As of January 2024, damages to residential housing in Ukraine amounted to $59 billion (Kyiv School of Economics 2024). As Russia continues and intensifies shelling, these damages grow every day. For some people, this is the loss of housing into which they invested all their lives. For some, it’s even worse – the destroyed housing may have been bought with a mortgage loan. The housing problem was acute for Ukraine already before the full-scale war (at the end of 2021, there were 500,000 families in the housing queue), and now the challenge is paramount. What policies and instruments could be used to finance construction and provide housing to people?

Even before the full-scale war, mortgages in Ukraine were not very developed. The ratio of mortgages to GDP was less than 1% in 2020, compared with 9% in Romania, 22% in Poland and 44% in Germany. According to estimates of the National Bank of Ukraine, in 2019–22, only about 2% of housing deals were concluded using mortgages. There are several intertwined reasons behind this.

First, since 1991, inflation in Ukraine has rarely been in single digits. Until 2015, the government effectively targeted the exchange rate, using abrupt devaluations when the situation became unsustainable. This resulted in high dollarisation of the economy and volatile inflation.

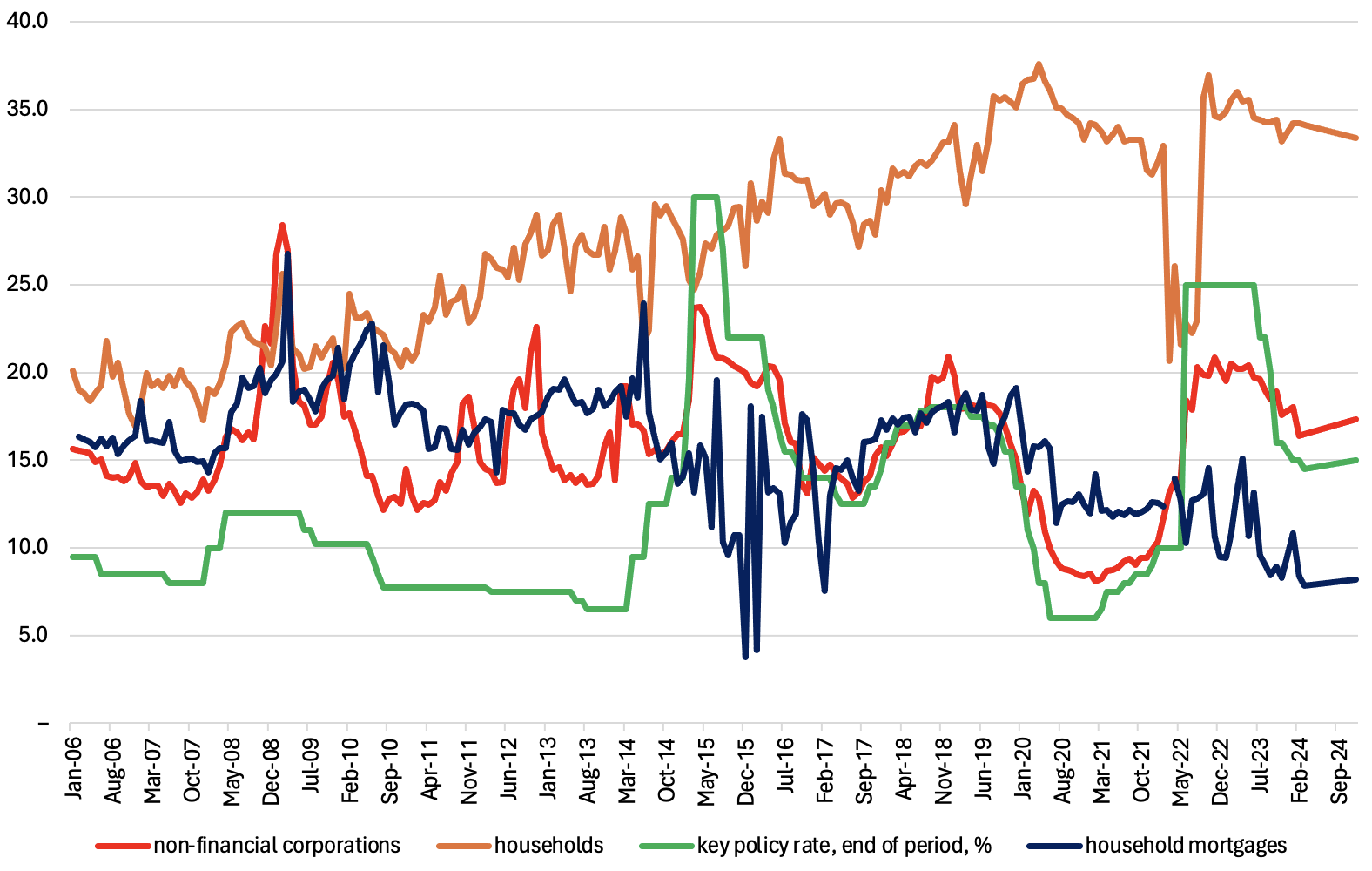

Due to high inflation, interest rates have been high (Figure 1) most of the time since 1991, and very few banks wanted to issue long-term loans to households and businesses. The situation worsened after the 2008 financial crisis: in the early 2000s, the fixed exchange rate created an illusion of hryvnia stability, and many people took foreign currency mortgages under much lower interest rates. But after devaluations of over 50% in 2008–09, these mortgages became unsustainable, and the National Bank of Ukraine banned foreign currency mortgages.

