Our banking system is built to fail. On average, it fails every 15 years. Right on time – fifteen years after the Global Financial Crisis – it’s failing again. Silicon Valley Bank (SVB) and Signature Bank, alive and well a month ago, are now dead and buried. They placed 2nd and 3rd in our nation’s great pantheon of bank failures.

First Republic, our nation’s 18th largest bank, is on life support. Eleven mega banks just gave it mouth to mouth with a $30 billion deposit. Buying deposits, not stock was a kiss of death. The news further cratered the bank’s credit rating – to junk – and tanked its stock. A year back, a share of First Republic fetched $170. Today, it’s worth $14.

The financial crisis is spreading overseas. UBS just “purchased” Credit Swiss – for peanuts. This was no First Republic. Credit Swiss was Switzerland’s second largest bank with clients in 50 countries. Switzerland’s central bank lent the paper tiger $54 billon, but to no avail. Within days, Credit Swiss’ 167 year-old history was history.

Which august or newbie bank is next to say sayonara? First Republic’s funeral is surely being arranged. How about Charles Schwab? It’s now bleeding $20 billion a month in deposits. Morgan Stanley just downgraded the company. Its stock is also in freefall. Charles Schwab is the 8th largest US bank!

Anyone else in trouble? How about over half of the 4,236 FDIC-insured commercial banks? They are, experts say, all insolvent on a mark-to-market basis.

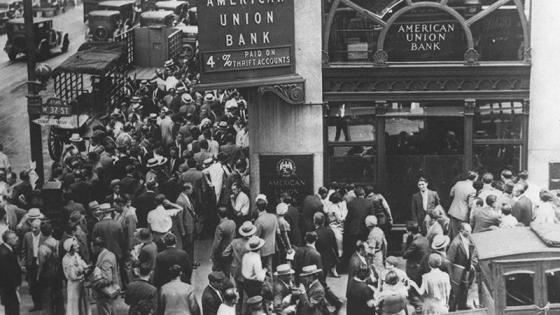

One thing is clear. The run is accelerating. Since SVB’s uninsured creditors tweeted FIRE! and rushed from that crowded dark theatre with its tiny exit, $550 billion in uninsured deposits have fled our “sound” banking system – over half to money market funds with the rest to JP Morgan and other money centre banks. And much of the money going to the money centre banks is being parked in mutual funds of those banks or swept into such funds overnight. But $550 billion is small potatoes compared to the $8 trillion in uninsured deposits ready to take flight in the seconds it takes to send a wire.

The three musketeers – the Treasury, the FDIC, and the Fed – could try to end the contagion by having the FDIC insure all deposits. But nervous keystrokes could force the FDIC to hand out trillions to depositors whose banks go belly up. And, truth be told, the FDIC is broke. It had $128 billion in reserves at the end of December – less than the total deposits in SVB and Signature. (Given the failures of those banks, its assets are now less than $100 billion.) A run to beat all runs would force the Fed to print those trillions for the FDIC. The ensuing fear of hyperinflation would lead all depositors to grab their money and head to IKEA. Furniture beats worthless paper.

Sound over the top? Not if you’re Argentine. As each financial crisis hits, the government reassures the public that its bank deposits are insured. Yet everyone runs expecting inflation. Then the government limits weekly withdrawals. Eventually, you get your pesos back – after they’re worth centavos in purchasing power.

Every banking crisis has a different catalyst, but there are two common denominators – leverage and opacity. And after each crisis a different “permanent” solution is found, none of which fundamentally addresses leverage or opacity. This keeps bankers and their army of regulators in the game.

The days of rounding up the usual suspects may, however, be over. You can no longer be even a little bit leveraged, let alone the 90% average of today's banks. Treasury Secretary Yellen said as much to the Senate Finance Committee:

“If a bank has an overwhelming run that's spurred by social media or whatever, so that it's seeing deposits flee at that (keystroke) pace, a bank can be put in danger of failing.”

The "whatever" references, in my mind, opacity. The reason that half of FDIC-insured commercial banks are insolvent is that when you mark their hold-to-maturity assets to market, the collective assets of these banks are 90% less than the amount being carried on the books. If the banking system were one entity, marking its assets to what they are worth, not their pretend value, would wipe out all capital in the banking system. Of course, not all banks are equally leveraged. Some have more than 10% capital, some less. And some have larger and some smaller percentage mark-to-market losses than 10%. This is why not all banks are insolvent. But more than half? Wow!

The opacity, in this case, was officially approved by financial "wizards," with no training in finance – accountants. The Financial Accounting Standards Board sanctioned hold-to-maturity valuation. This may be why so few bankers, depositors, regulators, and analysts looked the other way or didn't look at all. But the worst thing here is that because the accountants let the banks misstate their balance sheets, no one knew, until now, that so many banks were underwater. Once again, we had some players in the financial system with, surely, financially greased hands, hide the bacon and put a critical public good – financial market-making/exchange – at risk.

There is an answer. Just follow the money. It’s heading to equity-financed mutual funds. These are effectively banks with zero leverage that disclose their holdings, at market, not book value. The move represents an endogenous transition to limited purpose banking (LPB) – limiting the financial system to its legitimate purpose, not gambling with the financial market’s functioning, but intermediating – connecting savers to investors and lenders to borrowers. One of us (Kotlikoff) proposed LPB in the aftermath of Lehman's collapse. Jimmy Stewart Is Dead, published in 2010 makes the case. So does, On the Economics Consequences of the Vikers Commission, whose title pays homage to Keynes.

LPB is simple. It requires all financial corporations to operate as 100% equity-financed mutual funds. Since the financial system will have no debt, no financial company can fail, making financial panics ancient history. LPB was effectively tested in the Great Recession. Then, as now, we had over 7,000 equity financed mutual funds. None failed. Money market funds failed, but they were leveraged based on their fallacious claim to be backed to the buck. In 2016, the SEC ended that practice.

Under LPB, all mutual fund assets are fully verified and disclosed, in real time, by a new federal agency – the Financial Services Agency (FSA). The FSA hires private companies, which work just for it, to shine a bright, continuous light on all details of mutual fund holdings.

As for financing mortgages, small business loans, and other illiquid investments, this would be done by closed-end mutual funds. The FSA’s disclosure of their holdings would make their shares highly liquid. Sound extreme? Check out the covered bond market, which has been financing mortgages this way in Denmark and other parts of Northern Europe for over 200 years!

Contingent insurance mutual funds would replace traditional leverage insurance. Sound extreme? Go to your local racetrack and use the parimutuel betting system that’s been working just fine since 1867 – with not a single government bailout. And contingent insurance pools go back to tontines, started in 1653. They were standard financial fare for over 150 years. The NY Stock Exchange was first housed in the Tontine Café!

Banking as we know it is dying. It’s time to arrange a smooth transition to limited purpose banking and end financial panics with their massive economic damage once and for all.