The technological breakthrough in artificial intelligence (AI) in recent years has put the economic implications of the diffusion of AI at the forefront of the academic and policy debates. The discussion revolves around the potential pervasiveness of such technology in business, and its consequences for the labour market: workers exposed to AI can either benefit from it to perform complex working tasks, or they could be displaced and substituted. This has led to polarised views on the aggregate effects on employment, either deemed positive (Albanesi et al. 2023) or negative (Bonfiglioli et al. 2024). Importantly, what lies at the heart of the overall macroeconomic effect of AI adoption is its impact on the productivity of the private sector, a divisive issue in academia - see Brynjolfsson et al. (2019) for an optimistic view, and Acemoglu (2024) for a less positive picture.

In a new paper (Gazzani and Natoli 2024), we focus on understanding the macroeconomic impacts of AI innovation, particularly its broader implications for economic growth, inflation, and labour markets. We utilise granular patent data from the US Patent and Trademark Office, spanning from 1980 to 2019, to construct an aggregate measure of AI intensity in US innovation. This measure is derived from AI scores assigned to individual patents based on eight AI categories (machine learning, natural language processing, computer vision, speech technology, knowledge processing, AI hardware, evolutionary computation, and planning and control system) reflecting the AI content within the disclosed technologies. By averaging scores on a monthly basis based on the month patents are filed, we aim to capture fluctuations in AI intensity as anticipated variations in the weight of AI in future technological development, following previous works using patents to extrapolate news on future technology (Miranda Agrippino et al. 2020).

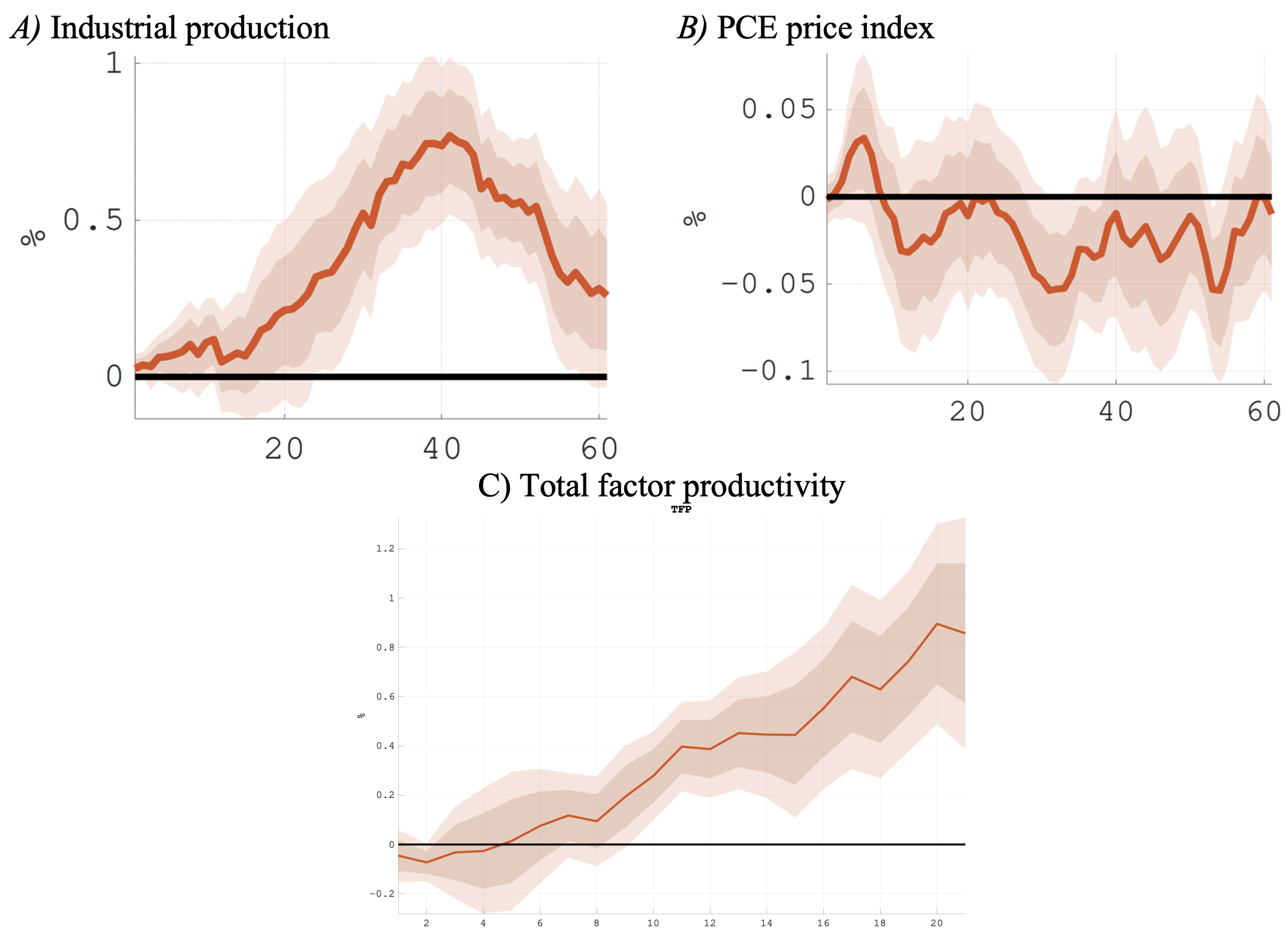

Using local projections (Jordà 2005), we find that a higher AI intensity of US innovation has effects similar to those of a positive supply push and induces a gradual increase in industrial production and a reduction in consumer prices; these effects result from a surge in total factor productivity that peaks after five years (Figure 1). In the labour market, the findings indicate a significant increase in the demand for workers despite a transformation in the tasks needed by firms: the increase in job openings outpaces layoffs, inducing an overall employment-enhancing effect. Payrolls, hours worked, and wages all increase, particularly for medium-high skilled workers. This suggests that rather than simply replacing jobs, AI may be creating new opportunities within the workforce.