Figure 1 Interest rates in hryvnia (%)

Data source: National Bank of Ukraine

Second, historically low trust in banks resulted in FX cash and real estate being used as the means of savings. This in turn led to real estate transactions largely done with dollars in cash – a form of transaction used not only for convenience but also for tax evasion. Hence, bank intermediation is simply unnecessary for a large part of the market. This arrangement is acceptable also for construction companies that need cash to pay their informal workers and to bribe politicians who make decisions on the distribution of land.

Third, many people still get their salaries partly unofficially (‘in envelopes’) and thus cannot confirm their revenues for the bank scoring procedure.

Finally, Ukrainian politicians often used housing issues to ‘buy’ votes. They provided subsidised housing or subsidised mortgages to some categories of people, while also undermining creditor rights’ protection by protecting people who were unable to repay their mortgages.

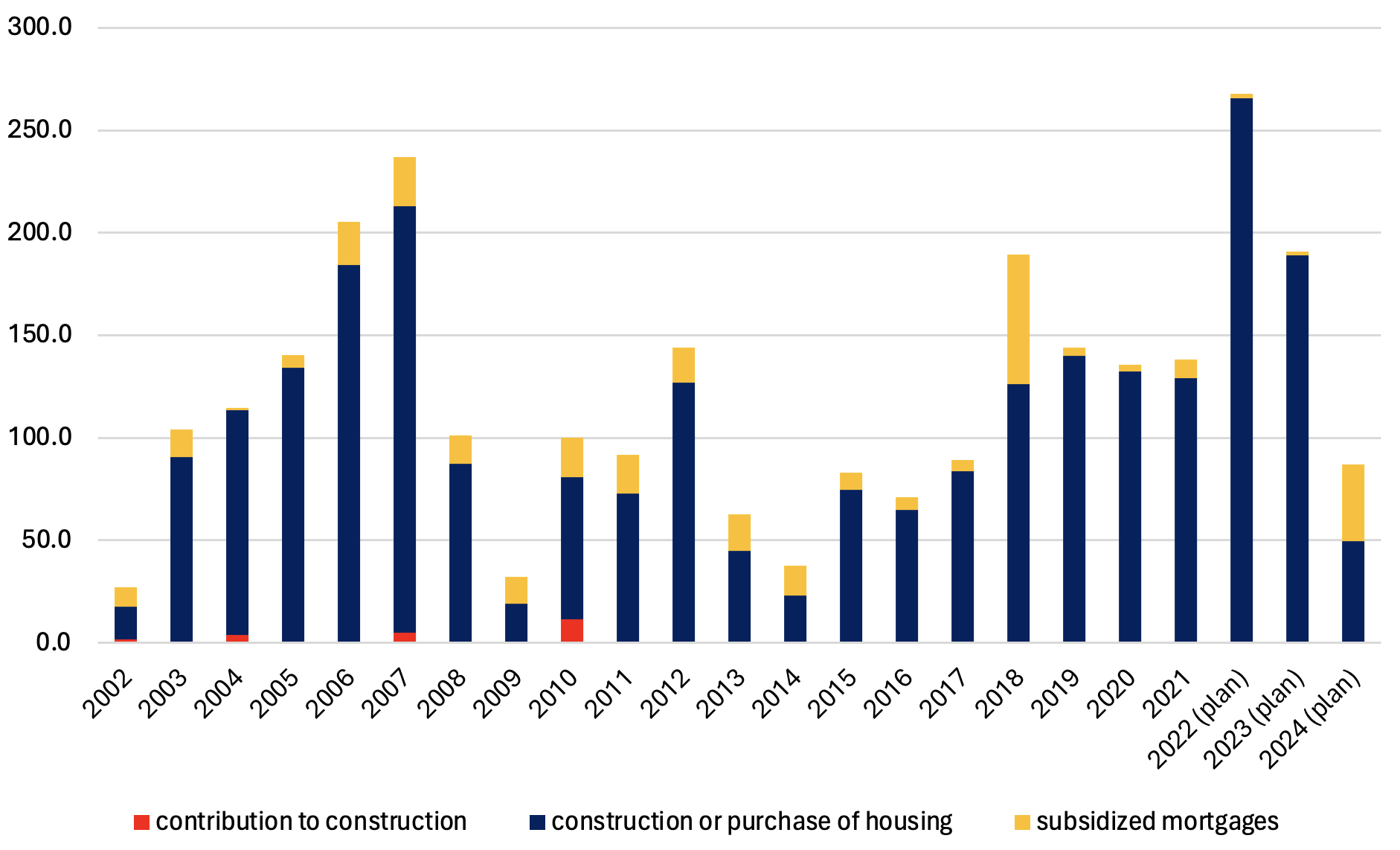

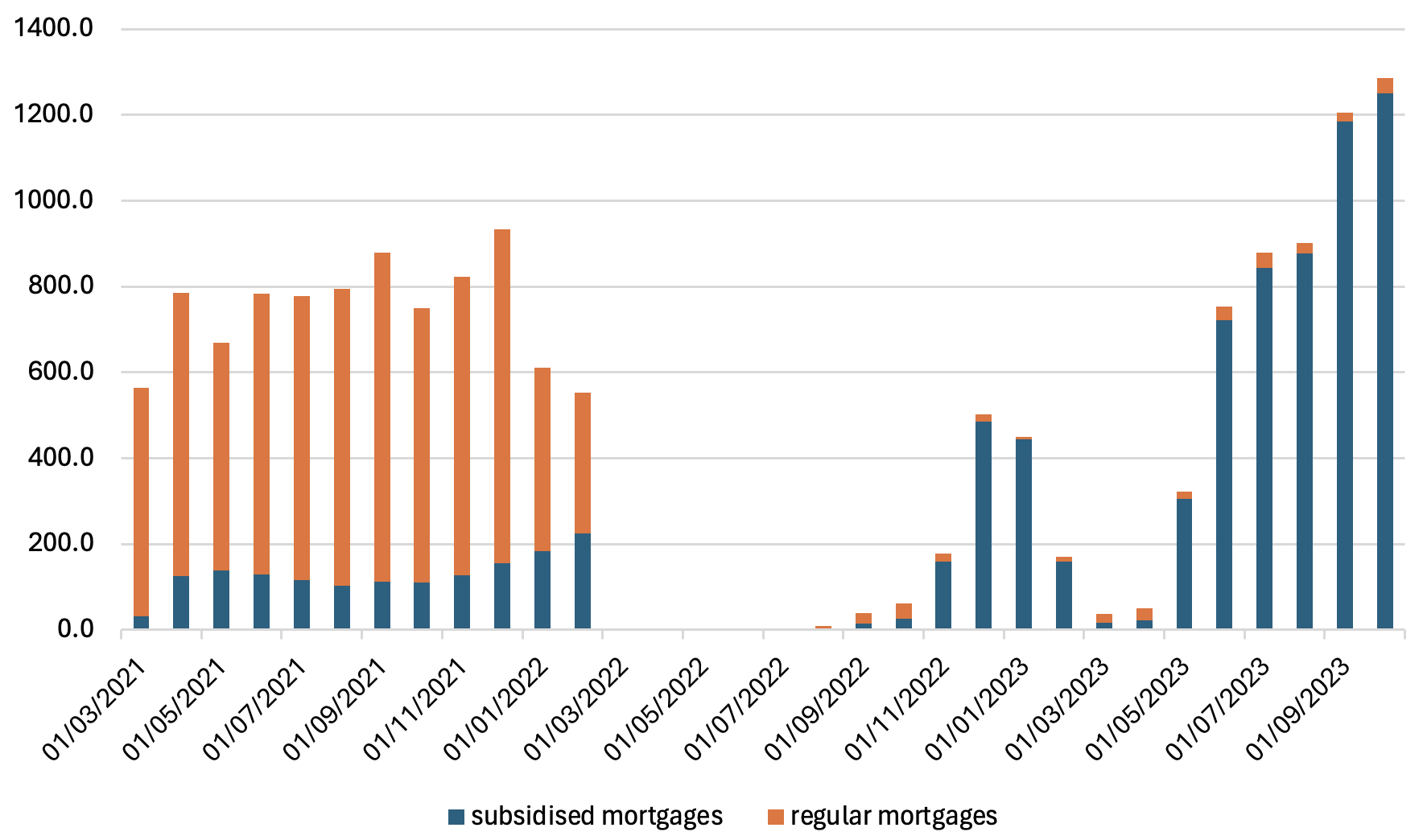

Ukrainian governments treated symptoms while exacerbating fundamental problems in the housing market. Fortunately, government spending on subsidised housing was not so large as to significantly distort the market (Figure 2). Only after the start of the full-scale invasion by Russia did subsidised mortgages begin to exceed ‘regular’ mortgages (Figure 3). This is the case not only for mortgages but for credit in general: about 90% of new corporate loans issued after February 2022 are subsidised.

