Climate-related risks are now a recognised factor in financial decision-making and therefore in the prices of assets. Two types of climate-related risks are generally recognised: transition risks and physical risks. Transition risks arise because of changes in policies, technologies, and consumer and investor preferences that are already occurring and will need to occur in the future to mitigate the emissions of greenhouse gases. Physical risks are risks associated with losses from physical manifestations of climate change. The more successful we are at mitigating emissions the higher the transition risks, but physical risks will be reduced. While this appears to be a trade-off, it is not, because any delay in mitigation actions makes all risks higher (Furman et al. 2015).

One important concern related to climate policies is financial stability (Zettelmeyer et al. 2022, Hiebert 2022). There is a possibility that climate mitigation actions that are too drastic may lead to a significant repricing of assets, including stranded assets (assets with zero value). An example would be a very high carbon tax that would dramatically reduce the value of fossil-fuel-related assets. At the same time, physical events associated with climate change are already threatening the values of assets including real estate, the insurance industry, public infrastructure, biodiversity, and nature. If mitigation actions are not drastic enough, the frequency and severity of climate-related disasters will continue to increase. This also means that more funds will need to be spent on climate adaptation - actions that we will have to undertake to protect people, property, and nature from climate-related damages (Zettelmeyer et al. 2022).

How much asset repricing can we expect in the future? The answer depends on how much these risks are already priced in. Many studies have addressed this question for different asset classes, finding a variety of asset responses to both physical events and climate policies. Yet, it is difficult to benchmark the findings without explicitly modelling climate beliefs. This is because there are three key differences between climate shocks and shocks traditionally modelled in asset pricing literature: first, climate shocks do not come from a fixed distribution, but rather from a distribution with mean and variance that increase over time; second, there is fundamental uncertainty about the climate parameter that drives this distribution shift; third, there is uncertainty about climate scenarios due to policy and technology uncertainty concerning climate change mitigation actions. While markets appear to be pricing actual weather outcomes correctly (Taylor and Schlenker 2019), the translation of weather outcomes to prices of other assets likely depends on the beliefs of those trading these assets. Given fundamental uncertainties associated with climate scenarios (Barnett et al. 2020) and divergent beliefs about possible climate outcomes (see, for example, Yale Climate Opinion Maps for the US), rational expectations might not be the best framework for understanding the pricing of climate risks.