Figure 1 Macroeconomic effects of an increase in AI intensity in technological innovation

Notes: The vertical axes in Panels A and B are expressed in percent. The vertical axis in Panel C is expressed in percentage points.

We extend the analysis to sectoral dynamics by examining the effects of AI-driven technological innovation across industries. Interestingly, the impact on employment and wages shows little variation across sectors, indicating a generalised expansionary effect driven by AI adoption.

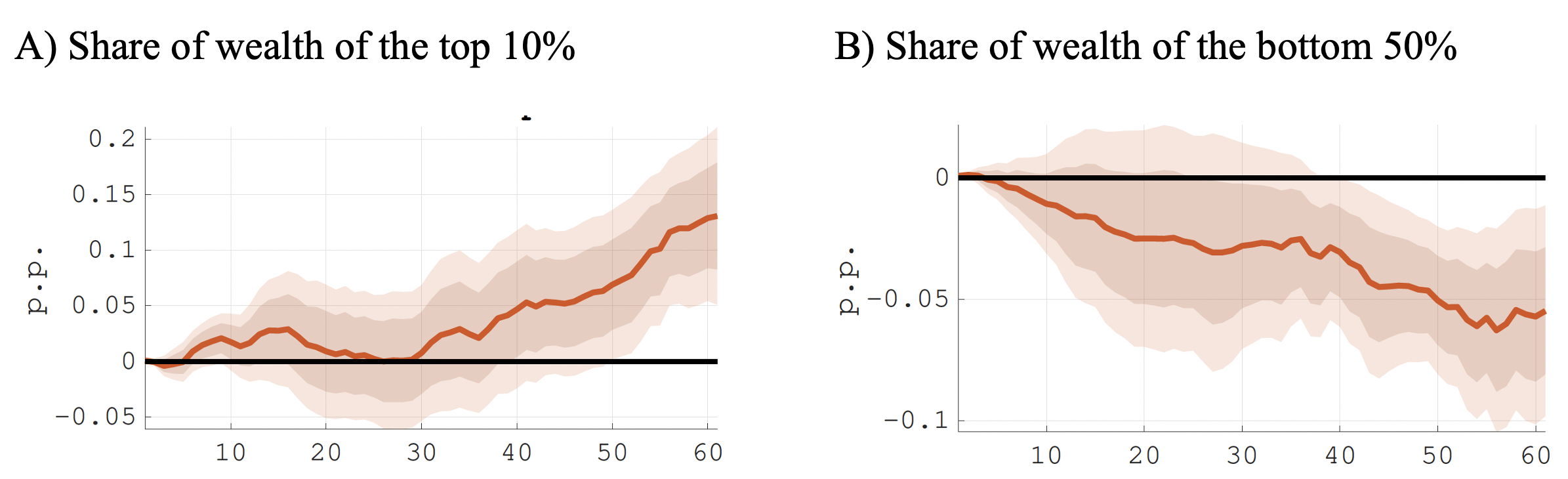

Despite the positive macroeconomic effects, our research identifies potential distributional challenges. Specifically, we find that while AI intensity in innovation increases labour income and wealth for the top 10% of income earners, it simultaneously contributes to a persistent decline in the share of wealth held by the bottom 50% (Figure 2). This widening gap raises concerns about inequality and aligns with predictions from the literature that automation and technological advancements can exacerbate disparities in society and between labour and capital income earners.

Figure 2 Effects on wealth inequality

Notes: The vertical axes in Panels A and B are expressed in percentage points.

In sum, this work underscores the importance of considering the aggregate expansionary push that AI can provide when investigating its full macroeconomic consequences. This goes beyond the evaluation of the impact on AI-exposed sectors in isolation, which has characterised most of the empirical research to date. While AI innovation offers substantial benefits in terms of productivity, economic growth, and labour market enhancements, it also poses significant challenges related to wealth distribution. As AI continues to evolve, understanding these dynamics will be crucial for formulating informed policies that promote equitable growth and address the potential pitfalls of technological advancement.

Authors’ note: This column does not necessarily reflect the views of the Bank of Italy or the European System of Central Banks.

References

Acemoglu, D (2024), “The Simple Macroeconomics of AI”, NBER Working Paper 32487.

Albanesi, S, A Dias da Silva, J F Jimeno, A Lamo and A Wabitsch (2023), “Artificial intelligence and jobs: Evidence from Europe”, VoxEU.org, 29 July.

Bonfiglioli, A, R Crinò, G Gancia and I Papadakis (2024), “The effect of AI adoption on jobs: Evidence from US commuting zones”, VoxEU.org, 12 August 2024.

Brynjolfsson, E, D Rock and C Syverson (2019), “Artificial Intelligence and the Modern Productivity Paradox: A Clash of Expectations and Statistics”, in The Economics of Artificial Intelligence, University of Chicago Press.

Gazzani, A and F Natoli (2024), “The macroeconomic effects of AI innovation”, SSRN Working Paper.

Jordà, O (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95(1): 161–182.

Miranda-Agrippino, S, S Hacioglu Hoke and K Bluwstein (2020), "Patents, News, and Business Cycles", CEPR Discussion Paper 15062.