Figure 2 Central budget expenditures on subsidised housing ($ million)

Notes: Data converted to US dollars using the average annual exchange rate. For years up to 2021, actual expenditures are provided. For 2022–24, planned expenditures are given because detailed data on budget execution are not published. ‘Subsidised mortgages’ cover the difference between market and subsidised rates and injections of taxpayers’ money into the statutory capital of the Youth Housing Fund, which amounts to $30 million over the considered period. ‘Construction or purchase of housing’ means that the government constructed or purchased flats or houses and provided them to some categories of people. Local governments can also provide housing using local budget funds (not shown in the figure).

Data source: NBU, Treasury.

Figure 3 New mortgage loans to households, in millions hryvnia

Source: National Bank of Ukraine Financial Stability Report, December 2023

This experience should help set the principles and policies that would support mortgage development during the reconstruction.

The first principle is to set the rules and enforce them. Specifically, the government should develop and implement clear rules for the distribution of land in municipalities. Municipalities should approve their development plans and then auction off the land for construction of specified objects – such as housing, infrastructure and recreational facilities (see Green et al. 2023 for an extensive discussion on urban development).

Today, the chaotic distribution of land for multi-storey buildings results in shortages of infrastructure such as kindergartens or schools and causes traffic jams and collateral damage (for example, in Kyiv, a part of the metro line was closed because uncontrolled construction caused movement of underground waters). One important incentive to implement the rules would be the introduction of mandatory e-declarations for representatives of local governments, in line with the central government officials. Other anti-corruption policies are suggested by Becker et al. (2023). In addition, the government should not try to protect the debtors or interfere in the debtor-creditor relationship (the planned adoption of EU bankruptcy norms should help with this).

Second, inflation-control policies are key to ensuring a predictable macroeconomic environment. The National Bank of Ukraine fixed the exchange rate after Russia’s full-scale invasion, but overall, it is determined to return to inflation targeting when conditions allow. It is also resolved to refrain from inflationary financing of the budget deficit, but this will largely depend on external support to Ukraine. Thus, in 2014 and 2022, the National Bank had to print money to finance the defence spending.

Third, given the high risks and uncertainties related to war, the government should implement risk-reduction policies that could range from judicial reform to strengthen property rights protection to the introduction of war insurance (instead of subsidised loans).

Fourth, one should not hope for financial innovations to accelerate mortgages in Ukraine. The banking sector is much more developed – both in terms of assets and in terms of control and oversight – than other financial institutions (non-bank financial institutions hold only 12% of financial sector assets, and credit unions account for just 0.1% of non-bank financial assets). Thus, banks will be the primary suppliers of mortgages in the foreseeable future. Ukraine can prepare the legislation to issue covered bonds or mortgage-backed securities, but we should not expect that these assets will be popular under current market conditions.

Finally, providing durable peace and security in Ukraine is fundamental for any long-term investment. Ukraine cannot win this war alone, and as the collection of essays edited by Gorodnichencko and Rashkovan (2023) argues, it is in the interest of everyone to help Ukraine win. If there is political will, the aggressor can start paying for the damage it has done already (Gorodnichenko and Becker 2024).

Conclusion

The war has largely exacerbated the housing problem, which was already acute in Ukraine. Because of the populistic policies of many Ukrainian governments since 1991, the housing market has been largely left in the shadows, and mortgages are not popular. While subsidised housing programmes existed, it was insufficient to match the number of families eligible for subsidised housing. On the positive side, this did not distort the market much.

For recovery, the government must first fix the fundamental problems: strengthen creditor rights protection, set and enforce clear rules for land distribution, and stick to low-inflation macroeconomic policies. If war insurance is introduced, it should extend to houses, making this investment less risky and interest rates lower. For the foreseeable future, Ukraine will rely on mortgages issued by banks while preparing a legal basis for more innovative mortgage financing instruments.

References

Becker, T, J Lehne, T Mylovanov, G Spagnolo, and N Shapoval (2023), “Anti-corruption policies in the reconstructing of Ukraine”, VoxEU.org, 22 February.

Green, R K, J V Henderson, M E Kahn, A Nikolsko-Rzhevskyy, and A Parkhomenko (2023), “Rebuilding cities in Ukraine”, VoxEU.org, 8 July.

Gorodnichenko, Y, and T Becker (2024), “Using the returns of frozen Russian assets to finance the victory of Ukraine”, VoxEU.org, 25 April.

Gorodnichenko, Y, and V Rashkovan (2023), Supporting Ukraine: More critical than ever, CEPR.

Kyiv School of Economics (2024), “Report on damages to infrastructure from the destruction caused by Russia's military aggression against Ukraine as of January 2024”, April.