and economists is that merchandise trade is the driving force of globalisation.

Another statistical oversight of services trade reinforcing this misguided view is that, apart from ‘direct’ GATS services trade, services can also be traded internationally in an ‘indirect’ way, as part of exported goods. Think, for instance, of the software incorporated in the device (a laptop or mobile phone) you use to read this column. Or think of the value of the design services incorporated in the last pair of shoes you bought, in case they were imported. Such ‘services in boxes’ are subject to GATT rules and are captured under the ‘mode 5’ services trade (Cernat and Kutlina-Dimitrova 2014).

In a recent paper (Cernat 2024), I tackle these statistical gaps by using two important databases that are the result of close cooperation between various international organisations. The Trade in Services by Modes of Supply (TISMOS) database (WTO 2024) is a unique database where, based on experimental statistics, the WTO Secretariat estimated the total value of GATS services trade by modes of supply, including via mode 3 that is systematically missing from other services trade statistics. The OECD-WTO Trade in Value Added database (TiVA) allows us to derive the value of mode 5 services embedded in world merchandise trade.

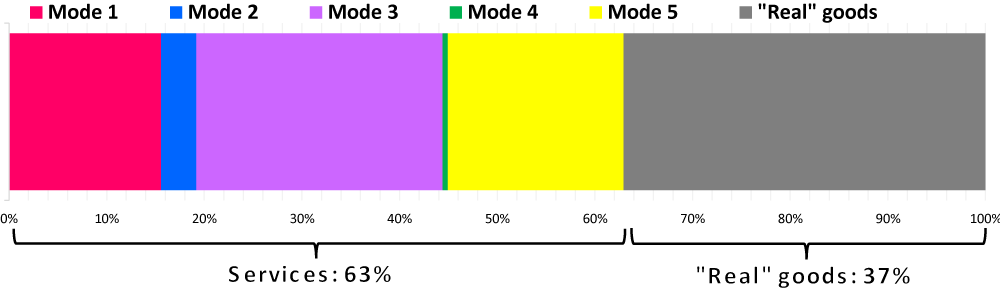

Figure 1 World trade in goods and services, by modes of supply

Note: GATS services cover modes 1 to 4. Mode 5 services are covered by GATT rules. "Real" goods is calculated by deducting the value of mode 5 services from world merchandise trade.

Source: Author’s calculations based on the methodology described in Cernat (2024).

Hence, by combining the TISMOS and TiVA database, I provide a comprehensive assessment of the value of total services trade, under all five modes of supply. When all fives modes of supply are considered, world trade in service is no longer a small fraction of goods trade but skyrockets to around $22 trillion in 2021 and becomes actually larger than trade in ‘real’ goods (Figure 1).

Mapping the modes of supply: How countries differ in their services trade performance

When considering all five modes of supply, the overall picture of world trade in services provides a powerful message: global trade in services is far more important than most people think. This conclusion essentially hinges on the crucial contribution of mode 3 services, which are generally missing from official trade statistics. Yet, world shares can be misleading. Are mode 3 services the dominant mode of supply for all countries in the world? The TISMOS and TIVA databases offer the possibility to analyse the relative importance of all five modes of supply at detailed country level.