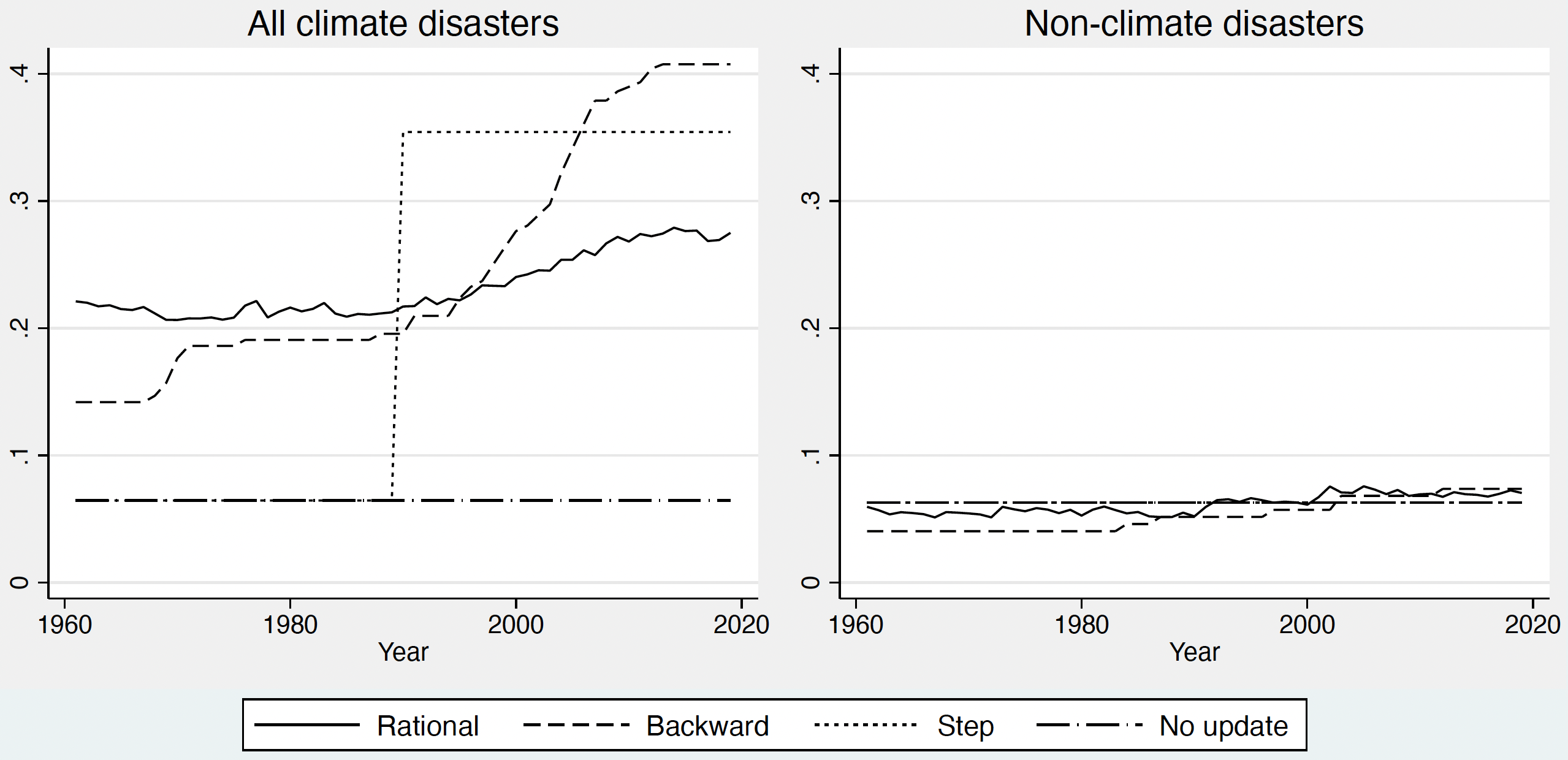

Focusing on physical risks, in a recent paper Hale (2024) shows that, depending on the assumption about the belief formation, beliefs about the probability of climate-related disasters occurring may or may not capture the upward trend of the climate-related disaster frequency that we observe ex-post in the data. Climate disasters are defined as meteorological (hurricanes and storms), hydrological (floods), or climatological (fires). Figure 1 demonstrates that for climate disasters the dynamics of beliefs are quite different depending on whether the agents’ beliefs are rational (beliefs about disaster distribution are updated after observing or not observing the disasters), backward-looking (beliefs are formed based on a moving average of past disaster frequency), stepwise (no belief change except a wake-up call in the early 1990s), or fixed (assuming the distribution is unchanged but we keep observing tail events). This is not an issue for non-climate disasters, for which the actual distribution is stable. This observation is very important for asset pricing models because most models, even those that are designed to incorporate disasters, are not well-suited to reflect the shocks that come from a distribution that is shifting and becoming more dispersed over time.

Figure 1 Climate disaster probability: Belief dynamics

Source: Hale (2024)

Turning to transition risks, Sharma (2024) finds that the interest rate sensitivity of bank loans to transition risk exposure of the borrowers crucially depends on the banks’ belief formation and information acquisition efforts. In particular, she finds that improving transparency of firms’ transition risk exposure through mandatory climate disclosures such as those introduced in the EU and those adopted by the SEC in the US is likely to improve the pricing of transition risks by banks and eventually allow for reallocation of credit to firms that invest in the greening of their technology.