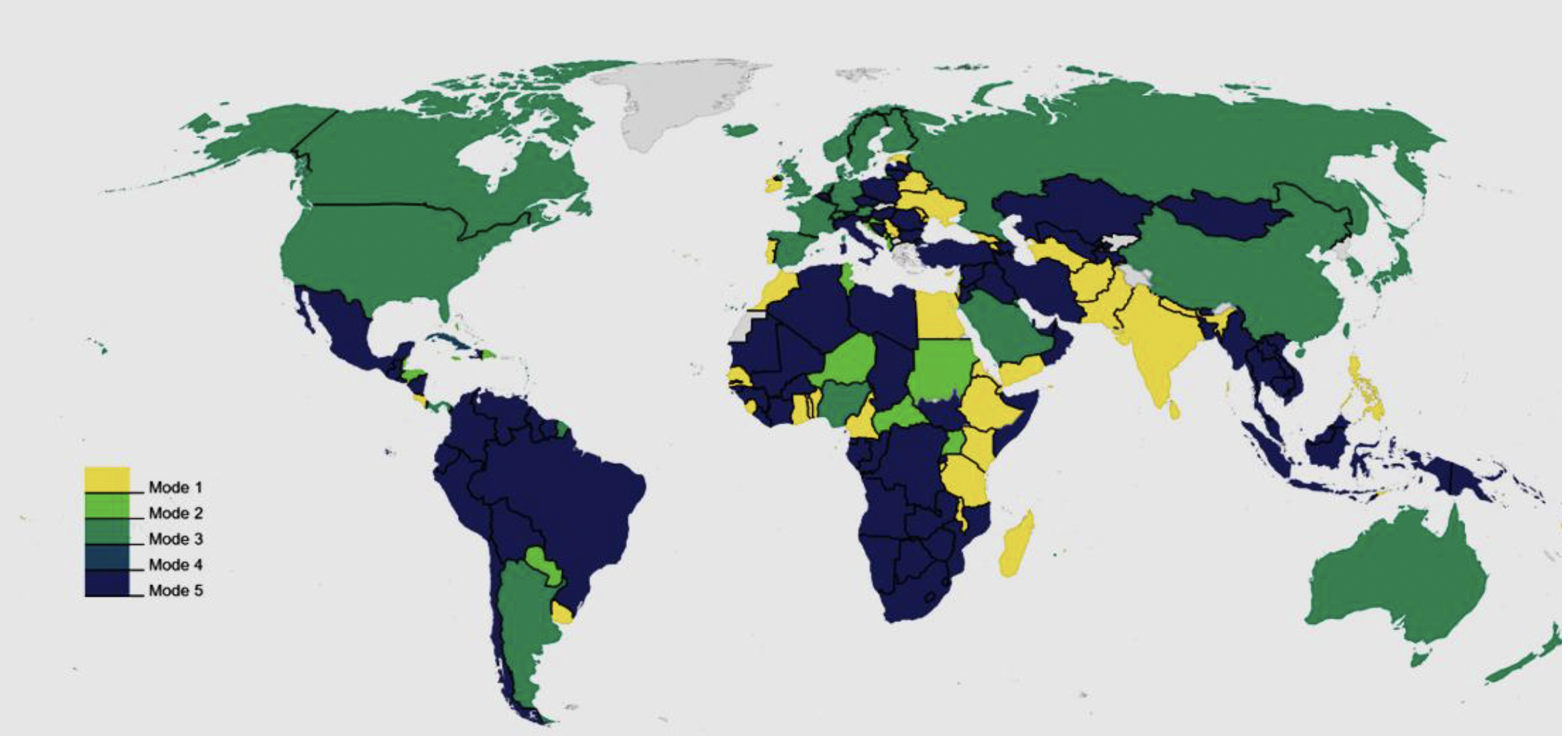

The wide diversity of services trade patterns becomes clearer when we plot the most important mode of supply for countries around the world (Figure 2). For instance, we observe that mode 1 is the main mode of supply for a very diverse set of countries including some EU member states (e.g. Ireland, Portugal), as well as several developing countries in Africa (Morocco, Cameroon, Kenya) and Asia (India, Pakistan, Philippines). In contrast, mode 3 is the main mode of supply for many OECD countries and several developing and emerging economies (e.g. China, Argentina, Saudi Arabia).

Figure 2 Mapping the main mode of supply for services exports

Source: Cernat (2024).

Figure 2 also clearly shows that mode 5 is the most important services mode of supply for a large number of countries across all continents. It is especially important for most Latin and Central American countries, for a large number of African countries, and for the ASEAN region. As many other analyses have shown, mode 5 services (such as engineering, design, banking, software and logistics) play an increasingly important role in global trade flows (e.g. Baldwin et al. 2024, Blazquez et al. 2020). Several authors have also suggested that mode 5 services affect firms’ export capabilities positively and that buying more of such intermediate services is linked to higher firm-level export intensity (Lodefalk 2015). Mode 5 services are nowadays adopted on a large scale not only in manufacturing activities but also in agriculture and mining, two sectors that have a sizeable economic footprint in many developing countries. There are plenty of examples – from the ‘internet of wine’ to the ‘internet of bananas’ (Rajak et al. 2023) – showing the significant potential offered by new technologies and associated mode 5 services for agricultural exporters.

To conclude, services trade is already more important than most people think when looking only at the usual trade statistics. The future of global trade is already in services, as their total value (under GATS and via mode 5 combined) exceeds the value of world merchandise trade. To get an accurate picture of the ongoing trade realities and the trade policy priorities, one needs to go beyond official statistics and rely on other databases such as TISMOS and TIVA. The good news is that such data are now more readily available and allow policymakers to get a complete ‘cartography’ of their national competitive advantage in services by mode of supply and calibrate their trade policy priorities accordingly.

Author’s note: The views expressed herein are those of the author and do not necessarily reflect an official position by the European Commission.

References

Baldwin, R, R Freeman and A Theodorakopoulos (2024), “Deconstructing Deglobalization: The Future of Trade is in Intermediate Services”, Asian Economic Policy Review 19(1): 18-37.

Blazquez L, C Diaz-Mora and B Gonzalez-Diaz (2020), “The role of services content for manufacturing competitiveness: A network analysis”, PLoS ONE 15(1).

Cernat, L (2024), “What Mode of Supply Will Matter the Most for the Future of Services Trade?”, ECIPE Policy Brief.

Cernat, L and Z Kutlina-Dimitrova (2014), “Thinking in a box: A “mode 5” approach to services trade”, Journal of World Trade 48(6): 1109 – 1126.

The Economist (2024), “Will services make the world rich? American fried chicken can now be served from the Philippines”.

Lodefalk, M (2015), “Tear down the trade-policy silos! Or how the servicification of manufacturing makes divides in trade policymaking irrelevant”, VoxEU.org, 16 January.

Rajak, P, A Ganguly, S Adhikary and S Bhattacharya (2023), “Internet of Things and smart sensors in agriculture: Scopes and challenges”, Journal of Agriculture and Food Research 14.