Research on subjective belief formation about climate risk shows that while individuals learn from climate events such as large weather shocks, they assign greater importance to their past perceptions about damages from climate change. This disproportionately larger weight on their ‘prior beliefs’ is a consequence of uncertainty relating to information about climate change or their own political beliefs (Cameron 2005, Deryugina 2013, Sharma 2024). As a result, beliefs are updated with inertia, depending on the rigidity of individuals’ updating process. Another source of heterogeneity in belief updates is whether individuals update their beliefs regardless of the type of information they come across (‘accuracy-motivated’) or whether they update their beliefs only when the information conforms to their prior beliefs (‘directional-motivated’) which may lead to belief polarisation. (Druckman and McGrath 2019, Zappalà 2023).

These findings suggest two important issues in modelling the pricing of climate risks. First, further research is needed to understand the way financial markets are forming their beliefs about climate change and its possible future impacts, including beliefs about mitigation policies. Without this information, it is difficult to interpret current empirical findings on the pricing of climate risks. Second, most studies point to the importance of reliable information on firms’ exposure to climate risks and the transparency of climate mitigation policies. In fact, the more transparent the climate mitigation plans, the less likely the ‘green swan’ events - rapid asset repricing.

When it comes to pricing physical climate risks, two important dimensions of beliefs need to be considered. First, what are the assumptions on market participants’ understanding of the dynamics of the climate parameter and its distribution, which could be represented by a growing frequency and severity of climate-related disasters or by an increasing and more dispersed average temperature. Second, if market participants rationally predict future climate change, what climate scenario do they have in mind? Possibly, it could be a collection of probabilities attached to different scenarios. To make things more complex, one might have to consider the fact that climate scenarios in turn depend on climate mitigation policies.

A variety of well-established integrated assessment models (IAMs) exist and allow for the modelling of economic systems together with the biosphere effects of economic activities and the feedback from climate back to economic fundamentals. These models, however, do not usually include sufficient complexities needed to use them for pricing of the assets. In particular, they generally do not explicitly include any belief formation, policy shocks, or other uncertainties. We believe substantial progress still needs to be made in the field of asset pricing to fully understand what our observations tell us about the way in which asset markets price climate risks.

References

Barnett, M, W Brock and L P Hansen (2020), “Pricing Uncertainty Induced by Climate Change”, The Review of Financial Studies 33(3): 1024–1066.

Borio, C, S Claessens and N Tarashev (2022), “Finance and climate change risk: Managing expectations”, VoxEU.org, 7 June.

Cameron, T A (2005), “Updating subjective risks in the presence of conflicting information: an application to climate change”, Journal of risk and Uncertainty 30(1): 63–97.

Deryugina, T (2013), “How do people update? The effects of local weather fluctuations on beliefs about global warming”, Climatic Change 118(2): 397–416.

Druckman, J N and M C McGrath (2019), “The evidence for motivated reasoning in climate change preference formation”, Nature Climate Change 9(2): 111–119.

Furman, J, R Shadbegian and J Stock (2015), “The cost of delaying action to stem climate change: A meta-analysis”, VoxEU.org, 25 February.

Hale, G (2024), “Climate Disasters and Exchange Rates: Are Beliefs Keeping Up With Climate Change?”, IMF Economic Review 72: 253-291.

Hiebert, P (2022), “A case for climate-related macroprudential policy”, VoxEU.org, 26 September.

Kahneman, D and A Tversky (1972), “Subjective probability: A judgment of representativeness”, Cognitive Psychology 3(3): 430–454.

Sharma, B (2024), “Information about Climate Transition Risk and Bank Lending”, Working Paper.

Taylor, C A and W Schlenker (2019), “The market is betting on climate change”, VoxEU.org, 2 May.

Zappalà, G (2023), “Drought exposure and accuracy: Motivated reasoning in climate change beliefs”, Environmental and Resource Economics 85(3): 649-672.

Zettelmeyer, J, B Weder di Mauro, U Panizza, M Gulati, L Buchheit and P Bolton (2022), “Climate and debt”, VoxEU.org, 3 October.